Little Reaction in USD Crosses After the US Core PCE

The main event for the week has passed without much drama as markets remain steady after the Core PCE inflation report for February. It showed that inflation remained sticky in general, but that didn’t help the USD much. Instead, we saw a small dip of around 20 pips, but that has been erased already.

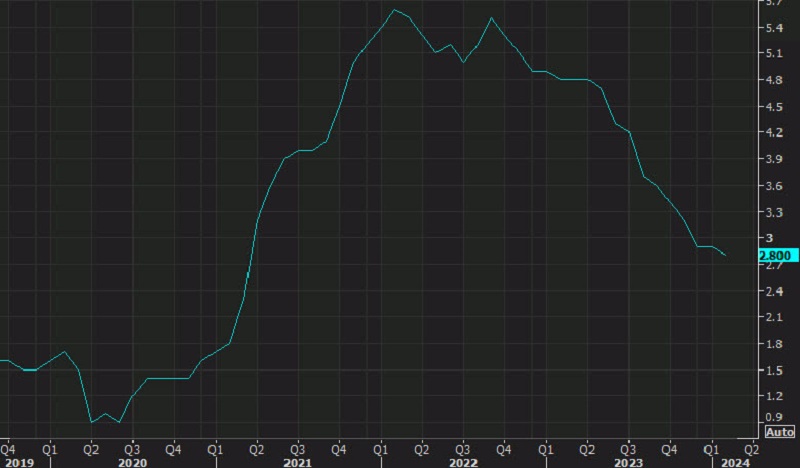

US Core PCE YoY Chart

On Good Friday, while the stock and bonds markets are closed, the foreign exchange (FX) market remains open, albeit with significantly reduced trading activity. This resulted in the release of the Personal Consumption Expenditures (PCE) data being in an unusual situation today, with liquidity being thin, so some were worried about possible large moves in the USD after the PCE release.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The key figure in the PCE report was the month-over-month core PCE reading. While on the surface it matched the expected +0.3% month-over-month (m/m) value, the unrounded figure was +0.261%, which is notably closer to +0.2% than +0.4%. However, it’s worth noting that the January’s figure was revised up to +0.5% from +0.4%, which may have balanced things out.

Overall, the year-over-year core PCE inflation rate of +2.5% was in line with expectations, reflecting core inflation. Following the data release, the US dollar experienced a decline of 15-20 pips across the board. This decline could be attributed to various factors such as the lower unrounded number, relief that inflation wasn’t higher, or simply random movements in a holiday-thinned market.

Highlights of FED Personal Consumption Expenditure PCE, February 2024

- PCE Core Inflation:

- Year-on-year (y/y) core inflation came in at +2.8%, matching expectations.

- The prior month’s figure was revised slightly lower from +2.9% to +2.8%.

- PCE Core Month-over-Month (m/m):

- Core PCE increased by +0.3% month-over-month, in line with expectations.

- However, the unrounded figure was slightly lower at +0.261%.

- The prior month’s figure was revised upward from +0.4% to +0.5%.

- Headline PCE:

- Year-on-year (y/y) headline PCE inflation stood at +2.5%, meeting expectations.

- Month-over-month (m/m) headline PCE increased by +0.3%, slightly below the expected +0.4%.

- The unrounded figure for m/m headline PCE was +0.333%.

- 6-Month Core Annualized:

- Core annualized inflation over the past six months was reported at +2.9%, up from the prior figure of +2.6%.

Consumer Spending and Income for February:

- Personal Income:

- Personal income increased by +0.3%, slightly below the expected +0.4%.

- The prior month’s figure remained unchanged at +0.3%.

- Personal Spending:

- Personal spending showed a robust increase of +0.8%, surpassing expectations of +0.5%.

- The prior month’s figure was revised significantly upward from +0.2% to +0.8%.

- Real Personal Spending:

- Real personal spending increased by +0.4%, contrasting with the previous month’s revised figure of -0.2%.

Sidebar rates

82% of retail CFD accounts lose money.