Moneta Markets Review

- Moneta Markets Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Security and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Leverage and Margin

- Trading Instruments and Products

- Deposit and Withdrawals

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, Moneta Markets is a trustworthy Forex Broker that aims to simplify access to global financial markets for ordinary traders worldwide. It offers access to over 1,000 assets and leading trading platforms. The Broker has a trust score of 80 out of 99.

| 🔎 Broker | 🥇 Moneta Markets |

| 📈 Established Year | 2019 |

| 📉 Regulation and Licenses | FSCA, FSA Seychelles, CIMA, ASIC |

| 📊 Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | PRO Trader, App Trader, MetaTrader 4, MetaTrader 5, CopyTrader App |

| 📌 Account Types | Direct STP, Prime ECN, Ultra ECN |

| 💴 Base Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL |

| 📍 Spreads | From 0.0 pips |

| 💹 Leverage | 1:1000 |

| 💵 Currency Pairs | 44; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 50 USD |

| 💷 Inactivity Fee | None |

| 🔊 Website Languages | English, French, German, Spanish, Vietnamese, Thai, Russian, Arabic, Portuguese, Chinese, etc. |

| 🪙 Fees and Commissions | Spreads from 0.0 pips, commissions from $6 round turn |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States, Canada, Hong Kong |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, indices, shares, ETFs, bonds, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

🏆 10 Best Forex Brokers

| Broker | Min Deposit | Website | Leverage | Review | |

| 🥇 |  | Minimum Deposit $100 |  | 1:400 | Read Review |

| 🥈 |  | Minimum Deposit $100 |  | 1:30 | Read Review |

| 🥉 |  | Minimum Deposit $25 |  | 1:1000 | Read Review |

| 4 |  | Minimum Deposit $0 |  | 1:500 | Read Review |

| 5 |  | Minimum Deposit $100 |  | 1:100 | Read Review |

| 6 |  | Minimum Deposit $200 |  | 1:2000 | Read Review |

| 7 |  | Minimum Deposit $10 |  | 1:1000 | Read Review |

| 8 |  | Minimum Deposit $10 |  | 1:Unlimited* | Read Review |

| 9 |  | Minimum Deposit $100 |  | 1:500 | Read Review |

| 10 |  | Minimum Deposit $1 |  | 1:3000 | Read Review |

Moneta Markets Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Security and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Trading Instruments and Products

- ☑️ Deposit and Withdrawals

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

Moneta Markets, founded in 2019, aims to simplify access to global financial markets for ordinary traders worldwide. With over a decade of industry expertise, the broker offers lightning-fast executions, straightforward pricing, and round-the-clock client service.

Moneta Markets supports traders of all levels with over 1,000 assets, including forex, commodities, indices, and share CFDs. Its user-friendly platform portfolio includes MetaTrader 4 and ProTrader.

The company follows the principle of constant progress and improvement, leading to great accomplishments. Moneta Markets is now an internationally recognized business under regulatory supervision from the CIMA, FSCA, FSA, and ASIC.

This regulatory compliance demonstrates Moneta Markets’ commitment to openness and customer safety, resulting in a safe and trustworthy trading environment.

Does Moneta Markets provide a demo account where traders may practice?

Moneta Markets offers a demo account with $100,000 in virtual funds.

Can I use Moneta Markets trading services from any country?

Moneta Markets operates internationally. However, it is limited in certain areas owing to regulatory constraints or local regulations.

Detailed Summary

| 🔎 Broker | 🥇 Moneta Markets |

| 📈 Established Year | 2019 |

| 📉 Regulation and Licenses | FSCA, FSA Seychelles, CIMA, ASIC |

| 📊 Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | PRO Trader, App Trader, MetaTrader 4, MetaTrader 5, CopyTrader App |

| 📌 Account Types | Direct STP, Prime ECN, Ultra ECN |

| 💴 Base Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL |

| 📍 Spreads | From 0.0 pips |

| 💹 Leverage | 1:1000 |

| 💵 Currency Pairs | 44; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 50 USD |

| 💷 Inactivity Fee | None |

| 🔊 Website Languages | English, French, German, Spanish, Vietnamese, Thai, Russian, Arabic, Portuguese, Chinese, etc. |

| 🪙 Fees and Commissions | Spreads from 0.0 pips, commissions from $6 round turn |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States, Canada, Hong Kong |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, indices, shares, ETFs, bonds, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

