Ethereum (ETH) Caught in a Tug-of-War: Soaring Optimism Meets Stagnant Price, Key Levels to Watch

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently caught in a puzzling situation. While excitement is brewing over the imminent launch of the first-ever US spot Ethereum ETF, the token’s price remains stubbornly stuck in neutral territory.

ETH Supply Squeeze and a Looming ETF

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

On the one hand, optimism abounds among ETH holders. The cryptocurrency is experiencing a supply crunch. Staking, where tokens are locked up to earn rewards, and the booming DeFi (decentralized finance) space are absorbing a significant chunk of ETH, taking it out of circulation. This limited availability could theoretically drive up prices.

Further fueling the positive sentiment is the highly anticipated launch of a spot Ethereum ETF. This long-awaited regulatory approval could open the floodgates for institutional investment, bringing a fresh wave of demand and potentially pushing prices higher. Analysts even predict the ETF to attract billions of dollars within its first few months.

But Will Ethereum Prices Plunge After the Launch?

However, a layer of uncertainty clouds this optimistic outlook. Memories of Bitcoin’s ETF launch in January still linger. Back then, prices took a nosedive after the initial excitement, leading some to fear a similar fate for Ethereum. Additionally, concerns remain about Grayscale, a massive cryptocurrency investment firm, potentially selling its significant ETHE holdings once the ETF becomes available.

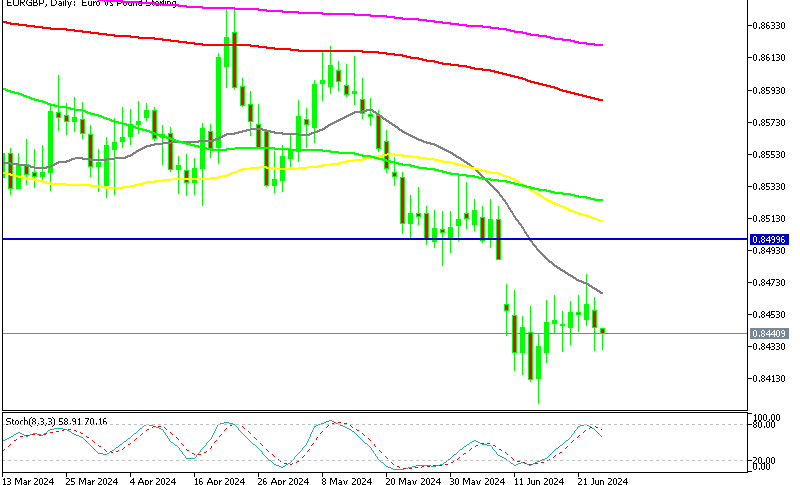

Liquidations and Resistance Levels

Adding to the short-term murkiness are recent price fluctuations. While these swings haven’t been dramatic, they triggered a wave of liquidations across the market, with Ethereum leading the pack. This suggests some investors might be getting jittery.

Moreover, ETH is struggling to overcome a key resistance level of $3,700. A decisive break above this point is seen as crucial for further price gains in the short to medium term. Conversely, a sustained drop below $3,500 could trigger further selling and push prices towards the next support level at around $3,200.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |