Euro Feeling Better Today As Eurozone Inflation CPI Remains High

The May inflation data from Eurostat confirms that Eurozone inflation remains stubbornly high, leaving the ECB neutral at the moment. Both headline and core CPI numbers show little change from preliminary estimates, after climbing 2 points from the previous month. The ECB will likely remain vigilant following the data, as they repeated a few times today, focusing on inflation trends in Q3 to guide its future policy actions.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

May Eurozone CPI Inflation Report – 18 June 2024

Eurostat Released CPI Data:

- May Final CPI: +2.6% year-over-year (y/y) vs +2.6% y/y preliminary

- Prior Month: +2.4% y/y

- Prior Month: +2.7% y/y

Inflation Overview:

- The final CPI and core CPI figures for May remain unchanged from the preliminary estimates, indicating that inflation in the Eurozone is proving to be persistent.

- Headline inflation rose to 2.6% from 2.4% in the previous month, while core inflation, which excludes volatile items such as energy and food, increased to 2.9% from 2.7%.

Economic Implications:

- Persistent Inflation: The stickiness of inflation, especially core inflation, suggests that price pressures remain elevated despite prior expectations of easing. This could influence the European Central Bank’s (ECB) monetary policy decisions.

- ECB Rate Cuts: With inflation remaining higher than desired, the ECB may be cautious about cutting rates too soon. The development of inflation trends in Q3 will be critical in determining whether the ECB will consider rate cuts in September.

- Eurozone Bonds and Currency: Persistent inflation may keep ECB policy more hawkish for longer, potentially supporting the euro and putting upward pressure on Eurozone bond yields if rate cuts are delayed.

- Equities: Elevated inflation can pose challenges for equities, particularly if it leads to tighter monetary conditions. However, stable core inflation might provide some support to equity markets if economic growth remains steady.

- Q3 Developments: Monitoring inflation trends in Q3 will be crucial. A sustained decline in inflation could pave the way for the ECB to consider rate cuts, but persistent or rising inflation would likely delay such moves.

- ECB’s Stance: The ECB will closely watch incoming data, and any signs of easing inflationary pressures could influence their policy stance. The central bank’s communications and policy meetings in the coming months will be pivotal.

We also had the German ZEW survey results today, highlighting a stalling in German economic sentiment, with current conditions worsening and economic optimism not meeting expectations. Contributing factors include rising inflation expectations and recent political uncertainties within the Eurozone. These results suggest potential challenges ahead for the German economy, which could influence market dynamics, particularly in the Euro and German equities. So, the small jump in the Euro on the stronger CPI numbers, was balanced by the lower ZEW economic sentiment for both Germany and the Eurozone.

Latest Germany ZEW Sentiment Report – 18 June 2024

- Current Conditions: -73.8 points vs -65.0 points expected

- Prior: -72.3 points

- The current conditions index worsened, falling to -73.8 from -72.3 in the previous month and missing expectations of -65.0. This indicates a deterioration in the perceived current state of the German economy.

- Prior: 47.1 points

- Economic sentiment showed a slight improvement to 47.5 from 47.1, but still fell short of the expected 50.0. This suggests that optimism about future economic conditions has stalled.

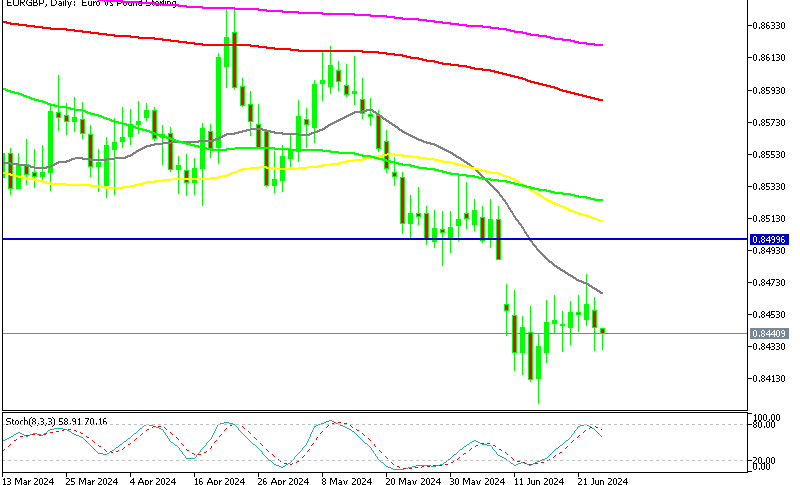

EUR/USD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |