10 Best Zero Spread Forex Brokers

The 10 Best Zero Spread Forex Brokers revealed. We have evaluated hundreds of Forex and CFD Brokers charging the tightest spreads to identify the 10 Best with spreads from 0.0 pips on EUR/USD.

10 Best Zero Spread Forex Brokers (2025)

- Exness – Overall, The Best Zero Spread Forex Broker

- IC Markets – Spreads can start from 0.0 pips on Raw Accounts

- Pepperstone – Competitive spreads and commission structure

- Axi – Zero Spreads on major Forex pairs

- Vantage Fx – Ultra-low spreads, with some accounts offering spreads from 0.0 pips

- Tickmill – Fast execution speeds and competitive commissions

- RoboForex – Zero pips Spreads on specific account types

- HFM – No hidden fees, and low commissions

- XM – Zero Spreads on major currency pairs

- FXOpen – Low-cost trading with spreads from 0.0 pips

Top 10 Forex Brokers (Globally)

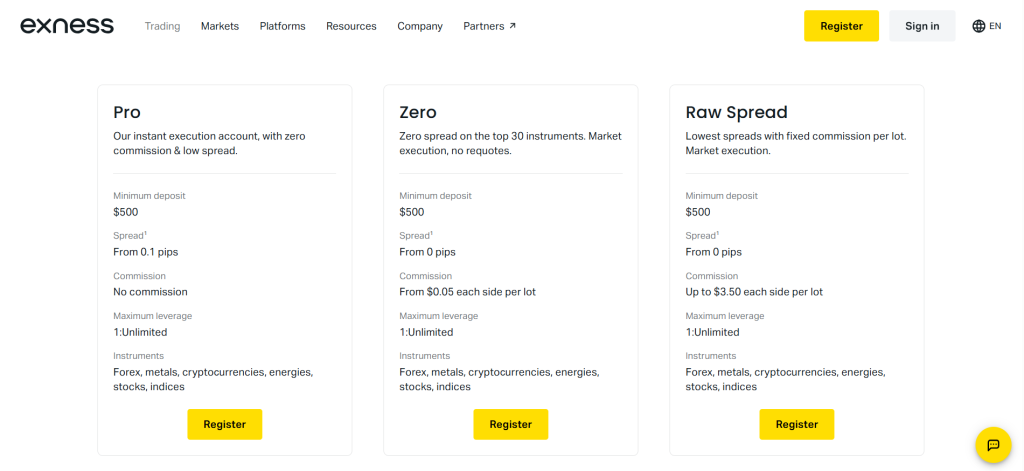

1. Exness

Exness is a globally regulated forex broker offering zero spread accounts with raw spreads from 0.0 pips, fast order execution, high leverage up to 1:2000, and support for local payment methods. Ideal for cost-conscious traders.

Frequently Asked Questions

Is Exness a legit and regulated broker?

Yes, Exness is a legitimate and highly regulated broker. It holds licenses from multiple reputable international bodies, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and FSC (Mauritius and BVI), ensuring client protection and operational transparency.

Does Exness offer zero spread accounts?

Yes, Exness offers a “Zero” account type designed for traders seeking ultra-low spreads. This account features 0.0 pip spreads on the top 30 most traded instruments for 95% of the trading day, alongside a small commission per lot.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | Limited Education Resources |

| Low Minimum Deposit | No Proprietary Copy Trading |

| Zero Spread Accounts | Not Available in Some Regions |

| High Leverage | Leverage Restrictions May Apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a globally authorized and well-regulated forex broker offering zero spread accounts, high leverage, and fast withdrawals. Its low entry barrier and strong safety features make it ideal for both new and experienced traders.

