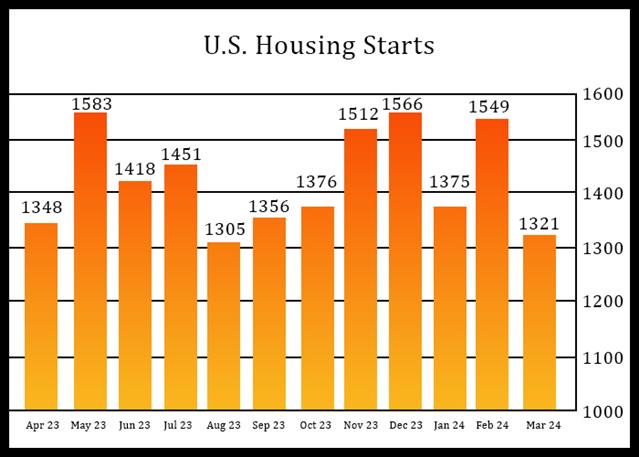

U.S. Housing Starts Pull Back Sharply In March, Extending Recent Volatility

After reporting a substantial rebound in new residential construction in the U.S. in the previous month, the Commerce Department released a report on Tuesday showing housing starts pulled back by much...

After reporting a substantial rebound in new residential construction in the U.S. in the previous month, the Commerce Department released a report on Tuesday showing housing starts pulled back by much more than expected in the month of March.

The Commerce Department said housing starts plummeted by 14.7 percent to an annual rate of 1.321 million in March after soaring by 12.7 percent to a revised rate of 1.549 million in February.

Economists had expected housing starts to slump by 2.7 percent to an annual rate of 1.480 million from the 1.521 million originally reported for the previous month.

The significant rebound in February came after housing starts plunged by 12.2 percent in January, suggesting considerable month-over-month volatility in the housing market.

Multi-family starts led the pullback in March, plummeting by 21.7 percent to an annual rate of 299,000 after surging by 7.0 percent to a rate of 382,000 in February.

The report said single-family starts also tumbled by 12.4 percent to an annual rate of 1.022 million in March after skyrocketing by 14.6 percent to a rate of 1.167 million in February.

The Commerce Department said building permits also dove by 4.3 percent to an annual rate of 1.458 million in March after jumping by 2.3 percent to a revised rate of 1.523 million in February.

Building permits, an indicator of future housing demand, were expected to dip by 0.3 percent to a rate of 1.514 million from the 1.518 million originally reported for the previous month.

Single-family permits plunged by 5.7 percent to an annual rate of 973,000, while multi-family permits slid by 1.2 percent to an annual rate of 485,000.

“Housing construction is poised to slow as potential homebuyers indicate now is a poor time to buy a home,” said Jeffrey Roach, Chief Economist for LPL Financial.

“Investors should expect residential investment becoming a drag on GDP growth in the coming quarters,” he added. “Housing activity may not fully stabilize until the Fed commences their easing cycle.”

The National Association of Home Builders released a separate report on Monday showing homebuilder confidence in the U.S. came in flat in the month of April.

The report said the NAHB/Wells Fargo Housing Market Index came in at 51 in April, unchanged from March and in line with economist estimates.

The unchanged reading halts a four-month advance by the housing market index, which reached its highest level since last July in the previous month.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account