6 Best Forex Brokers with Minimum $1 Deposit comprehensive guide introduces you to the top ten Forex brokers who will welcome you to the world of trading with a $1 minimum deposit.

In this in-depth guide, you’ll learn:

and much, MUCH more!

6 Best Forex Brokers with Minimum $1 Deposit (2025)

- ☑️IFC Markets – Overall, The Best Forex Broker with a Minimum $1 Deposit

- ☑️InstaForex – Best Mobile Trading App

- ☑️Admirals – Best CFD Forex Broker

- ☑️TD Ameritrade – Excellent Customer Service

- ☑️Forex4You – Best Partnership Program

- ☑️OANDA – Best Low Cost Forex Broker

IFC Markets

IFC Markets is a globally recognized forex and CFD broker, catering to traders of all experience levels. It’s particularly appealing to beginners due to its low entry barrier and diverse account options.

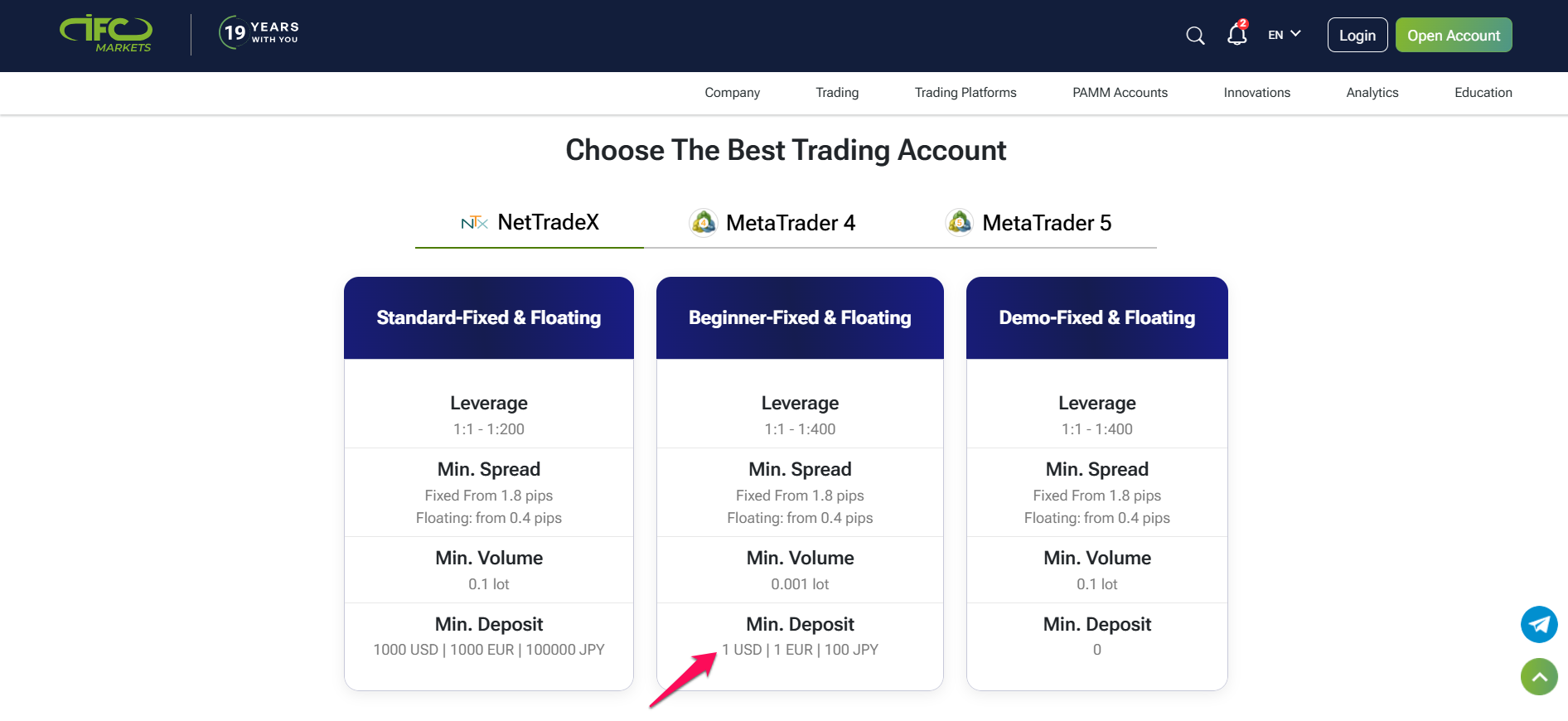

The broker offers two main account types. The Micro (Beginner) Account and the Standard Account. With the Micro Account, traders can Start trading with as little as $1 or equivalent in EUR, JPY, or uBTC.

With its low minimum deposit requirement and diverse account options, IFC Markets stands out as an accessible choice for beginners looking to enter the world of forex and CFD trading.

| Minimum Deposit: $1 Regulated by: BVI FSC Crypto: Yes | |

Frequently Asked Questions

What trading platforms does IFC Markets offer?

IFC Markets provides access to three platforms: NetTradeX (proprietary platform), MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

What is the minimum deposit required to start trading?

You can start trading with a minimum deposit of $1 by opening a Beginner (Micro) account.

What leverage does IFC Markets offer?

Leverage options vary depending on the account type and trading platform, with a maximum leverage of up to 1:400.

Does IFC Markets offer Islamic (swap-free) accounts?

Yes, IFC Markets provides Islamic accounts that comply with Sharia law, featuring no swap charges.

Our Insights

IFC Markets is a globally accessible forex and CFD broker that stands out for its low entry barrier, allowing beginners to start trading with just $1. With support for multiple trading platforms (NetTradeX, MT4, MT5), swap-free Islamic accounts, and a wide range of funding options—including crypto and local transfers—it offers flexibility for traders around the world.

InstaForex

InstaForex is a globally recognized forex and CFD broker, catering to traders of all experience levels. It’s particularly appealing to beginners due to its low entry barrier and diverse account options.

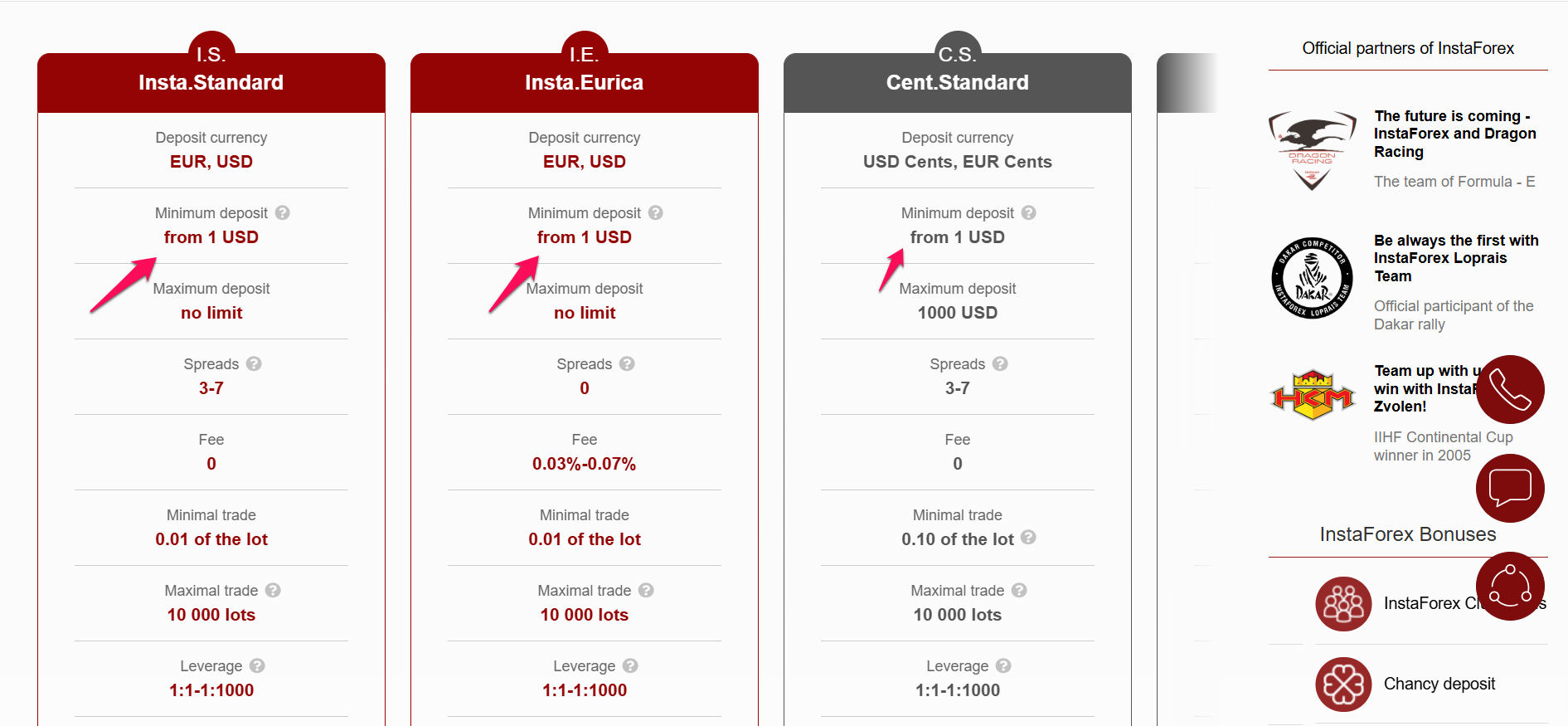

The broker offers a Insta.Standard, Insta.Eurica, Cent.Standard, and Cent.Euria accounts, which requires a $1 minimum deposit, offering fixed spreads from 3 pips. Suitable for beginners and traders who prefer a low-risk trading environment.

With its low minimum deposit requirement and diverse account options, InstaForex stands out as an accessible choice for beginners looking to enter the world of forex and CFD trading.

| Minimum Deposit: $1 Regulated by: FSC Crypto: Yes | |

Frequently Asked Questions

What is the minimum deposit to start trading?

You can open an account with as little as $1, making it accessible for beginners. This applies to Insta.Standard, Insta.Eurica, Cent.Standard, and Cent.Eurica accounts.

What trading platforms does InstaForex offer?

InstaForex provides access to multiple trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and InstaTick Trader.

What leverage does InstaForex offer?

InstaForex offers leverage up to 1:1000, allowing traders to control larger positions with a smaller capital outlay.

Is there a demo account available?

Yes, InstaForex offers a free demo account with virtual funds, allowing you to practice trading without financial risk.

Our Insights

InstaForex stands out as a beginner-friendly forex broker thanks to its ultra-low $1 minimum deposit, diverse account types (including cent and Islamic accounts), and access to popular platforms like MT4 and MT5. It’s a solid entry point for new traders seeking flexibility, educational support, and a low-cost way to start trading.

Admirals

Admirals is a globally recognized forex and CFD broker, regulated by top-tier authorities including the UK’s Financial Conduct Authority (FCA) and Australia’s Australian Securities and Investments Commission (ASIC).