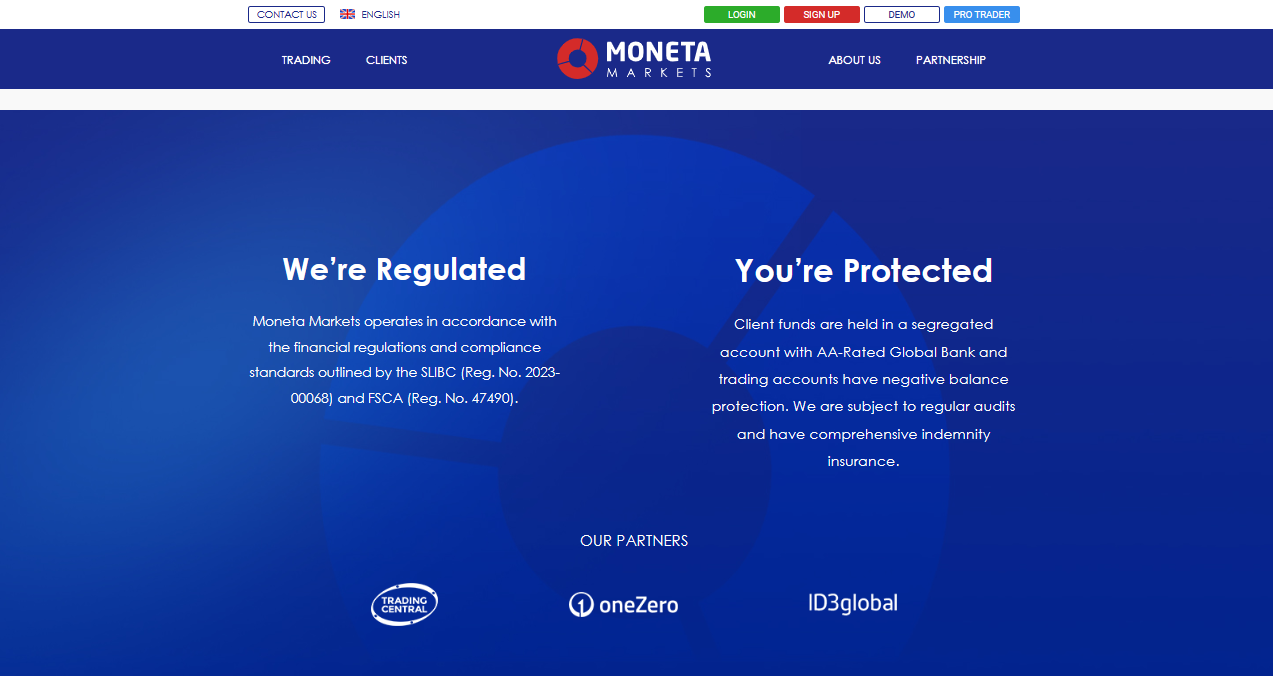

Security and Security

Moneta Markets is a reliable trading platform with strong security measures to protect customers’ money and transactions. Key features include SSL encryption, two-factor authentication (2FA), and separating client funds from business funds.

This ensures that traders’ funds are held in separate bank accounts, a practice common among trustworthy brokers. Moneta Markets maintains these segregated accounts with National Australia Bank, a major financial institution in Australia.

Can traders report suspicious activities or security breaches on Moneta Markets’ platform?

Yes, traders can report any suspicious activities or security breaches to Moneta Markets’ customer support team, who are available 24/5 to address concerns and investigate potential security issues.

Are there additional security features available to enhance account protection?

Yes, Moneta Markets offers two-factor authentication (2FA) to add an extra layer of security to traders’ accounts.

