USD Resumes Decline As Consumer Sentiment Improves on Dovish FED Rhetoric

Risk sentiment has turned positive in recent weeks, as central banks seem to have finally stopped raising interest rates. This has been weig

Risk sentiment has turned positive in recent weeks, as central banks seem to have finally stopped raising interest rates. This has been weighing on the US Treasury yields, which have been retreating, pulling the USD down with them as well. Risk assets such as stock markets and commodity dollars have been showing strength in the meantime.

Inflation has been slowing, heading toward normal levels, so the FED is less hawkish now and their comments are sounding more hawkish. FED member Waller who is usually hawkish stated that “there are good justifications for lowering policy rates if inflation continues to decline for several months”.

This is a significant shift from him and the first indication from any FED official that rate cuts are imminent or could occur. The market is already pricing in a 75% chance of a rate decrease in May, but that hasn’t been backed up by the FED until today. The Conference Board consumer confidence showed an increase as well for this month, so we’re seeing significant US dollar selling, as well as bids in bonds and purchasing in stocks. GOLD has surged above $2,040, while EUR/USD is above 1.10 for the first time since August.

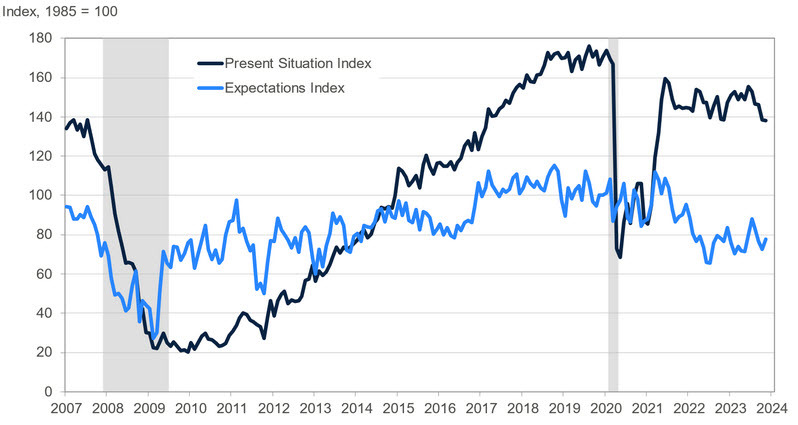

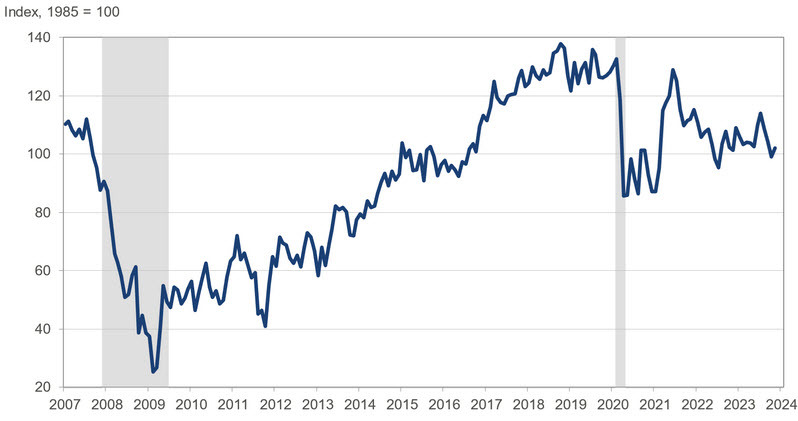

US November Consumer Confidence from The Conference Board

- Prior was 102.6 (revised to 99.1)

- November consumer confidence 102.0 vs 101.0 expected

Details:

- Present situation index 138.2 vs 143.1 prior (prior revised to 138.6)

- Expectations index 77.8 vs 75.6 prior

- 1-year Inflation 5.7% vs 5.9% prior

- Jobs hard-to-get 15.4 vs 13.1 prior

“Consumer confidence increased in November, following three consecutive months of decline,” said Dana Peterson, Chief Economist at The Conference Board. “This improvement reflected a recovery in the Expectations Index, while the Present Situation Index was largely unchanged. November’s increase in consumer confidence was concentrated primarily among householders aged 55 and up; by contrast, confidence among householders aged 35-54 declined slightly. General improvements were seen across the spectrum of income groups surveyed in November. Nonetheless, write-in responses revealed consumers remain preoccupied with rising prices in general, followed by war/conflicts and higher interest rates.”

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account