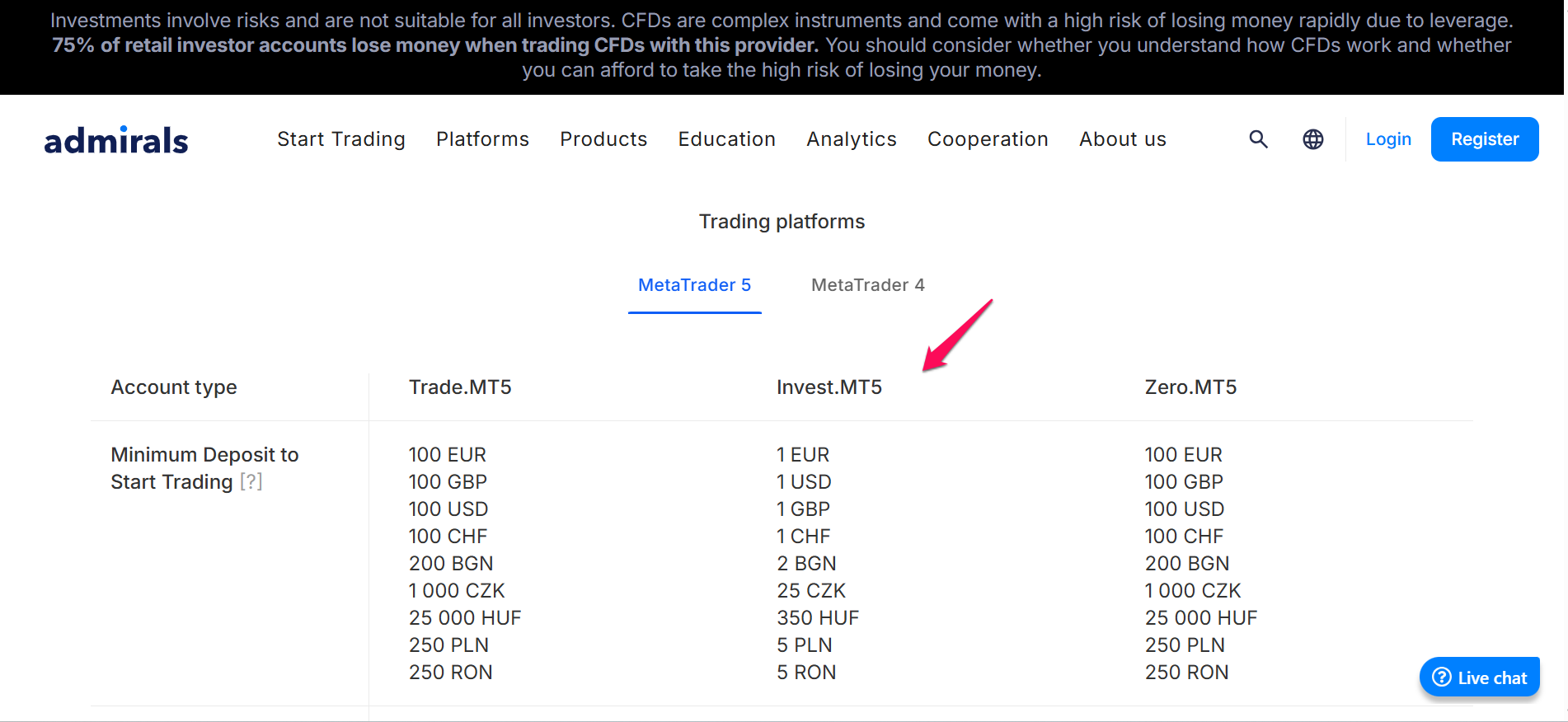

The broker offers and Invest.MT5 account that requires a $1 minimum deposit. It provides access to over 4,500 stocks and 400 ETFs; fractional investing; no leverage; and low commissions starting from $0.02 per share.

Admirals stands out for its commitment to providing a secure and versatile trading environment, catering to both novice and experienced traders.

| Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes | |

Frequently Asked Questions

What is the minimum deposit to start trading?

The minimum deposit varies by account type: Invest.MT5 $1, and Trade.MT5 / Trade.MT4 / Zero.MT5 / Zero.MT4 $100.

What trading platforms does Admirals offer?

Admirals provides access to: MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and Athe dmirals Mobile App.

Does Admirals offer Islamic (swap-free) accounts?

Yes, Admirals provides Islamic accounts that comply with Sharia law, featuring no swap charges. These accounts are available upon request and are subject to approval.

Is there a demo account available?

Yes, Admirals offers free demo accounts for all its platforms.

Our Insights

Admirals is a well-regulated, global broker offering a range of trading accounts suitable for both beginner and experienced traders. With a low minimum deposit of $1 for its Invest.MT5 account provides accessible entry points for traders.

TD Ameritrade/Charles Schwab

TD Ameritrade was a prominent U.S.-based online brokerage firm, renowned for its comprehensive trading platforms and services.

The broker offers multiple account types: Standard Accounts, Electronic Funding, and Margin Accounts with low minimum deposits, making it accessible to all traders.

TD Ameritrade was renowned for its robust trading platforms, educational resources, and commitment to investor accessibility, notably through its $0 minimum deposit for standard accounts. While it no longer operates independently, its legacy continues under Charles Schwab, which upholds the same standards of service and innovation.

| Minimum Deposit: $1 Regulated by: FINRA, CFTC, SEC, SFC Crypto: Yes | |

Frequently Asked Questions

Is TD Ameritrade still active?

