DAX Recovers from Yesterday’s Low – PMI Data Vs Hawkish FOMC Minutes

The FOMC minutes released yesterday showed a more hawkish stance from the committee’s members. The main sentiment is that inflation is not

The FOMC minutes released yesterday showed a more hawkish stance from the committee’s members. The main sentiment is that inflation is not declining towards the 2% target as quickly as hoped.

Tech stocks, however, got a boost from a better-than-expected Nvidia earnings report, sending the NASDAQ to a new all-time high. Some analysts are expecting AI to create a stock market boom as the technology filters through various industries.

The DAX recovered some lost ground on the open, up 0.35%. PMI Manufacturing and PMI Services came in better than forecast. The bullish data for the German economy gave the index a small boost.

What still remains to be seen is whether the FOMC’s hawkish will take over sentiment. The DAX reached an all-time high on April 16, of 18920. Since then, the market has failed to post a new high and trading sessions have shown no momentum with the market drifting sideways.

Looking at the forex market for clues we can see the euro is back up again, after dropping 20 pips on the minutes release. The EUR/USD is up 0.17% on the day, also boosted by Eurozone PMI data which was better than forecast.

For now, it seems that the revelation of a more hawkish stance has taken a back seat. We can expect to find more clues in upcoming data that might ignite hopes of a rate cut from the Fed sooner rather than later.

Technical View

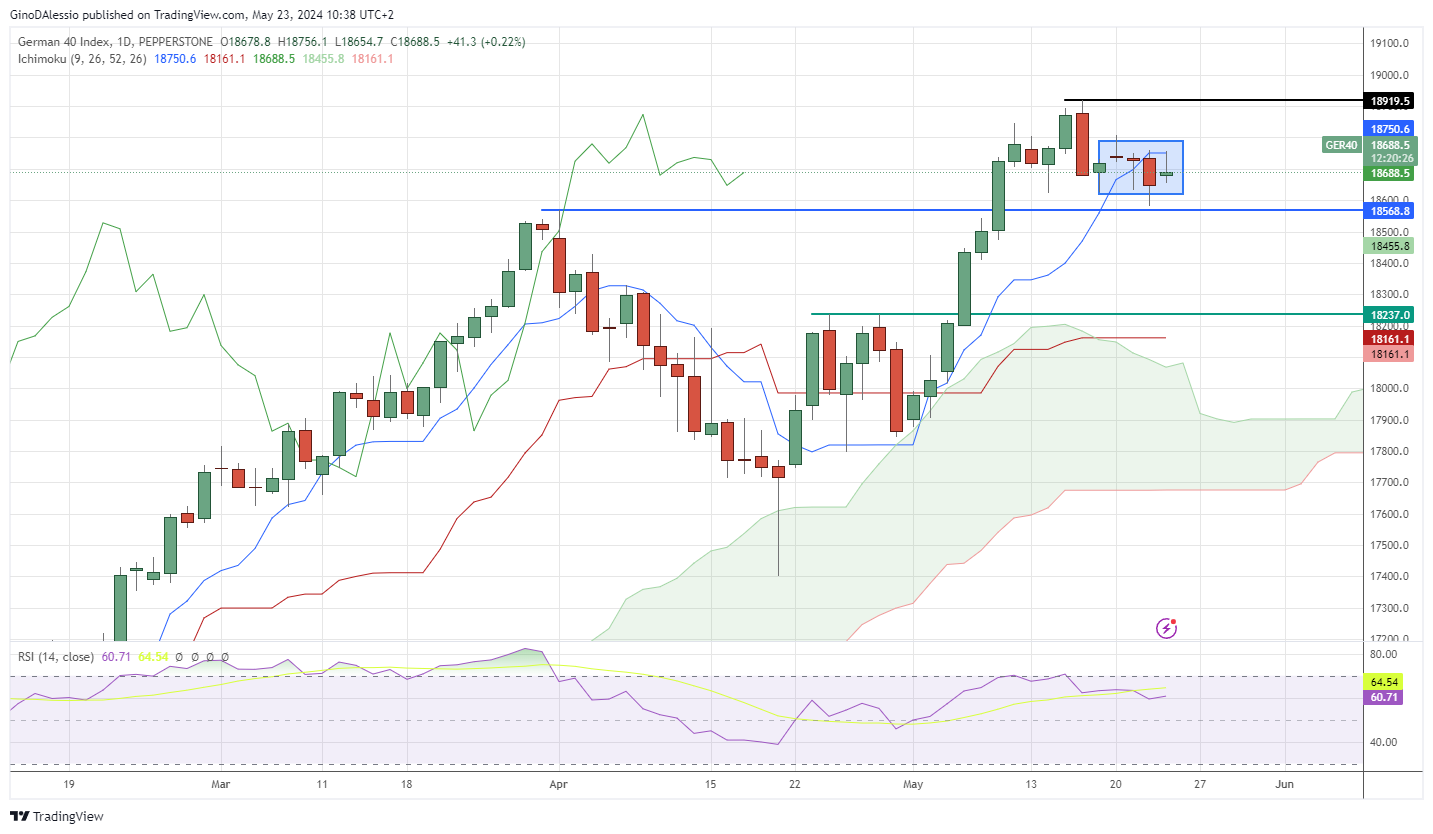

The day chart for the DAX below shows a recent sideways market (blue area). Which is typical of a market in consolidation, a break of this area should give rise to a new movement in the direction of the break.

A break to the downside would be met by support at 18568 (blue line) and the at 18237 (green line). The 18237 level was set by a double top in April and should be a challenge to break. To the upside, the market will find resistance at 18919 (black line), which is the current all-time high.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account