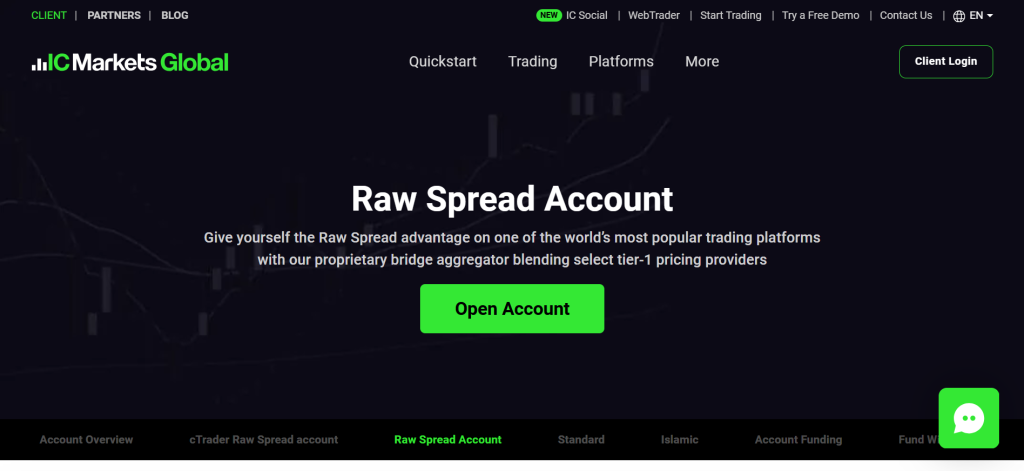

2. IC Markets

IC Markets is a globally regulated forex broker offering raw spread accounts with spreads from 0.0 pips, ultra-fast execution, and low commissions. It supports MT4, MT5, and cTrader, making it ideal for scalpers and algorithmic traders.

Frequently Asked Questions

What platforms does IC Markets support?

IC Markets supports a strong lineup of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both highly popular for their advanced features. They also offer cTrader for ECN-style trading and TradingView, known for its powerful charting tools.

Does IC Markets offer copy trading?

Yes, IC Markets offers comprehensive copy trading solutions. They provide cTrader Copy integrated directly into their client area for seamless access. Additionally, they support their own IC Social app and external services like ZuluTrade and Signal Start.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight Spreads from 0.0 Pips | $200 Minimum Deposit |

| Low Commission Fees | Limited Investor Protection in Some Jurisdictions |

| Fast Execution Speed | No Proprietary Platform |

| Multiple Trading Platforms | No Bonuses or Promotions |

| Islamic Accounts Available | Inactivity Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legit and well-regulated forex broker offering zero-spread accounts, fast execution, and powerful platforms. It’s ideal for serious traders, though beginners may find the $200 minimum deposit relatively high.

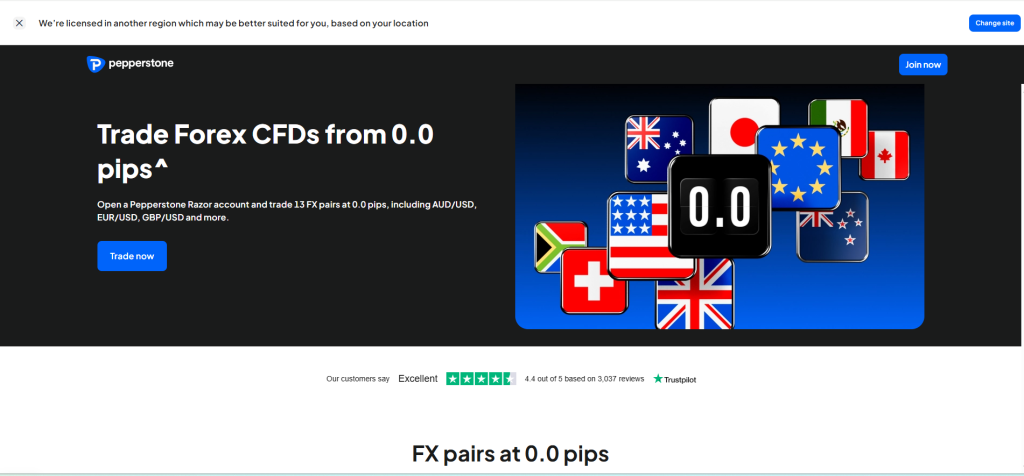

3. Pepperstone

Pepperstone’s Razor account is tailored for experienced traders, offering raw spreads starting from 0.0 pips on major currency pairs like EUR/USD. This account type is ideal for scalpers and algorithmic traders seeking tight spreads and fast execution speeds.