No. TD Ameritrade was officially merged into Charles Schwab in 2024. All customer accounts, platforms, and services have been transitioned to Schwab.

Does Charles Schwab still offer the same features?

Mostly yes. Charles Schwab has retained many of TD Ameritrade’s features, including: thinkorswim platform, Commission-free trading, Wide range of tradable assets.

Could non-U.S. residents open an account?

Generally, no. TD Ameritrade restricted access in many countries, including South Africa, the EU, and parts of Asia. Some accounts were allowed in Singapore, Hong Kong, and Malaysia.

Is TD Ameritrade beginner-friendly?

Yes. It provides: Commission-free trades, Strong educational resources, Practice accounts (paper trading), and Simple web and mobile platforms.

Our Insights

In 2024, Charles Schwab fully merged with TD Ameritrade, continuing its legacy under a new name. While TD Ameritrade no longer operates independently, the features that made it popular—advanced tools, accessible investing, and strong customer support—remain available through Schwab.

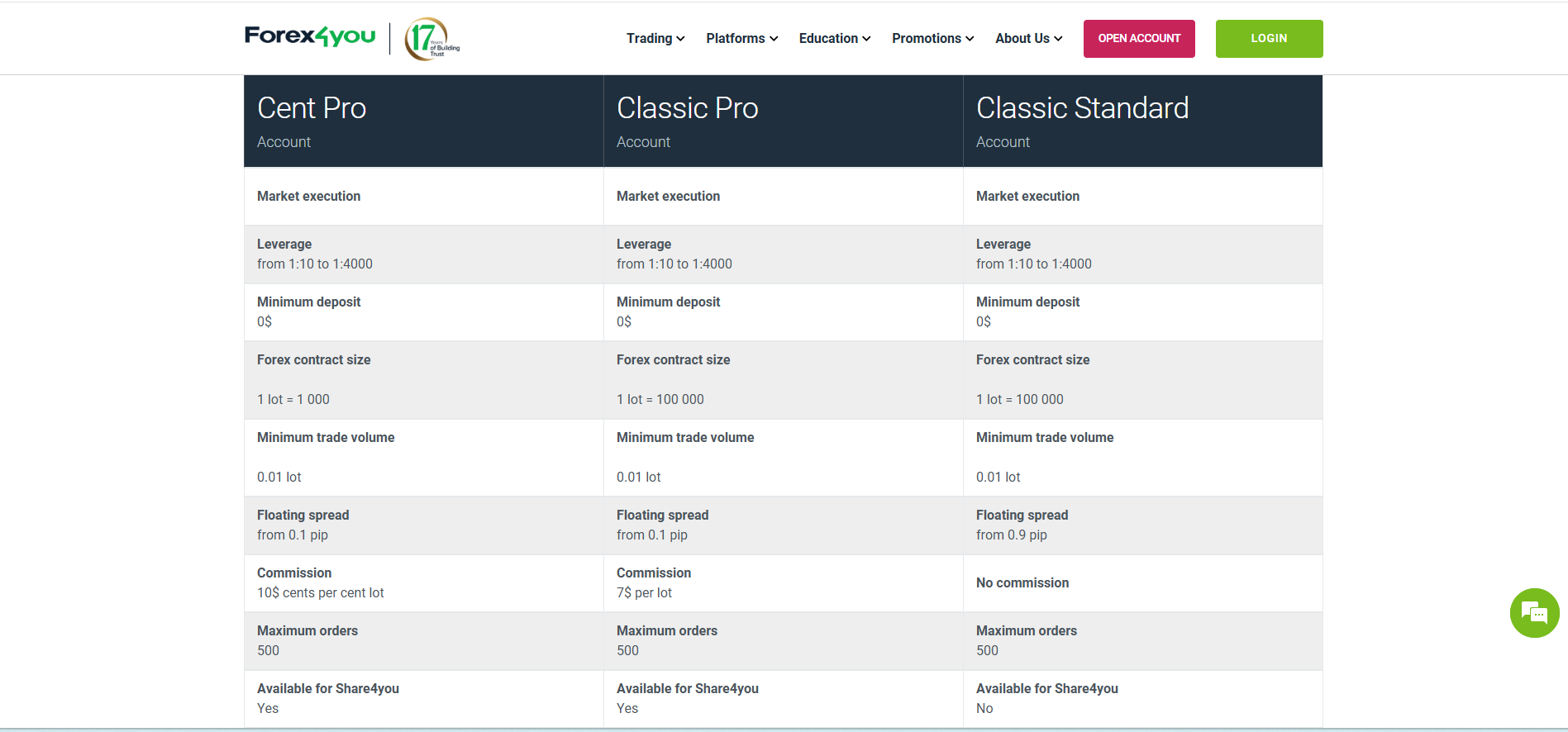

Forex4You

Forex4you is a globally accessible forex and CFD broker, regulated by the British Virgin Islands Financial Services Commission (BVI FSC).

It offers a variety of account types with no minimum deposit requirement, making it particularly appealing for beginners and those looking to start trading with a minimal investment.

Its range of educational resources and copy trading features make it an attractive choice for new traders aiming to enter the forex market with minimal financial commitment

| Minimum Deposit: $0 Regulated by: BVI FSC, FSC Crypto: No | |

Frequently Asked Questions

What is Forex4you?

Forex4you is a global forex and CFD broker offering various account types, trading platforms, and services tailored for both novice and experienced traders.

What leverage does Forex4you offer?

Forex4you provides multiple leverage options, including 1:10, 1:100, 1:200, 1:500, and up to 1:1000, depending on the account type and trader’s preference.

What is the minimum deposit to start trading?

Forex4you does not impose a minimum deposit requirement; traders can start with any amount they are comfortable with. However, recommended deposits vary by account type—for instance, $50 for Cent accounts and $500 for Classic accounts.

What trading platforms are available?

Traders can access the MetaTrader 4 (MT4) platform and Forex4you’s proprietary platforms, catering to various trading needs and preferences.

Our Insights

Forex4you is a beginner-friendly forex and CFD broker offering flexible trading options, including a $0 minimum deposit, high leverage (up to 1:1000), and access to MetaTrader 4 and proprietary platforms. With multiple account types and a transparent fee structure, Forex4you is a solid choice for those looking to start trading with minimal capital and scale as they learn.

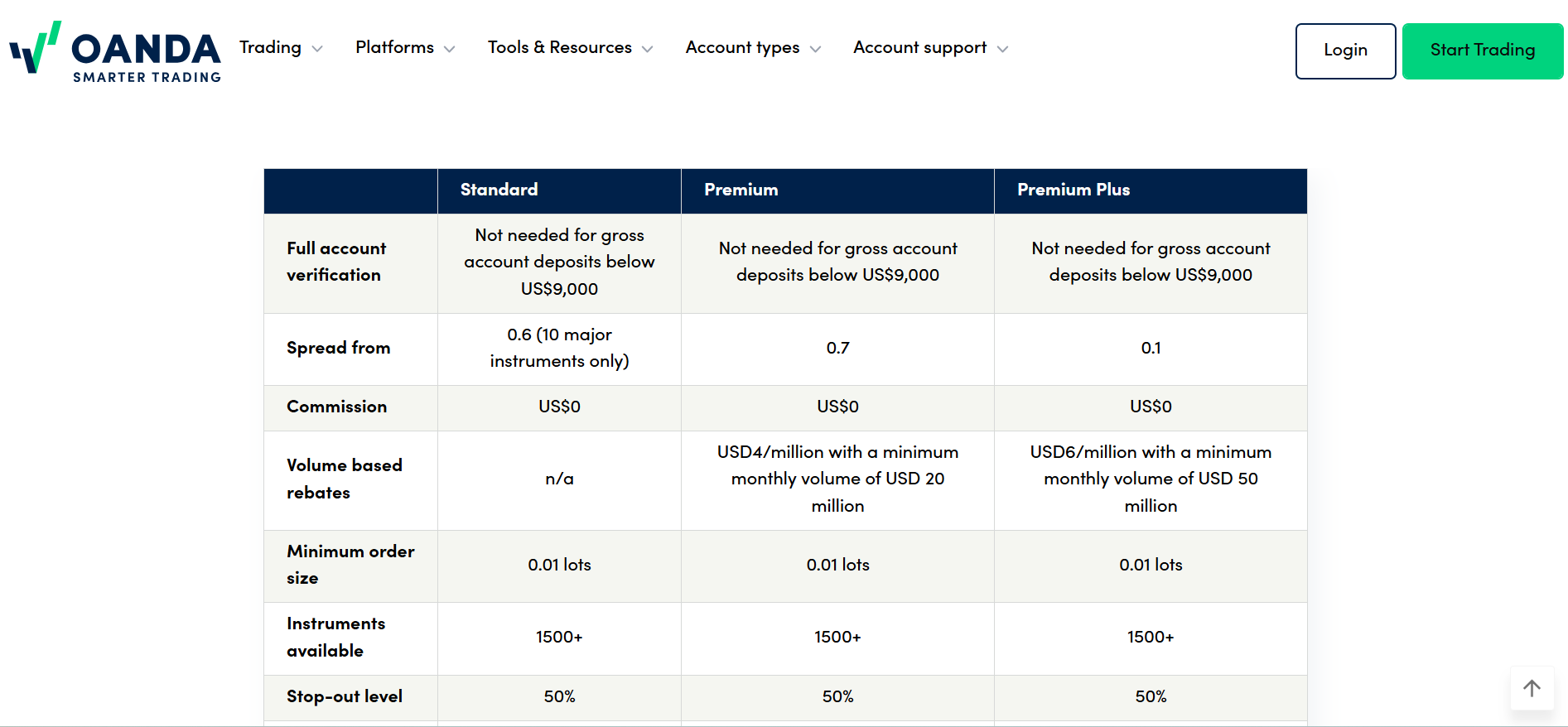

OANDA

OANDA is a globally recognized forex and CFD broker, regulated by top-tier authorities such as the U.S. Commodity Futures Trading Commission (CFTC), UK Financial Conduct Authority (FCA), and Australian Securities and Investments Commission (ASIC).

The broker does not require a minimum deposit to open or maintain a trading account, allowing traders to start with any amount they are comfortable with.

OANDA stands out as a flexible and accessible broker, especially for beginners, due to its no minimum deposit requirement on standard accounts.

| Minimum Deposit: $0 Regulated by: NFA, CFTC Crypto: Via Paxos | |

Frequently Asked Questions

What is the minimum deposit required?

OANDA does not impose a minimum deposit on its Standard account—you can start with any amount.

Does OANDA offer a Demo account?

Yes. OANDA offers free demo accounts with virtual funds, unlimited duration, and access to all platforms.

Is OANDA suitable for beginners?

Yes, OANDA is a good choice for beginners. It offers a user-friendly trading platform, educational resources like webinars and tutorials, and a demo account for practice.

How can I contact OANDA customer support?

OANDA provides 24/5 multilingual customer support via: Live chat, Email, Phone support, and their Help center.

Our Insights

With no minimum deposit for its standard account, multiple platform choices (fxTrade, MT4, MT5), robust educational materials, and strong client protections (segregated funds, negative-balance protection), it’s an excellent choice for both new and experienced traders.

What is a $1 Minimum Deposit?

A $1 minimum deposit means that you can open a trading account with as little as $1. This is typically offered by brokers to make it easier for new or small-scale traders to start trading with minimal financial commitment.

Key points about a $1 minimum deposit

- Access to live markets: It allows traders to access real-time forex markets, execute trades, and use the broker’s trading platforms.

- Small initial investment: Ideal for those who want to test trading strategies or learn the ropes without risking significant capital.

- Varies by broker: While many brokers offer low minimum deposit requirements, others may require more substantial amounts (e.g., $50, $100) for an account to be opened.

This kind of deposit is often available for demo accounts or micro accounts, which allow trading with small lot sizes and limited risk exposure.

In Conclusion

Forex brokers with a $1 minimum deposit offer a highly accessible entry point for beginners to start trading with minimal financial risk. While the features and tools may vary by broker, this low-barrier option helps new traders gain experience and gradually scale their involvement in the forex market

You Might also Like: