10 Best Volatility 75 Forex Brokers

The 10 Best Volatility 75 Brokers Revealed. We have explored and tested several prominent Forex brokers to identify the Top 10 VIX 75 Forex Brokers.

10 Best Volatility 75 Forex Brokers (2025)

- AvaTrade – Overall, The Best Volatility 75 Forex Broker

- Deriv – Flexible trading conditions, and diverse platform options

- FXCM – Wide range of specialty platforms for algorithmic trading

- Pepperstone – User-friendly experience with transparent fees

- HFM – Unique features like HFcopy, its copy trading platform

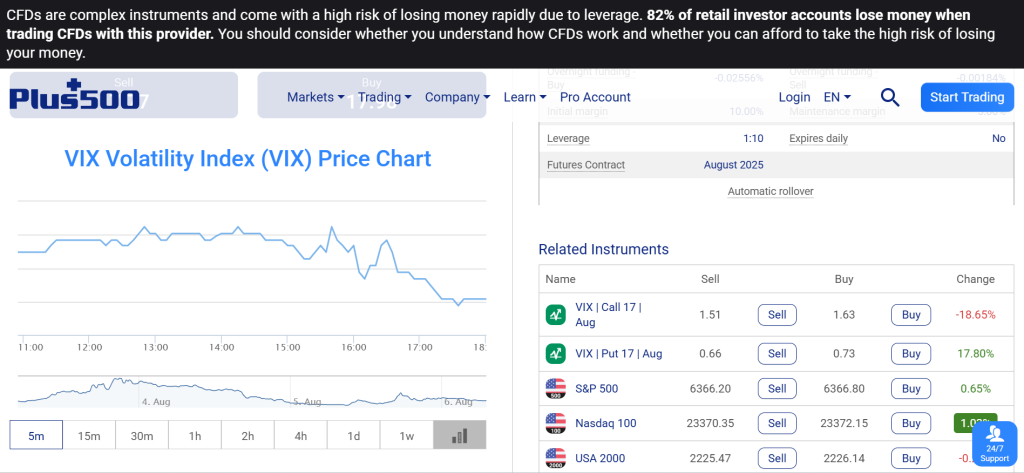

- Plus500 – Real-time alerts, and a demo account for practice

- FP Markets – Allows traders to execute trades on the Volatility 75 Index with ease

- FXTM – Competitive pricing, and fast execution

- IG – Access to a vast number of global markets

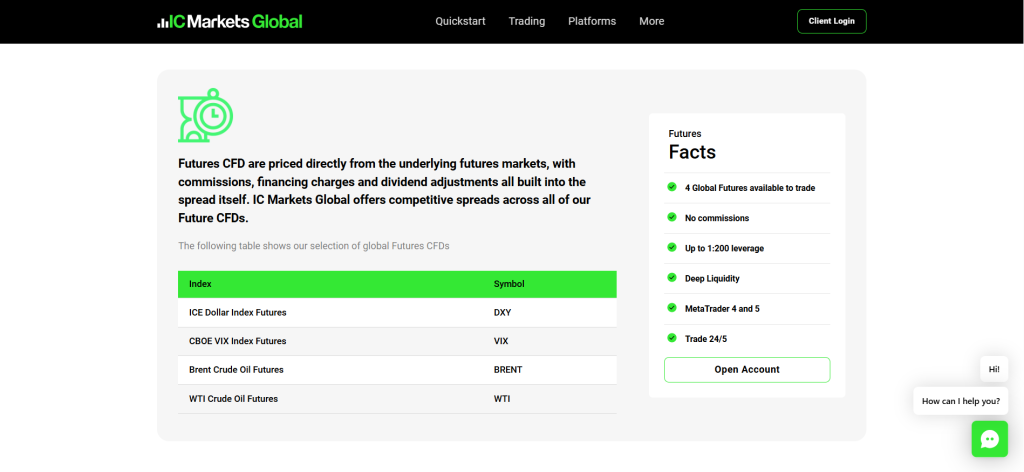

- IC Markets – Raw spreads from 0.0 pips

Top 10 Forex Brokers (Globally)

1. AvaTrade

AvaTrade offers trading on the Volatility 75 Index (VIX) through CFDs, enabling traders to speculate on market volatility. The broker is recognized for its easy-to-use platforms, including MetaTrader 4 and 5, AvaTradeGO, and WebTrader, along with competitive spreads and the protection of negative balance guarantees.

Frequently Asked Questions

Can I trade Volatility 75 (VIX) on AvaTrade?