Frequently Asked Questions

What Leverage Does Pepperstone Offer?

Pepperstone’s leverage varies based on the regulatory entity and asset class. For retail clients under some jurisdictions, leverage can go up to 1:400. In stricter regulatory environments, retail leverage is capped at 1:30. For Professional clients – up to 1:500.

Is Negative Balance Protection Provided?

Yes, Pepperstone provides Negative Balance Protection for its retail clients. This ensures that a trader’s losses cannot exceed the funds available in their trading account, safeguarding them from falling into debt even during highly volatile market conditions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight Spreads | No Proprietary Platform |

| Low Commissions | Limited Education Tools |

| Top-Tier Regulation | Inactivity Fee |

| Multiple Platforms | No Bonuses/Promotions |

| Swap-Free Accounts | Leverage Restrictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legal and well-regulated broker offering tight spreads, fast execution, and top-tier platforms. It suits both beginners and advanced traders seeking a secure, cost-effective, and transparent trading environment.

Top 3 Zero Spread Forex Brokers – Exness vs IC Markets vs Pepperstone

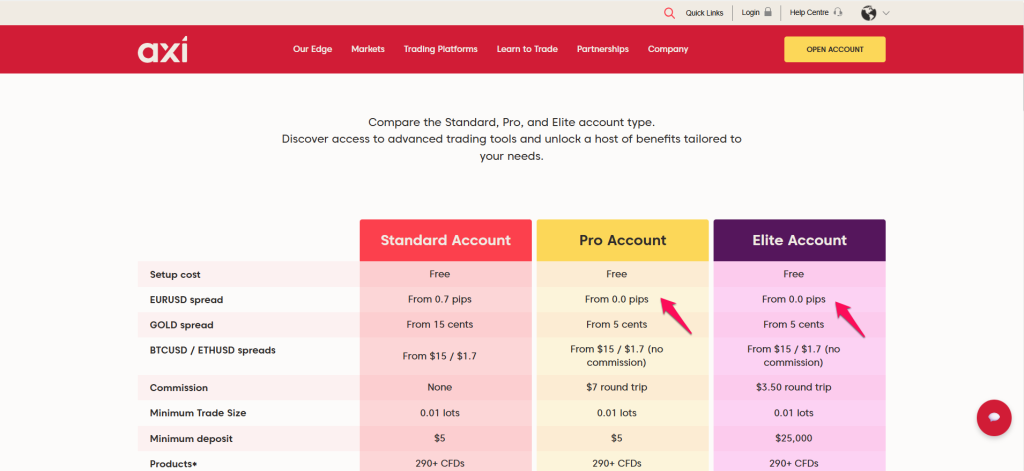

4. Axi

Traders can benefit from zero spreads on Raw Spread accounts, competitive commissions, and access to over 2,250 instruments including forex, indices, commodities, stocks, and cryptocurrencies.

Frequently Asked Questions

What trading platforms does Axi offer?

Axi primarily offers the widely popular MetaTrader 4 platform across various versions, including desktop, WebTrader, and mobile. They also provide their own Axi Trading Platform mobile app for trading on the go and have recently started supporting MetaTrader 5 in certain regions.

Does Axi offer demo accounts?

Yes, Axi offers free demo accounts. These accounts provide a risk-free environment with virtual funds (typically $50,000) to practice trading strategies, explore the MetaTrader 4 platform, and familiarize yourself with real-time market conditions before committing to real capital.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by top authorities | Limited product range |

| Low minimum deposit | No proprietary trading platform |

| Tight spreads | Higher commissions |

| Negative balance protection | No cryptocurrency trading |

| Islamic Accounts | Leverage limits vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a globally approved forex and CFD broker offering tight spreads, strong regulation, and user-friendly platforms. It’s ideal for cost-conscious traders, though limited CFD variety and platform options may deter some users.

5. Vantage Fx

Vantage is a globally regulated forex and CFD broker known for its RAW ECN accounts, which offer zero spreads—perfect for traders prioritizing low costs and institutional-grade pricing. With a minimum deposit of just $50, you can access over 1,000 instruments, including forex, indices, commodities, and shares.

Frequently Asked Questions

Are there commission-free accounts?

Yes, Vantage offers commission-free accounts. Their Standard STP Account operates with spreads that include the broker’s markup, meaning no separate commission is charged per trade. This is ideal for traders who prefer a simpler cost structure without explicit commission fees.

Does Vantage FX allow copy trading?

Yes, Vantage offers robust copy trading solutions. They have their Vantage Copy Trading integrated into their Client Portal and mobile app. This allows users to easily follow and replicate the trades of top-performing signal providers in real time.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulation | Limited product range |

| Tight spreads & low commissions | Customer support mixed |

| Negative-balance protection | App/platform issues |

| Unlimited demo account | Limited research content |

| Copy/social trading | High fees on stock CFDs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Vantage FX is a registered broker offering tight spreads, advanced platforms, and strong regulatory oversight. It suits both beginners and pros, though some may find platform issues or limited instruments a drawback.

6. Tickmill

Tickmill is a registered and FCA‑, CySEC‑, FSCA‑, FSA‑regulated ECN broker offering zero‑spread execution on its Raw (Pro/VIP) accounts. The broker delivers tight 0‑pip spreads, robust regulation, and high leverage—making it an appealing choice for active traders.

Frequently Asked Questions

Does Tickmill offer zero-spread accounts?

Yes, Tickmill offers a Raw Account that features spreads from 0.0 pips on major currency pairs. While the spread itself can be zero, this account type typically involves a commission of $3 per lot per side on forex and precious metals.

Does Tickmill offer swap-free accounts?

Yes, Tickmill offers swap-free (Islamic) accounts. These accounts are compliant with Sharia law, eliminating overnight interest charges on open positions. Both their Classic and Raw Account types can be converted to an Islamic version, providing flexibility for Muslim traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Heavily regulated | Limited product range |

| Zero spreads | High deposit for VIP account |

| Low commissions | Limited educational content |

| Islamic (swap-free) accounts | No proprietary trading platform |

| Excellent customer service | Restricted leverage |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is an authorized broker known for its zero-spread accounts, fast execution, and strong regulatory oversight. It suits active traders seeking low-cost trading, though product variety and educational content remain somewhat limited.

7. RoboForex

RoboForex is a licensed broker regulated by CySEC (EU) and IFSC (Belize), providing zero-spread trading through its ECN and Prime accounts, with spreads starting from 0.0 pips plus a commission.

Frequently Asked Questions

What is the minimum deposit at RoboForex?

RoboForex offers a low minimum deposit of USD 10 for most of its popular account types, including ProCent, Pro, Prime, and ECN accounts. However, the R StocksTrader account requires a higher minimum deposit of $100.

Does RoboForex offer zero-spread accounts?

Yes, RoboForex offers accounts with spreads from 0.0 pips. Their ECN and Prime account types are designed for professional traders, providing very tight, floating spreads (often 0 pips) on major currency pairs, accompanied by a commission per lot traded.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low minimum deposit | Offshore regulation |

| Zero spread accounts | Withdrawal fees |

| High leverage | No FSCA, ASIC, or FCA regulation |

| Multiple platforms supported | Basic educational resources |

| Copy trading via CopyFX | Inactivity fees |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐☆☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

RoboForex is an authorized broker offering zero-spread accounts, high leverage, and access to over 12,000 instruments. While feature-rich and affordable, its offshore regulation may concern traders prioritizing top-tier regulatory protection.

