Plus500 Minimum Deposit Review

The minimum deposit required to open a Plus500 Account is 100 USD. Plus500 offers access to a Single Live Trading Account.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Minimum Deposit and Account Types

Plus500 makes trading accessible and affordable by setting its minimum deposit at only 100 USD. This low entry point, together with flexible account options, attracts beginners and seasoned traders alike. Moreover, it allows users to test new strategies without committing a large upfront investment.

Frequently Asked Questions

What account types does Plus500 offer?

Plus500 provides two primary account types: the Real Account lets traders engage in live markets with real money, while the Demo Account uses virtual funds for risk-free practice. Additionally, the Demo option helps new traders learn and test strategies without putting actual capital on the line.

What is the required minimum deposit to start trading?

The minimum deposit for a Plus500 Real Account is just 100 USD or its local currency equivalent, keeping trading accessible to a wider audience. This low starting point appeals to first-time traders and those with limited budgets. Likewise, it encourages more people to enter the market confidently.

Our Insights

The 100 USD minimum deposit at Plus500 is ideal for new traders and those preferring to start with smaller capital. Additionally, the Demo Account enhances accessibility by allowing beginners to practice and build confidence without any financial risk.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

How to Open a Plus500 Account

1. Step 1: Begin the Account Registration

To initiate the account registration, simply click on the blue “Start Trading” button located at the top right corner of the Plus500 homepage.

2. Step 2: Complete the Registration

You will need to provide your email address and create a secure password to sign up. Alternatively, you can choose to register using your Google, Facebook, or Apple account for added convenience.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Deposit and Withdrawal

Plus500 streamlines deposits and withdrawals through widely accepted methods like cards, e-wallets, and bank transfers. With no platform fees and quick processing times, the system supports smooth, global financial access for traders of all experience levels.

| Method | Type | Fees (Plus500) | Processing Time |

| Visa/MasterCard | Credit/Debit Card | None | Instant (Deposit) 1 Day (Withdraw) |

| PayPal | E-Wallet | None | Instant (Deposit) 1 Day (Withdraw) |

| Skrill | E-Wallet | None | Instant (Deposit) 1 Day (Withdraw) |

| Bank Transfer | Direct Transfer | None | 1-3 Days (Deposit/Withdraw) |

Frequently Asked Questions

What deposit and withdrawal options does Plus500 support?

Plus500 allows deposits and withdrawals via Visa, MasterCard, PayPal, Skrill, and direct bank transfers. These options ensure flexibility and ease of use, catering to traders across different regions and financial preferences.

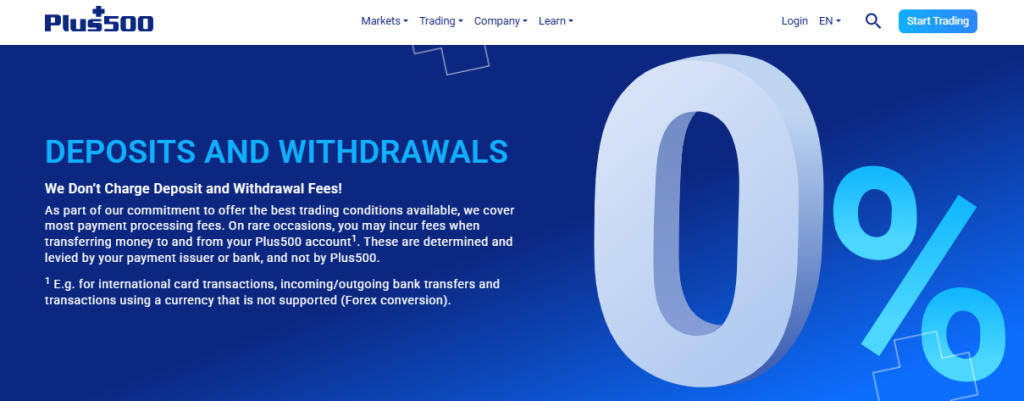

Does Plus500 charge for deposits or withdrawals?

No, Plus500 does not impose any deposit or withdrawal fees. However, traders should check with their bank or payment provider, as external charges or currency conversion fees may still apply depending on the service used.

Our Insights

Plus500 delivers an efficient, user-friendly fund management system with fast transaction processing and zero platform fees. It’s a reliable option for traders who prioritize simplicity, transparency, and convenience in handling their trading capital.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the Plus500 minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open a Plus500 account? – Lucas, Brazil

A: Plus500 requires a minimum deposit of 100 USD (or equivalent in EUR, GBP, AUD), allowing new traders to quickly access the platform and begin trading a wide range of Forex, CFDs, commodities, indices, and cryptocurrency instruments.

Q: How quickly can I withdraw funds from Plus500? – Aisha, UAE

A: Withdrawal requests are usually processed within 1–3 business days. E-wallets are often faster, while card and bank transfers may take slightly longer depending on the banking provider and country.

Q: Does Plus500 charge fees for deposits or withdrawals? – Mark, Canada

A: Plus500 does not charge any fees on deposits or withdrawals. Users should note that external payment providers may apply transaction or currency conversion fees depending on the method used.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: Plus500 requires that deposits be withdrawn using the same payment method. Profits exceeding the deposited amount can be sent to an alternative verified method registered in your name.

Q: What perks come with signing up at Plus500? – John, UK

A: Plus500 offers a user-friendly trading platform, commission-free trading on all instruments, a free demo account, leverage up to 1:300, negative balance protection, and risk management tools, making it suitable for both beginner and experienced traders seeking flexible, low-cost CFD trading.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Pros and Cons

✓ Pros ✕ Cons

Regulated by top-tier

authorities (FCA, ASIC,

CySEC)No support for

MetaTrader platforms

Negative Balance

Protection includedLimited educational

resources for

advanced traders

Wide range of CFDs:

Forex, Crypto, Indices,

Commodities, SharesOvernight fees on

leveraged CFD positions

User-friendly trading

platform with intuitive

interfaceInactivity fees may apply

after 3 months

Mobile app mirrors

desktop platform

featuresNo direct stock

ownership

CFDs only

Low minimum deposit

($100)Some regional

restrictions on crypto

and CFD trading

You might also like:

In Conclusion

Plus500 allows traders to start with a 100 USD minimum deposit and access commission-free trading across Forex, CFDs, commodities, indices, and cryptocurrencies. With fast withdrawals, multiple secure payment methods, and intuitive risk management tools, the platform provides a convenient and reliable environment for both beginners and professional traders.

Faq

No. Plus500 normally does not provide deposit matching or bonus programs. They prioritize competitive spreads and trading conditions over promotional incentives.

No. Plus500 primarily serves retail traders and does not promote specialist deposit methods for institutions. Larger organizations may need to contact Plus500 directly to negotiate appropriate procedures for large capital transfers.

The minimum deposit of $100 is frequently less than the minimum withdrawal amount, which varies per method. Check the current withdrawal policy for particular minimums, which may differ from the deposit level.

EU accounts benefit from regulatory safeguards such as separated client money and negative balance protection. Non-EU accounts may have different safeguards, so verify the particular protections available in your country.