Yes, you can trade the Volatility 75 Index (VIX) on AvaTrade. The broker offers this as a Contract for Difference (CFD) on its platforms, including MetaTrader 4 and MetaTrader 5, allowing traders to speculate on market volatility.

Is AvaTrade suitable for beginners?

AvaTrade is suitable for beginners due to its user-friendly platforms, risk-free demo account, and extensive educational resources. They offer a free AvaAcademy with courses, videos, and tutorials covering basic to advanced trading concepts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | Inactivity Fees |

| Low Minimum Deposit | Limited Customization on AvaTradeGO |

| Commission-Free Trading | No Direct Stock Ownership |

| Multiple Trading Platforms | Not Available in Some Countries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorized and well-regulated broker offering commission-free trading, a wide range of CFDs, and strong investor protections. Its user-friendly platforms and global compliance make it a solid choice for traders of all levels.

2. Deriv

Deriv is a regulated online trading platform that provides CFDs and synthetic indices trading, including the widely traded Volatility 75 Index (VIX 75). Traders can access a variety of assets such as forex, commodities, stocks, and cryptocurrencies through intuitive platforms like DTrader, DBot, and MetaTrader 5.

Frequently Asked Questions

Can I trade the Volatility 75 Index (VIX 75) on Deriv?

Yes, Deriv is well-known for offering the Volatility 75 Index (VIX 75) as one of its synthetic indices. This instrument is available to trade 24/7, making it a popular choice for traders seeking to speculate on market volatility.

Is there leverage on Deriv?

Yes, Deriv offers leverage on its various trading platforms, allowing traders to open larger positions with a smaller amount of capital. The maximum leverage varies significantly by asset class, with up to 1:4000 on some derived indices and up to 1:1000 on forex.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low Minimum Deposit | Limited Investor Protection |

| Access to Volatility 75 Index | No Real Asset Ownership |

| Multiple Trading Platforms | Synthetic Indices Are Proprietary |

| High Leverage | Limited Product Range |

| Commission-Free Trading | Not Available in Some Countries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Deriv is a legit online broker offering low-cost access to synthetic indices like Volatility 75, user-friendly platforms, and flexible trading options, making it a reliable choice for both beginner and experienced traders.

3. FXCM

FXCM offers trading on synthetic instruments such as the Volatility 75 Index (VIX 75), allowing traders to speculate on market volatility. The broker features competitive spreads, a range of educational materials, and advanced trading tools, making it a good choice for both novice and experienced traders.

Frequently Asked Questions

What is the minimum deposit?

The minimum deposit for an individual trading account with FXCM is $50. However, the minimum can be higher for certain account types, such as corporate or IRA accounts, and it may also vary depending on your country of residence and chosen payment method.

What platforms does FXCM offer?

FXCM offers several platforms to suit various trading needs. Their flagship platform is Trading Station, available on desktop, web, and mobile. They also support MetaTrader 4 (MT4), TradingView, and Capitalise AI for automated trading, along with a suite of specialty third-party platforms.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Well-regulated | High minimum deposit for corporate, trust, and Active Trader accounts |

| Low minimum deposit | Limited product range |

| Multiple trading platforms | Commission applies |

| Tight spreads | Swap/overnight fees |

| Strong research and education tools | No crypto deposits/withdrawals |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐☆☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXCM is a legal and well‑regulated forex and CFD broker offering low spreads, multiple trading platforms, and strong client protections, making it a trustworthy choice for traders seeking secure, transparent, and globally recognized trading services.

Top 3 Volatility 75 Forex Brokers – AvaTrade vs Deriv vs FXCM

4. Pepperstone

Pepperstone is a flexible, highly regulated broker with broad CFD offerings, including the Volatility 75 index, making it a suitable choice for traders interested in diversified CFD markets and volatility instruments.

Frequently Asked Questions

Does Pepperstone offer an Islamic (swap-free) account?

Yes, Pepperstone offers an Islamic (swap-free) account for traders who cannot earn or pay interest due to religious beliefs. This account type removes overnight swap charges, but in some cases, an administration fee may be applied to positions held for an extended period.

Does Pepperstone offer the Volatility 75 Index (VIX)?

Yes, Pepperstone offers trading on the Volatility 75 Index (VIX) as a CFD. You can speculate on the index’s price movements, which are derived from S&P 500 options. Pepperstone’s platform allows you to use the VIX as a tool to hedge your portfolio or to trade on market sentiment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multiple trading platforms | Range of crypto offerings is limited |

| Fast, ECN-style execution | Swap Fees |

| No deposit, withdrawal, or inactivity fees | Education section lacks depth |

| Negative balance protection | No interest is paid on idle cash balances |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an approved, well-regulated broker offering fast execution, competitive spreads, and a wide range of CFDs including Volatility 75. Its strong regulatory approvals ensure trader safety and reliable trading conditions across multiple platforms.

