Gold Price Prediction: Sideways Trading Continues, Brace for Breakout!

On the data front, at 17:30 GMT, the Philly Fed Manufacturing Index rose to 51.8 against the expected 22.5 and supported the US dollar, weighing on the yellow metal prices. The Unemployment Claims from the last week also rose to 770K against the expected 704K and weighed on the US dollar, capping further downward pressure on gold. At 19:00 GMT, the CB Leading Index declined to 0.2% against the forecast 0.3% and weighed on the US dollar and limited the losses in prices.Meanwhile, on Thursday, Fed Chair Jerome Powell said that the coronavirus pandemic had highlighted the need to advance systems for transferring money across international borders. The desire for improvement and digitalization has been accelerated for the less efficient areas of the current payment system after the coronavirus pandemic. Powell added that it has become crucial to integrate potential central bank digital currencies into the existing payment system alongside cash and other forms of money. He said that the pandemic crisis had underscored the limitation of current arrangements for cross-border payments and a need to add digital currencies to the system. Although the current money system was safe and reliable, it suffers from outdated technology.

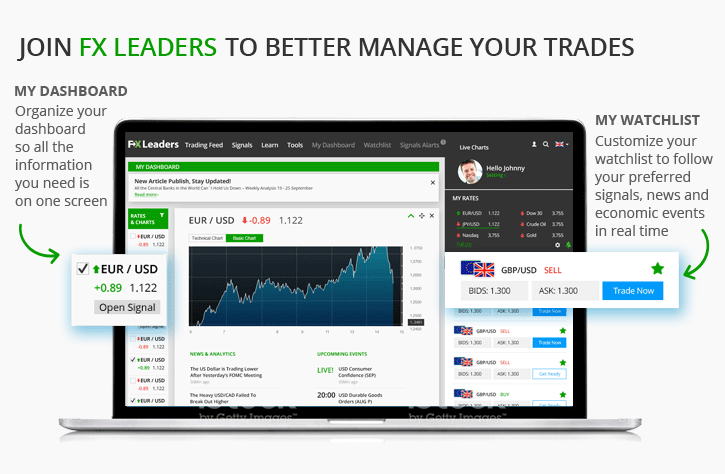

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments

Oldest