Where Will Crude Oil End up Next, Up or Down?

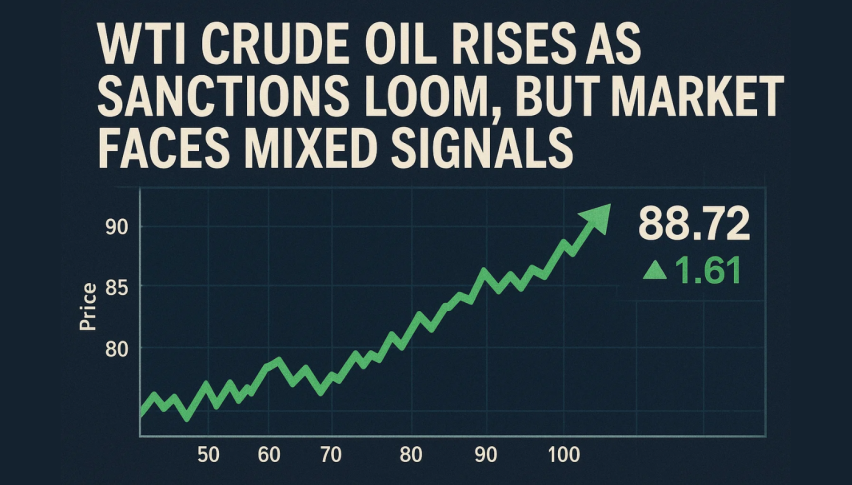

Crude Oil surged higher early last week on the Middle East conflict, then closed the gap but closed the week even higher

Last week we saw enormous volatility in crude Oil. WTI crude Opened with a $2.50 bullish gap higher on Monday, after the tensions in the Middle East. It continued climbing higher that day but on Tuesday the price stabilized and on Wednesday we saw a reversal lower, with the price closing the gap, as it fell to around $82.30 by Thursday, before the US EIA inventory report was released.

The inventories showed a massive increase in US crude Oil supplies, wiping out five weeks of drawdowns. It was accompanied by data suggesting that US oil output was at an all-time high.

EIA Weekly US Oil and Product Inventories

- Weekly oil inventories +1,0176K vs +492K expected

- Prior week inventories were -2224K

- Gasoline -1,313K vs -800K expected

- Distillates -1,837K vs -802K expected

- Refinery utilization -1.6% vs -0.4% expected

- Implied mogas demand 8.58m vs 8.01m prior

- Domestic production 13.2 mbpd vs 12.9 mbpd prior

API Data Released on Wednesday:

- Crude -12,940K

- Cushing -547K

- Gasoline +3,645K

- Distillate -3,535K

The spread between gasoline and disillates is becoming increasingly fascinating. There is a shortfall of diesel but an abundance of gasoline, yet the spread on distillates is so huge that refineries will operate hard and flood the market with gasoline since the cracks on diesel are still so big. Total inventories increased by 6.928 million barrels, although the market expected this after the private data yesterday.

Nonetheless, Oil surged by $4.69 the next day to close the week at $87.69, surpassing the high from earlier in the week. Take note of the three-candle reversal during the previous three days which were regained in just one day, with an engulfing bullish candlestick, as well as the higher low. Those are optimistic indications in a market that is still quite uncertain, although this uncertainty in the Middle East is playing in favour of crude Oil at the moment.

So, it will depend on how the conflict in Gaza goes, if it escalates then Oil will likely continue to remain well bid, if the tensions deescalate then it is likely that we will see a return back down to $80 lows. We are following the news and will keep you informed.

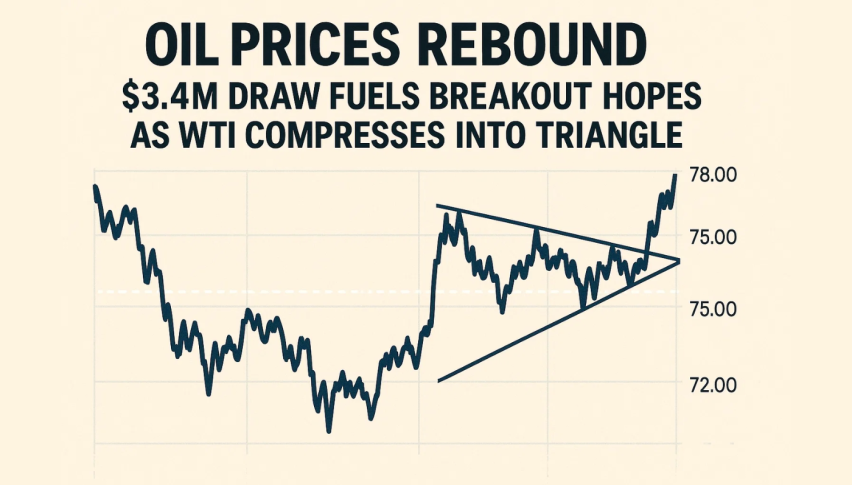

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account