5. HFM

HFM offers competitive trading conditions that include the Volatility 75 index, allowing traders to trade this popular volatility instrument alongside forex, commodities, and other CFDs. The broker supports various trading platforms like MetaTrader 4 and 5, with features suitable for both beginners and experienced traders.

Frequently Asked Questions

What trading platforms does HFM offer?

HFM offers a variety of trading platforms to cater to different traders. These include the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both available on desktop, web, and mobile. They also provide their own proprietary HFM Platform for a seamless trading experience.

Does HFM have an Islamic account?

Yes, HFM offers an Islamic (swap-free) account for traders who follow Sharia law. This account removes all interest and swap fees on overnight positions. It’s available on specific account types, and there may be an administrative fee on certain instruments.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Leverage up to 1:2000 may pose high risk for beginners |

| Low minimum deposit | Some accounts have commissions |

| Wide range of account types | Limited proprietary platform options |

| Supports multiple platforms | Inactivity fees apply |

| Negative balance protection | No fixed spreads option |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a globally trusted forex and CFD broker, registered and regulated by multiple authorities. Offering low deposits, various account types, and strong trading platforms, it caters to beginners and professionals while ensuring client protection.

6. Plus500

Plus500 is an internationally regulated CFD broker operating in several jurisdictions, providing access to forex, stocks, commodities, indices, and cryptocurrencies. The broker also offers CFD trading on volatility indices, including the well-known Volatility 75 Index (VIX 75), featuring competitive spreads and an intuitive trading platform.

Frequently Asked Questions

What trading platform does Plus500 use?

Plus500 uses its own proprietary trading platform, which is available on web, desktop, and mobile devices. It is known for its user-friendly interface and simplicity, designed for executing trades without the need for advanced, complex functionality often found in other platforms like MT4 or MT5.

Can I trade the Volatility 75 Index (VIX 75) with Plus500?

Yes, you can trade the Volatility 75 Index (VIX) with Plus500. They offer the VIX as a Contract for Difference (CFD), allowing you to speculate on market volatility without owning the underlying asset. It’s a popular instrument for hedging or trading on market sentiment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple jurisdictions | Not available to traders in USA |

| Commission-free trading | No MetaTrader (MT4/MT5) |

| User-friendly proprietary WebTrader platform | Limited advanced charting tools |

| Wide range of CFDs | No physical stock or asset ownership |

| Negative balance protection | No social or copy trading features |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is an authorized global CFD broker offering commission‑free trading on over 2,800 instruments. With a user‑friendly platform, strong regulatory oversight, and negative balance protection, it provides a secure and transparent environment for both beginner and experienced traders.

7. FP Markets

FP Markets is a regulated broker specializing in forex and CFD trading, providing access to currencies, commodities, indices, shares, and cryptocurrencies. Traders can also trade volatility indices like the popular Volatility 75 Index (VIX 75) through CFDs, featuring competitive spreads and fast execution on the MT4, MT5, and cTrader platforms.

Frequently Asked Questions

What is the minimum deposit for FP Markets?

The minimum deposit for both the Standard and Raw accounts at FP Markets is $100 AUD, or the equivalent in another currency. This amount allows you to access a wide range of instruments and platforms, including MT4 and MT5.

Can I trade the Volatility 75 Index with FP Markets?

Yes, FP Markets offers the Volatility 75 Index (VIX) as a CFD, allowing you to speculate on market volatility. This is a popular instrument for traders looking to hedge against a portfolio or profit from periods of market uncertainty. You can find it listed under their indices

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Some regions have lower leverage limits due to regulation |

| Low minimum deposit | IRESS platform has higher minimum deposit and data fees |

| Raw ECN spreads | Limited proprietary platform |

| Commission-free Standard accounts | Overnight swap fees |

| Supports multiple funding methods | Investor protection schemes are limited |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legit global forex and CFD broker, regulated by multiple authorities. Offering low spreads, fast execution, and diverse trading platforms, it caters to beginners and professionals while ensuring secure, transparent, and client‑fund‑protected trading.

8. FXTM

FXTM is a reputable, multi-regulated forex and CFD broker that offers trading in currencies, commodities, indices, and stocks. It also provides access to volatility indices such as the Volatility 75 (VIX 75) through CFDs, featuring competitive spreads and customizable leverage on the MT4 and MT5 platforms.

