The minister for Inland Revenue, Marcel made a positive speech on the state of the Chilean economy during the Latam Focus seminar.

Marcel mentioned the projection for GDP growth of 2.5% seemed to be even more realistic given the recent economic data from January, and that February data could possibly reaffirm the 2.5% forecast.

He also stated that Chile had gotten past its social problems and the disequilibrium that came after the Covid pandemic. The head of Inland Revenue also said that copper mining activity had surpassed its previous peak from November 2021.

However, the USD/CLP didn’t react to those promising words for the Chilean economy, today’s momentum saw the peso weaken sharply, falling to 969.50 against the US dollar. The market was led more by dollar strength, as investors perceive a longer wait before the Fed starts cutting rates.

Copper prices also played a part today, as copper futures lost 1.47% from the open. While the bullish sentiment for copper seems intact, such a sharp drop would influence copper exporters expectations for the exchange rate.

Technical View

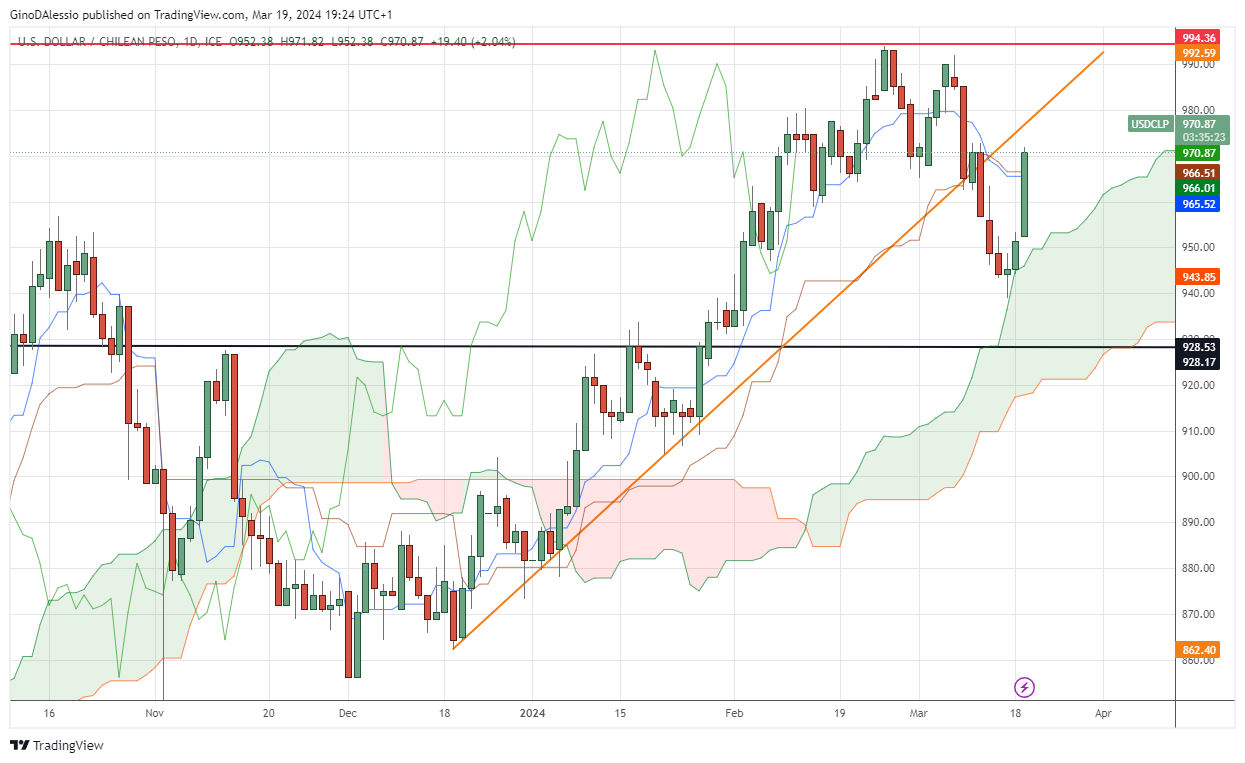

From the day chart below for USD/CLP we see the bullish trend is still in place. The market has bounced away from the upper side of the Ichimoku cloud, as many market technicians would have expected.

The break below a major trend (orange line) 6 trading sessions ago gave rise to more bearish price action. The nearest major support level (black line) was at 925.53, but the market found a much great support level from the green Ichimoku cloud.

To consider the bull trend as active, we would need to see the market rise above its recent high at 994.36. A lot depends on Wednesday’s FOMC press conference. However, from a purely technical standpoint the next stop for the peso is to test the resistance area (red line) at 994.36.

Today’s price action has seen the peso among the currencies losing the most ground as we await the FOMC. Expectations have been shifting over the past 3 trading sessions and the US dollar has been the main beneficiary.

We can expect tomorrow to get extremely volatile with market participants reading into Fed chair Powell’s words. It seems the market is gearing up for more hawkish statements from the governor of the Fed, and a higher US dollar.