8. HFM

HFM offers spreads from 0.0 pips, a $0 minimum deposit, leverage up to 1:2000, and support for MT4, MT5, WebTrader, and mobile apps, it’s ideal for scalpers and high-volume traders.

Frequently Asked Questions

What is the maximum leverage HFM offers?

HFM offers maximum leverage of up to 1:2000 on several account types, including the Cent, Zero, Pro, and Pro Plus accounts. However, leverage can vary based on your client classification and the specific regulatory entity you are under.

Does HFM offer zero-spread accounts?

Yes, HFM offers a Zero Account that provides spreads from 0.0 pips on major forex pairs and gold. This account is designed for traders seeking raw, super-tight spreads directly from liquidity providers. It operates with a commission per lot traded.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-regulated | Commission applies |

| Zero-spread account | Platform options limited to MT4/MT5 |

| $0 minimum deposit | Limited product range |

| High leverage | Inactivity fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a legit, well-regulated broker offering zero spreads, high leverage, and diverse instruments. Its low deposit requirements and strong safety measures make it suitable for both beginners and experienced traders seeking reliable trading conditions.

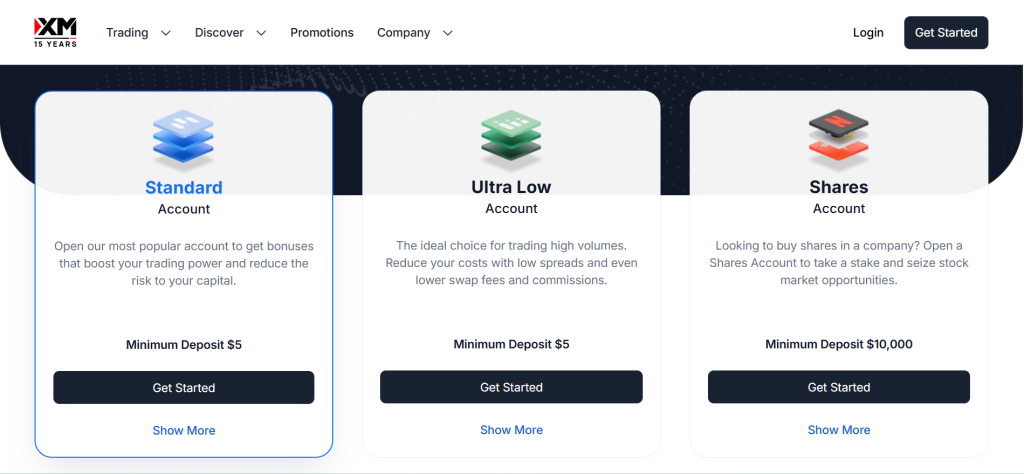

9. XM

XM is a regulated broker that offers a range of account types, including a Zero Account featuring spreads from 0.0 pips plus commissions. It provides leverage of up to 1:1000, requires a minimum deposit of $5, and supports both MT4 and MT5 trading platforms.

Frequently Asked Questions

Does XM offer zero-spread accounts?

Yes, XM offers a Zero Account designed for traders who prioritize extremely tight spreads. This account type provides spreads from 0.0 pips on major currency pairs, with a commission charged per trade (e.g., $3.50 per side for a standard lot).

Which trading platforms does XM support?

XM primarily supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These are available across various devices, including desktops, web browsers, and mobile. They also offer their own XM App for convenient mobile trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Commission fees |

| Zero spread account | Leverage limited |

| Low minimum deposit | No proprietary trading platform |

| Negative balance protection | Limited research and educational resources |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legal and well-regulated broker offering zero spread accounts, low minimum deposits, and access to 1,000+ instruments. It’s suitable for traders of all levels, though some account types carry higher spreads.