Frequently Asked Questions

What types of trading accounts does FXTM offer?

FXTM offers several account types to suit different trading styles. Their primary accounts are the Advantage, which features low commissions and spreads from zero pips; the commission-free Advantage Plus with slightly wider spreads; and a dedicated Advantage Stocks account.

Does FXTM provide a demo account?

Yes, FXTM provides a free demo account that allows you to practice trading with virtual funds in a risk-free environment. It mimics real market conditions, giving beginners a chance to get familiar with the platform and test strategies before trading with real money.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by top-tier authorities | High minimum deposit |

| High leverage | High commissions |

| Multiple account types | Limited CFDs |

| MT4, MT5, and mobile trading app supported | Does not support cTrader or TradingView platforms |

| Access to Volatility 75 (VIX 75) | No social or copy trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a legal forex and CFD broker, regulated by top authorities like the FCA, CySEC, and FSCA. It offers flexible account types, tight spreads, and access to instruments like Volatility 75 through MT4 and MT5 platforms.

9. IG

IG is a legal and well-regulated global CFD and forex broker offering access to a wide range of markets, including forex, shares, commodities, and indices. Traders can access the Volatility 75 Index (VIX 75) via CFDs with competitive spreads, advanced charting tools, and support for platforms like MT4 and IG’s proprietary web platform.

Frequently Asked Questions

Can I trade Volatility 75 (VIX 75) with IG?

Yes, you can trade the Volatility Index (VIX) with IG. They offer it as a CFD, allowing you to speculate on market volatility. The index is a measure of expected future volatility, often referred to as the “fear index,” and is a popular tool for hedging or trading market sentiment.

Does IG offer copy or social trading?

IG does not offer a fully integrated copy or social trading platform. However, they do provide tools that facilitate a form of social trading, such as client sentiment data, trading signals from third parties, and an online community forum to share ideas with other traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | Limited Leverage for Retail Traders |

| Advanced Trading Platforms | No Islamic (Swap-Free) Accounts |

| Tight Spreads | Complex Fee Structure for Shares |

| Negative Balance Protection | No Built-in Copy Trading |

| No Minimum Deposit | High Inactivity Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an approved and highly reputable broker, offering access to over 17,000 CFDs including Volatility 75. With strong regulation, advanced platforms, and tight spreads, it’s a trusted choice for serious global traders.

10. IC Markets

IC Markets is a legit, globally regulated forex and CFD broker known for ultra-low spreads and fast execution. It offers trading on forex, commodities, indices, stocks, cryptocurrencies, and volatility indices like Volatility 75 (VIX 75) via popular platforms including MetaTrader 4, MetaTrader 5, and cTrader.

Frequently Asked Questions

What is the minimum deposit for IC Markets?

The minimum deposit for IC Markets is $200. This is the required amount to open and activate a live trading account, whether it’s a Standard, Raw Spread, or cTrader account. This minimum is consistent across different account types.

Does IC Markets offer Volatility 75 (VIX 75)?

Yes, IC Markets offers the Volatility Index (VIX) as a CFD. It is listed as a “Futures CFD” and is available to trade on their MetaTrader platforms. Trading the VIX allows you to speculate on the expected 30-day volatility of the U.S. stock market.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight Spreads | No Investor Protection in Some Regions |

| Low Commission Fees | Not Beginner-Focused |

| High Leverage | No Proprietary Platform |

| Advanced Platforms | Limited CFD Range Compared to Larger Brokers |

| Access to Volatility 75 (VIX 75) | No Bonuses or Promotions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a globally recognized and registered forex and CFD broker known for its low spreads, fast execution, and institutional-grade liquidity. It’s well-suited for experienced traders seeking advanced platforms and access to markets like Volatility 75.

What is a Volatility 75?

Volatility 75 (VIX 75)—often called the Volatility Index or V75—is a synthetic index that measures market volatility. It’s popular among traders for its high risk–high reward potential.

What Exactly Is Volatility 75?

-

Volatility 75 is based on the S&P 500’s expected 30-day volatility, often referred to as the “fear index.”

-

It reflects how much the market thinks the S&P 500 will fluctuate in the near future.

-

A higher VIX usually means investors expect greater market uncertainty or fear.

-

A lower VIX means more market stability or confidence.

Criteria for Choosing a Volatility 75 Forex Broker

| Criteria | Description | Importance |

| Regulation | Broker must be registered and regulated by a credible authority (e.g. ASIC, FCA, CySEC). | ⭐⭐⭐⭐⭐ |

| Access to V75 | Ensure the broker offers VIX 75 or synthetic Volatility 75 (as applicable). | ⭐⭐⭐⭐⭐ |

| Spreads & Fees | Look for tight spreads and low commissions to maximize profit margins. | ⭐⭐⭐⭐☆ |

| Leverage Options | Higher leverage allows bigger positions with less capital, but also increases risk. | ⭐⭐⭐⭐☆ |

| Execution Speed | Fast order execution helps avoid slippage during rapid price moves. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Platforms like MT4, MT5, or cTrader are preferred for reliability and tools. | ⭐⭐⭐⭐☆ |

| Risk Management Tools | Negative balance protection and stop loss features are crucial in volatile markets. | ⭐⭐⭐⭐☆ |

| Customer Support | 24/5 or 24/7 support via chat, phone, or email ensures help when needed. | ⭐⭐⭐⭐☆ |

| Account Types | Multiple account options (e.g. Raw, Standard, Islamic) add flexibility. | ⭐⭐⭐☆☆ |

| Educational Resources | Guides, webinars, and V75-specific tutorials are helpful for new traders. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal | Fast and secure funding with multiple payment gateways (e.g. Skrill, Neteller). | ⭐⭐⭐⭐☆ |

| Copy Trading / Signals | Access to expert strategies can benefit beginners or passive traders. | ⭐⭐⭐☆☆ |

| Broker Reputation | Check user reviews, years in business, and transparency. | ⭐⭐⭐⭐☆ |

Top 10 Best Volatility 75 Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From what Volatility 75 index is to, how it is traded, we provide straightforward answers to help you understand Volatility 75 and choose the right broker confidently.

Q: What is the Volatility 75 Index or VIX? – Larry S

A: The Volatility 75 Index, or VIX, measures the expected price movement or volatility in the S&P 500 over the next month. It’s often called the “fear index” as it reflects investor anxiety about market uncertainty.

Q: Which Volatility 75 Index broker is the most popular choice among professional traders? – Candida V

A: AvaTrade is widely regarded as a popular choice due to strong regulation, user-friendly platforms, and helpful risk management features.

Q: How do I choose the best Volatility 75 Forex broker to suit my trading strategy? – Annie M

A: Factors to consider include regulatory status, fees, leverage options, trading platforms, and customer support.

Q: How is Volatility 75 CFD traded? – Andre S

A: You open an account with a regulated broker offering the index and trade CFDs, speculating on price movements without owning the underlying asset.

Q: When is the most profitable time to trade the Volatility 75 Index? – Bradley J

A: The index tends to offer more opportunities during uncertain markets or when the price nears key support or resistance levels.

Pros and Cons

| ✓ Pros | ✕ Cons |

| High Volatility | High Risk |

| 24/5 Market Access | Limited Broker Availability |

| Low Capital Requirements | Steep Learning Curve |

| Leverage Options | Spread Manipulation |

| Diversification | Swap/Overnight Fees |

You Might also Like:

- AvaTrade Review

- Deriv Review

- FXCM Review

- Pepperstone Review

- HFM Review

- Plus500 Review

- FP Markets Review

- FXTM Review

- IG Review

- IC Markets Review

In Conclusion

We identified the top 10 Volatility 75 Forex brokers through in-depth research and testing. Each offers unique strengths in platforms, pricing, and regulation, ensuring traders can choose a reliable partner for trading the VIX 75 Index with confidence and competitive conditions.

Faq

Trading the Volatility 75 Index can be highly profitable due to its extreme volatility, which creates numerous opportunities for quick gains. However, this high volatility also means a significant risk of substantial losses. Success depends on a sound strategy, strict risk management, and discipline.

Leverage for Volatility 75 (VIX 75) varies significantly by broker and regulatory jurisdiction. Some brokers, particularly those offering synthetic indices, may provide high leverage, potentially up to 1:1000 or even 1:4000.

Many brokers offer Volatility 75 (VIX 75) for trading on popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Some brokers, such as Deriv and Plus500, also provide their own proprietary trading platforms specifically designed for trading synthetic indices.

Due to its high volatility, it’s crucial to use strict risk management. Recommended strategies include using stop-loss orders to limit potential losses, proper position sizing to avoid overexposure, and a favorable risk-to-reward ratio. Avoiding excessive leverage is also essential.

Unlike traditional market assets, the Volatility 75 Index (VIX 75), especially the synthetic versions offered by some brokers, is often available for trading 24/7. This round-the-clock availability is a key feature, as it is not tied to the specific trading hours of a real-world stock exchange.