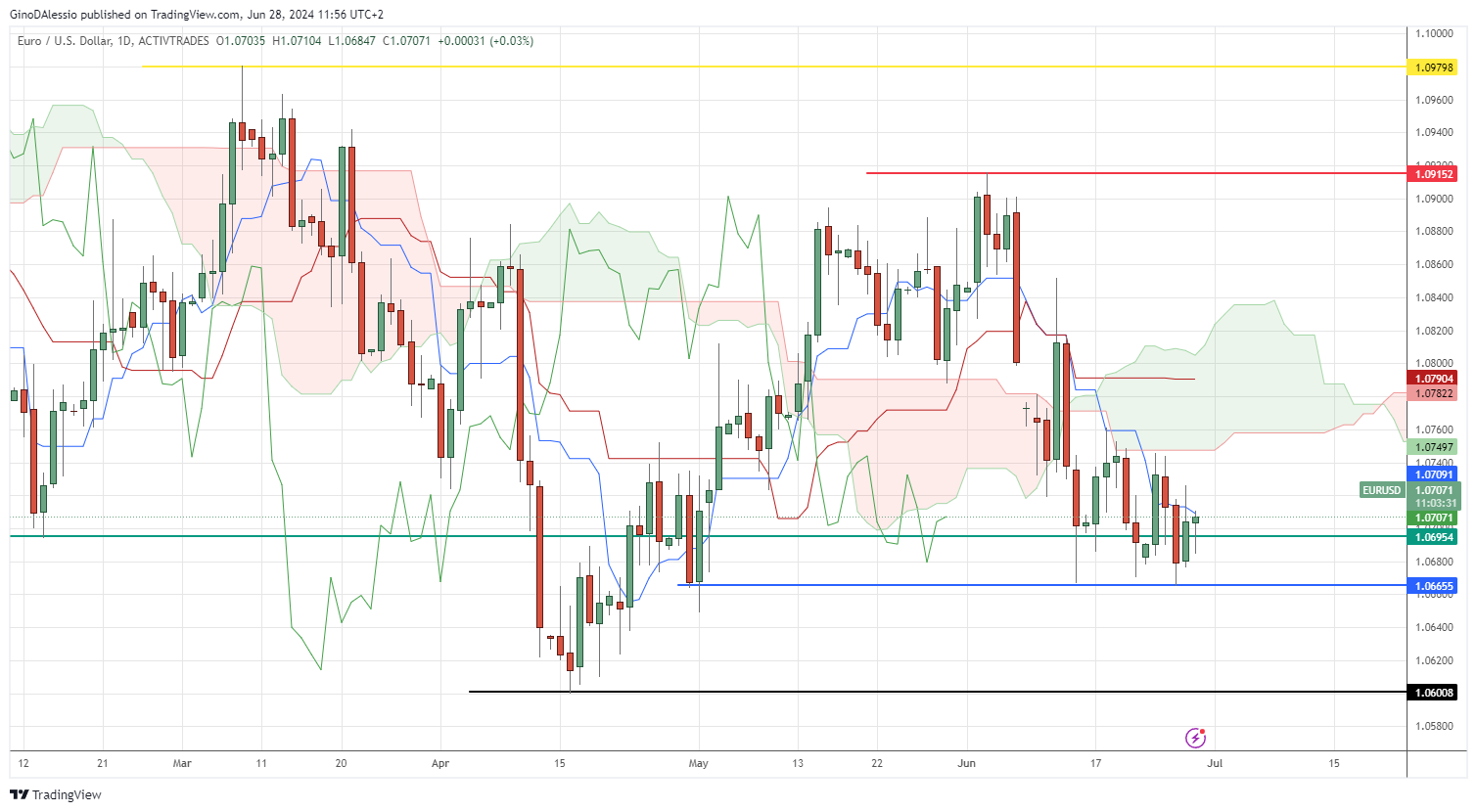

eur-usd

EUR/USD In a Range Ahead of U.S. PCE Data

Gino Bruno D'Alessio•Friday, June 28, 2024•2 min read

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

EUR/USD has been on a downtrend since the European Parliament elections, opening with a bearish gap lower but last night it opened up.

21 hours ago

Comments

Subscribe

Login

0 Comments