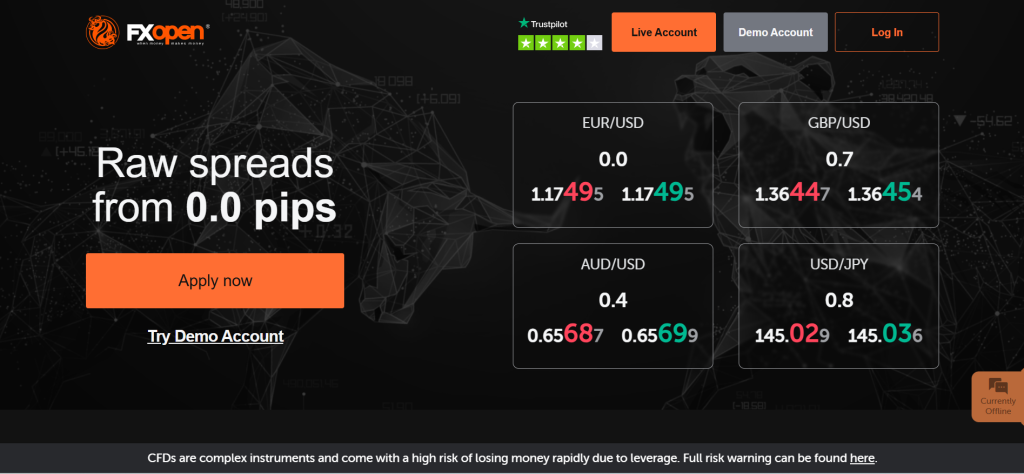

10. FXOpen

FXOpen is a licensed and multi-regulated broker that provides genuine zero spreads on ECN accounts, very low commissions, and a versatile selection of platforms and account types. With low minimum deposit requirements, strong fund protection measures, and high leverage options, it caters to traders of all experience levels, from beginners to professionals.

Frequently Asked Questions

Does FXOpen offer swap-free accounts?

Yes, FXOpen offers swap-free (Islamic) accounts to comply with Sharia law. While these accounts eliminate overnight interest (swaps), an additional commission equal to the swap value may be charged for positions held overnight. Traders need to request this feature and provide documentation.

Does FXOpen offer zero-spread accounts?

Yes, FXOpen offers accounts with spreads from 0.0 pips, notably on their ECN Account types). These accounts provide raw market spreads directly from liquidity providers, combined with a commission per lot traded, making them ideal for high-volume traders and scalpers.

Pros and Cons

| ✓ Pros | ✕ Cons |

| True ECN/STP execution | Limited educational and research materials |

| Low minimum deposits | Inactivity fees apply |

| Multiple platforms supported | Relatively small product range |

| High leverage | Customer support issues |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXOpen is an FCA- and CySEC-approved broker offering zero spreads on ECN accounts, low deposit options, and multiple platforms. It’s ideal for experienced traders, though beginners may find limited educational support and assets.

What is a Zero Spread Forex Broker?

A Zero Spread Forex Broker is a broker that offers trading accounts where the spread—the difference between the bid and ask price—is as low as 0.0 pips on certain instruments, particularly major currency pairs like EUR/USD.

Criteria for Choosing a Zero Spread Forex Broker

| Criteria | Description | Importance |

| Regulation | Ensure the broker is licensed by reputable authorities (e.g., FCA, ASIC, CySEC). | ⭐⭐⭐⭐⭐ |

| True 0.0 Spread Execution | Confirm the broker consistently offers 0.0 pip spreads, not just during low volatility. | ⭐⭐⭐⭐⭐ |

| Commission Fees | Check the commission per lot (usually $3–$7) which replaces the spread as the main cost. | ⭐⭐⭐⭐☆ |

| Execution Speed | Fast order execution is crucial, especially for scalpers and high frequency traders. | ⭐⭐⭐⭐☆ |

| Minimum Deposit | Consider how accessible the broker is—some zero spread accounts require higher deposits. | ⭐⭐⭐☆☆ |

