The CPI inflation numbers from Canada showed a jump in May, but USDCAD held its ground, which is a bullish sign, indicating that CAD buyers are standing aside. The Bank of Canada is contemplating a rate cut in July’s meeting, but today’s data casts doubt on that decision with odds falling to 53%, however the CAD didn’t benefit from it, so the Loonie is looking up now.

USD/CAD Chart H4 – The 200 SMA Continues to Hold

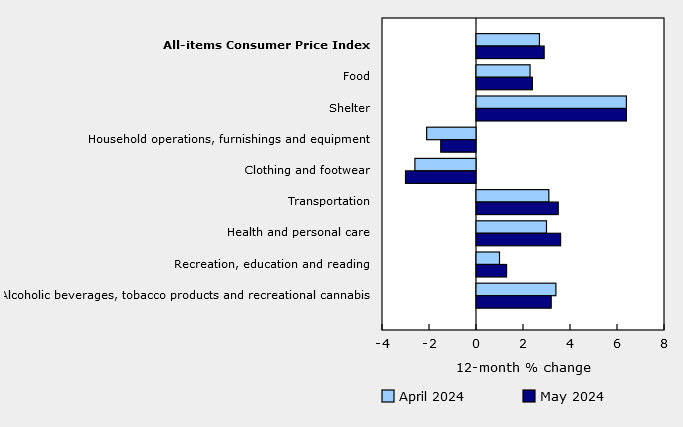

Headline CPI rose by 2.9% year-on-year, surpassing the expected 2.6% and last month’s 2.7%. Core indicators also showed increases, with high rents and vacation tours notably contributing to inflation. Typically, this would significantly strengthen the Canadian dollar, but the currency saw only a slight increase. USD/CAD is currently trading at 1.3665, up from 1.3675 before the data release, after briefly dipping to 1.3620.

Canada May CPI Report Summary

Headline CPI:

- Year-on-Year: 2.9% vs. 2.6% expected, prior month 2.7%

- Month-on-Month: +0.6% vs. +0.3% estimate

Core CPI Measures:

- Bank of Canada Core Year-on-Year: 1.8% vs. 1.6% prior

- Bank of Canada Core Month-on-Month: +0.6% vs. +0.2% prior

- Core CPI Month-on-Month SA: +0.3% vs. 0.0% prior

- Trimmed Mean Year-on-Year: 2.9% vs. 2.8% prior

- Median CPI Year-on-Year: 2.8% vs. 2.6% prior

- Common CPI Year-on-Year: 2.4% vs. 2.6% prior

Key May CPI Inflation Takeaways

- Service Price Inflation: The significant contribution of service price increases to the overall CPI acceleration will be a focal point for the BOC.

- Monetary Policy Outlook: Given the unexpected rise in inflation, the probability of a rate cut in July might decrease, as the BOC evaluates the need for further measures to control inflation.

Governor Macklem expressed confidence in maintaining stable inflation and wage growth, dismissing detailed wage data. He noted that wage growth peaked at 4.5% to 6%, approximately double the pre-pandemic average of 2% to 3%. With inflation now considerably lower and the labor market rebalancing, wage growth is showing signs of deceleration. Recent six-month data indicates that wage growth has slowed to around 4%, down from its peak but still higher than pre-pandemic levels.

Currently, market focus is shifting from interest rates to economic growth. While inflation might remain elevated for a bit longer, GDP is rapidly slowing, and there is an increasing risk of a recession, especially if the Bank of Canada doesn’t cut rates. In essence, the BOC faces a choice: implement gradual, modest cuts now, or opt for more substantial and rapid cuts later. Eventually, market attention will shift from the immediate rate decision to the broader, long-term challenges facing the Canadian economy.

USD/CAD Live Chart

USD/CAD