| Account Types | Look for ECN/Raw/Zero accounts specifically; avoid brokers that only offer standard accounts. | ⭐⭐⭐⭐☆ |

| Trading Platform | Ensure compatibility with MT4, MT5, cTrader, or proprietary platforms with fast execution. | ⭐⭐⭐⭐☆ |

| Asset Variety | More instruments (forex, indices, commodities) offer better diversification. | ⭐⭐⭐☆☆ |

| Negative Balance Protection | Protects you from losing more than your deposit—especially important with high leverage. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Check user reviews on sites like Trustpilot, Forex Peace Army, or Reddit. | ⭐⭐⭐⭐☆ |

Top 10 Best Zero Spread Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From what zero spreads mean to the minimum deposit, we provide straightforward answers to help you understand zero spreads and choose the right broker confidently.

Q: What exactly does ‘zero spread’ mean, and is it truly zero? – Alex M.

A: Zero spread” means the difference between the bid and ask price is effectively 0.0 pips for a significant portion of the trading day on certain instruments. While often truly zero on major pairs, it can widen during volatility or off-peak hours.

Q: If the spread is zero, how do these brokers make money? – Sarah K.

A: Zero-spread brokers typically generate revenue by charging a commission per lot traded. This commission replaces the profit they’d otherwise make from the spread markup, offering transparent pricing.

Q: Are zero-spread accounts available to all traders, or are there specific requirements? – Ben O.

A: Zero-spread accounts are often designed for experienced traders, scalpers, or those using Expert Advisors (EAs). They are usually ECN/Raw Spread accounts and might require a slightly higher minimum deposit than standard accounts.

Q: Do zero-spread accounts always require a much higher minimum deposit? – Emily L.

A: Not always, but often. While some brokers offer zero-spread accounts with minimums as low as $100-$200, others might require $500 or more, reflecting the institutional-grade liquidity and execution.

Q: Are zero spreads available on all trading instruments, or just specific ones? – Chris P.

A: Zero spreads are most commonly offered on major Forex pairs (e.g., EUR/USD, GBP/USD) and sometimes on popular commodities like Gold. For other instruments, you might find very low but not necessarily zero spreads.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tighter pricing | Commissions apply |

| Ideal for scalping and day trading | Zero spread may not apply 24/7 |

| Greater pricing transparency | Requires higher minimum deposits |

| Improved precision | Execution quality varies |

| Often faster execution | Can be overwhelming for beginners |

You Might Also Like:

- Exness Review

- IC Markets Review

- Pepperstone Review

- Axi Review

- Vantage Fx Review

- Tickmill Review

- RoboForex Review

- HFM Review

- XM Review

- FXOpen Review

In Conclusion

Zero-spread forex brokers offer 0.0 pip spreads, allowing traders to enter positions at raw market prices. They’re ideal for scalping and precision trading, though typically involve commission fees and require careful broker selection.

Faq

Slippage can occur with any account type, especially during high volatility (like news releases) or low liquidity. While zero-spread accounts aim for precise execution, market conditions can still cause orders to be filled at a slightly different price.

Zero-spread accounts are usually ECN/STP based, meaning orders are passed directly to liquidity providers. This often results in ultra-fast execution speeds (e.g., milliseconds), crucial for scalping and high-frequency trading strategies.

They are ideally suited for scalpers, day traders, and algorithmic traders (EAs) who place many trades and seek to minimize transaction costs on each trade. The precise entry and exit points are also highly beneficial.

The primary cost is the commission per lot, which is explicitly stated. Beyond that, be aware of potential overnight swap fees (unless it’s an Islamic/swap-free account) and any deposit/withdrawal fees the broker or payment provider might charge.

Yes, many highly regulated and reputable brokers offer zero-spread or raw-spread accounts. It’s crucial to choose a broker regulated by a strong authority (e.g., FCA, ASIC, CySEC) to ensure fund safety and fair practices.