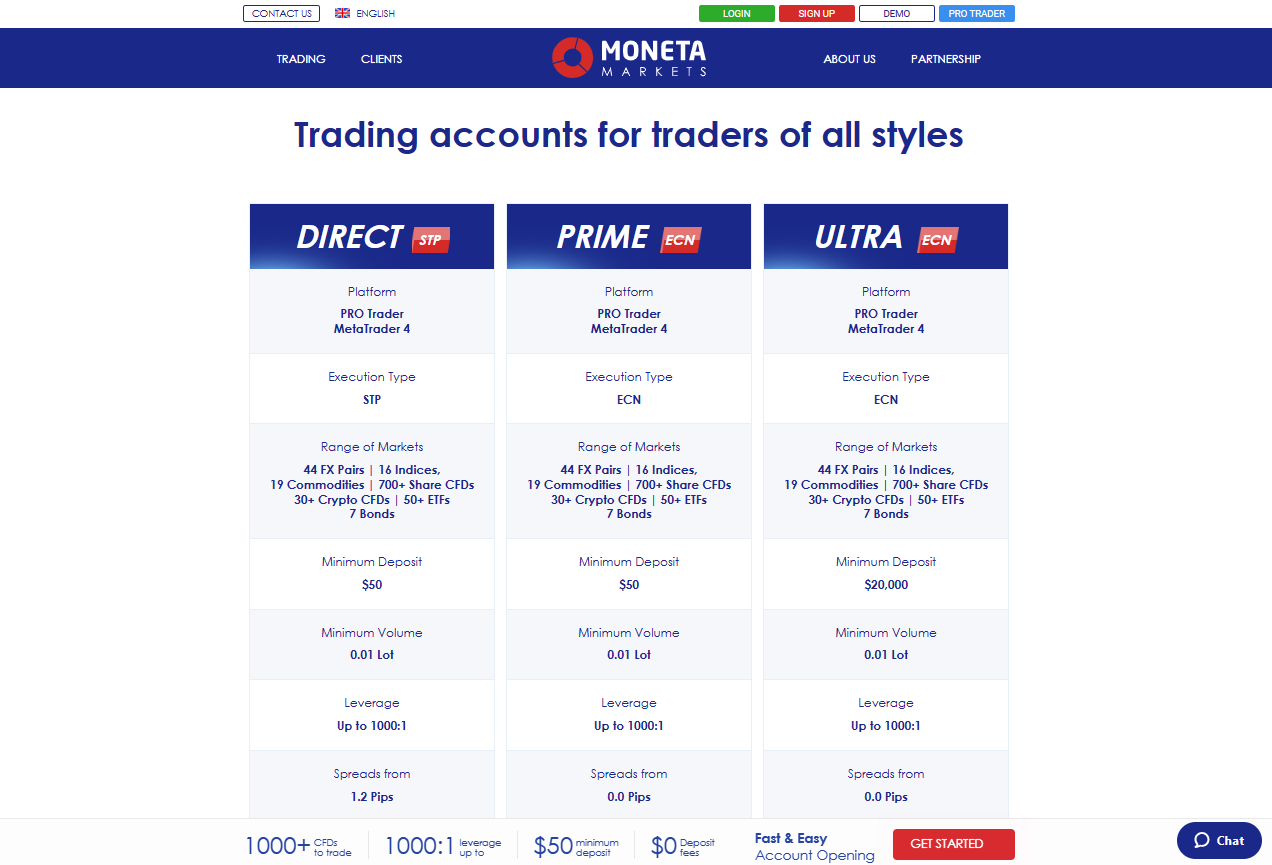

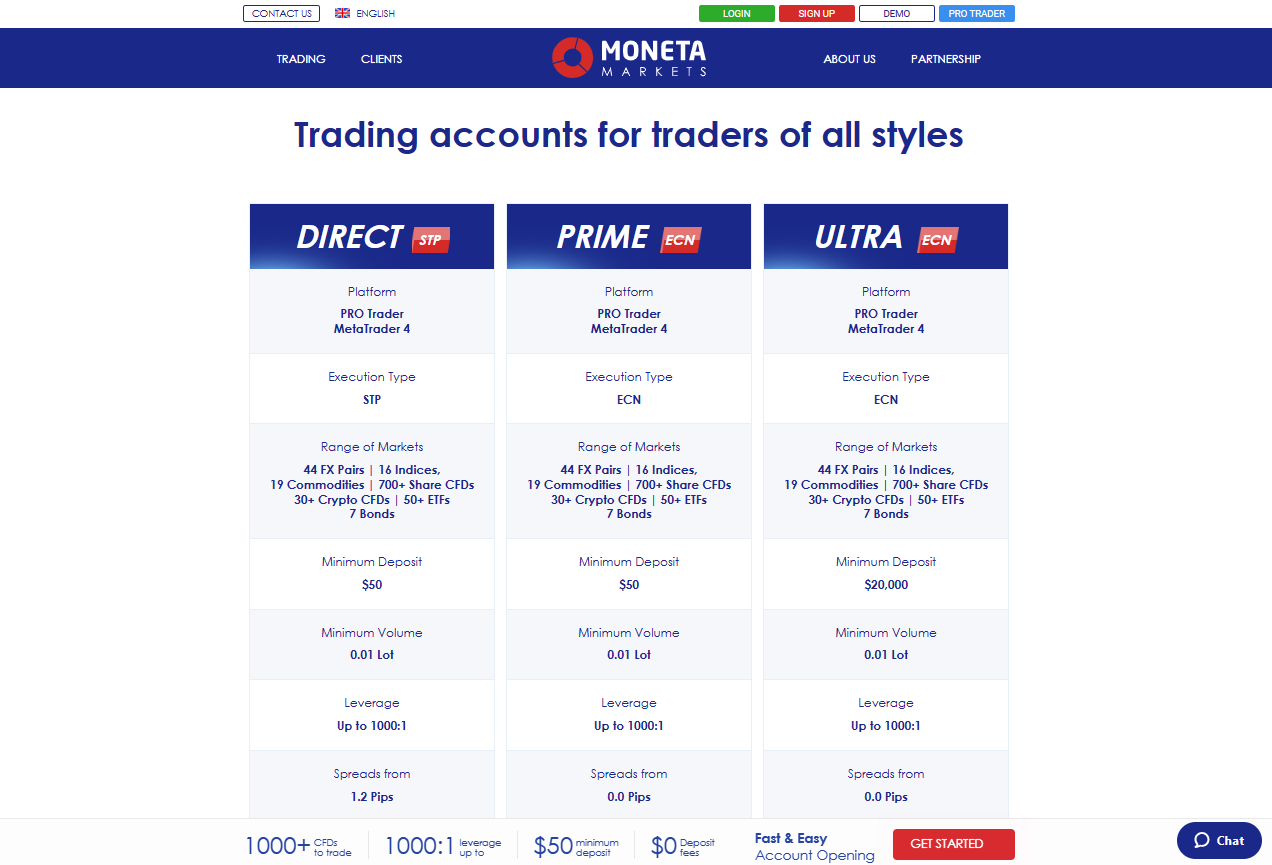

Account Types

| 🔎 Account Type | 🥇 Direct STP | 🥈 Prime ECN | 🥉 Ultra ECN |

| 🩷 Best Suited | Ideal for beginners and casual traders | Ideal for experienced traders | Ideal for scalpers and professional traders |

| 📈 Markets | Forex – 44 Indices – 16 Commodities – 19 Share CFDs – 700+ Crypto CFDs – 30+ ETFs – 50+ Bonds – 7 | Forex – 44 Indices – 16 Commodities – 19 Share CFDs – 700+ Crypto CFDs – 30+ ETFs – 50+ Bonds – 7 | Forex – 44 Indices – 16 Commodities – 19 Share CFDs – 700+ Crypto CFDs – 30+ ETFs – 50+ Bonds – 7 |

| 💴 Commissions | None. Only the spread is charged | $6 per round turn | $2 per round turn |

| 📉 Platforms | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:1000 | 1:1000 | 1:1000 |

| 💵 Minimum Deposit | 50 USD | 200 USD | 20,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Direct STP Account

Moneta Markets’ DIRECT STP account offers a comprehensive platform with MetaTrader 4 and Straight Through Processing (STP) execution, allowing traders to access 44 Forex pairs, 16 indices, 19 commodities, 700 stock CFDs, 30+ cryptocurrency CFDs, 50+ ETFs, and 7 bonds.

With a $50 minimum investment and leverage of up to 1000:1, it is ideal for beginners and offers competitive spreads at 1.2 pips. Islamic account options and no commission costs make it appealing.

Prime ECN Account

The PRIME ECN account is a scalper and EA user-friendly platform that runs on MetaTrader 4 with ECN execution. It offers a wider range of markets with narrower spreads, a higher minimum deposit of $200, and attractive fee rates of $3 per lot per side. It also offers Islamic account options.

Ultra ECN Account

The ULTRA ECN account is designed for experienced traders and money managers, offering advanced trading expertise and narrower spreads. A $20,000 minimum deposit offers a higher level of market access and execution type than the PRIME ECN account.

Unlike Islamic accounts, it offers cheaper commissions of $1 per lot per side. This account is ideal for sophisticated traders seeking advanced trading skills.

Demo Account

The Moneta Markets demo account offers traders a 30-day trial period with $100,000 in virtual money, providing a realistic trading experience. It supports platforms like MT4, MT5, and WebTrader and has configurable features.

The account is a simulation, resembling the real trading environment but without slippage due to the use of virtual money. This allows traders to understand trading without the financial risk of real markets. The demo account can be extended by contacting the broker’s support service.

Islamic Account

Moneta Markets offers swap-free trading accounts for traders who follow Islamic beliefs and cannot engage in traditional interest-based transactions. These accounts allow traders to trade without incurring or receiving swaps on their holdings while adhering to their religious views.

Instead of swap costs, traders pay a daily administration fee, which is withdrawn from their account balance. To open a swap-free account, traders must complete a swap-free form and log in without swaps.

However, Moneta Markets reserves the right to decline requests without explanation. The first ten days are swap-free for residents of certain countries, followed by fees depending on the transferred instruments.

Can I trade all instruments with Moneta Markets’ Ultra ECN account?

Yes, Moneta Markets’ Ultra ECN account offers access to all accessible trading products, such as Forex, commodities, indices, stocks, ETFs, bonds, and cryptocurrencies.

What are the primary distinctions between Moneta Markets account categories regarding minimum deposit requirements?

Moneta Markets’ account types have different minimum deposit requirements, with the Direct STP account needing a $50 deposit, the Prime ECN account requiring $200, and the Ultra ECN account demanding $20,000.

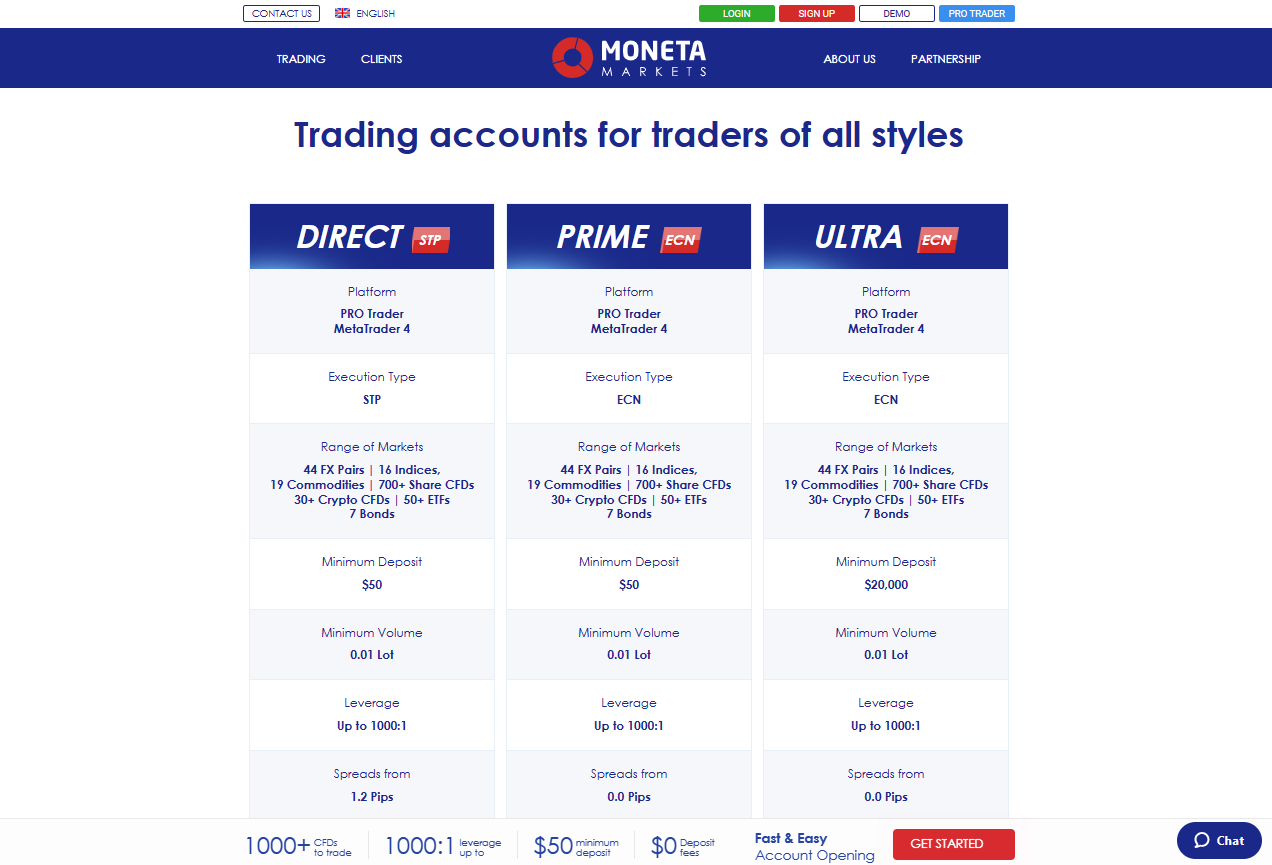

How To Open an Account

To register an account with Moneta Markets, follow these steps:

- Visit the Moneta Markets website and look for the “Open an Account” or “Sign Up” button, which is generally prominently displayed.

- Complete the online application form by entering your personal information (name, email address, country of residence, etc.) and generating a secure password.

- Upload the appropriate papers to verify your identity and address, including a government-issued ID (passport or driver’s license) and proof of residency.

- Select your chosen account type (individual or corporate) and trading platform (such as MetaTrader 4 or ProTrader).

- You can fund your account using one of Moneta Markets’ accepted deposit methods (bank transfer, credit/debit card, or e-wallets).

Once your account has been validated and financed, you will get your login information and be able to begin trading on the Moneta Markets platform.

Can I fund my Moneta Markets account right away after opening it?

Yes, you can fund your Moneta Markets account immediately after opening it by using one of the accepted deposit methods available on the platform.

How long does it take to have my Moneta Markets account validated and activated?

The verification process for a Moneta Markets account typically takes a few business days, after which your account will be activated and ready for trading.

Trading Platforms and Software

PRO Trader

The Moneta Markets PRO Trader platform offers professional traders a comprehensive trading experience with over 100 built-in indicators and 12 chart formats.

Its customizable features, such as chart layouts and light/dark mode, provide a personalized trading experience. Advanced risk management tools enable traders to place Stop Loss and Take Profit orders, improving capital protection

App Trader

Moneta Markets App Trader offers mobile trading access to over 1000 global markets, enhancing efficiency with enhanced order types and simple trade administration.

It offers quick deposits and withdrawals, sophisticated charting, and customizable watchlists for over 1,000 popular markets. With access to currencies, indices, and commodities, users can take advantage of trading opportunities anytime.

MetaTrader 4

The MetaTrader 4 platform offers a comprehensive trading experience, allowing users to access global markets and trade over 1000 instruments.

It is fully integrated with Moneta Markets PRO Trader, offering advanced charting tools and bespoke indicators for traders of all skill levels. It offers lightning-fast execution and customizable trading conditions.

MetaTrader 5

The MetaTrader 5 platform offers precise trading of over 1,000 global markets with over 21 timeframes, 30 built-in indicators, and custom scripting features.

It can be integrated with the PRO Trader platform for versatile trading, allowing access to global markets while on the move and exploring forex signals.

CopyTrader App

Moneta Markets CopyTrader App connects users to over 6,000 skilled traders, allowing users to choose traders, modify risk levels, and duplicate their trades.

The app features a lively trading community, challenges, friend trades, and live PnL reporting, making it an effective way for experienced and new traders to benefit from each other’s experiences.

Can I automate my trading strategies with Moneta Markets’ platforms?

Yes, Moneta Markets supports automated trading strategies through its MetaTrader platforms, allowing traders to utilize expert advisors (EAs) and algorithmic trading to execute trades automatically based on pre-defined parameters.

Does Moneta Markets offer social trading features on its platforms?

Yes, Moneta Markets provides social trading features through its CopyTrader app, allowing users to connect with skilled traders, copy their trades, and benefit from their expertise.

Fees, Spreads, and, Commissions

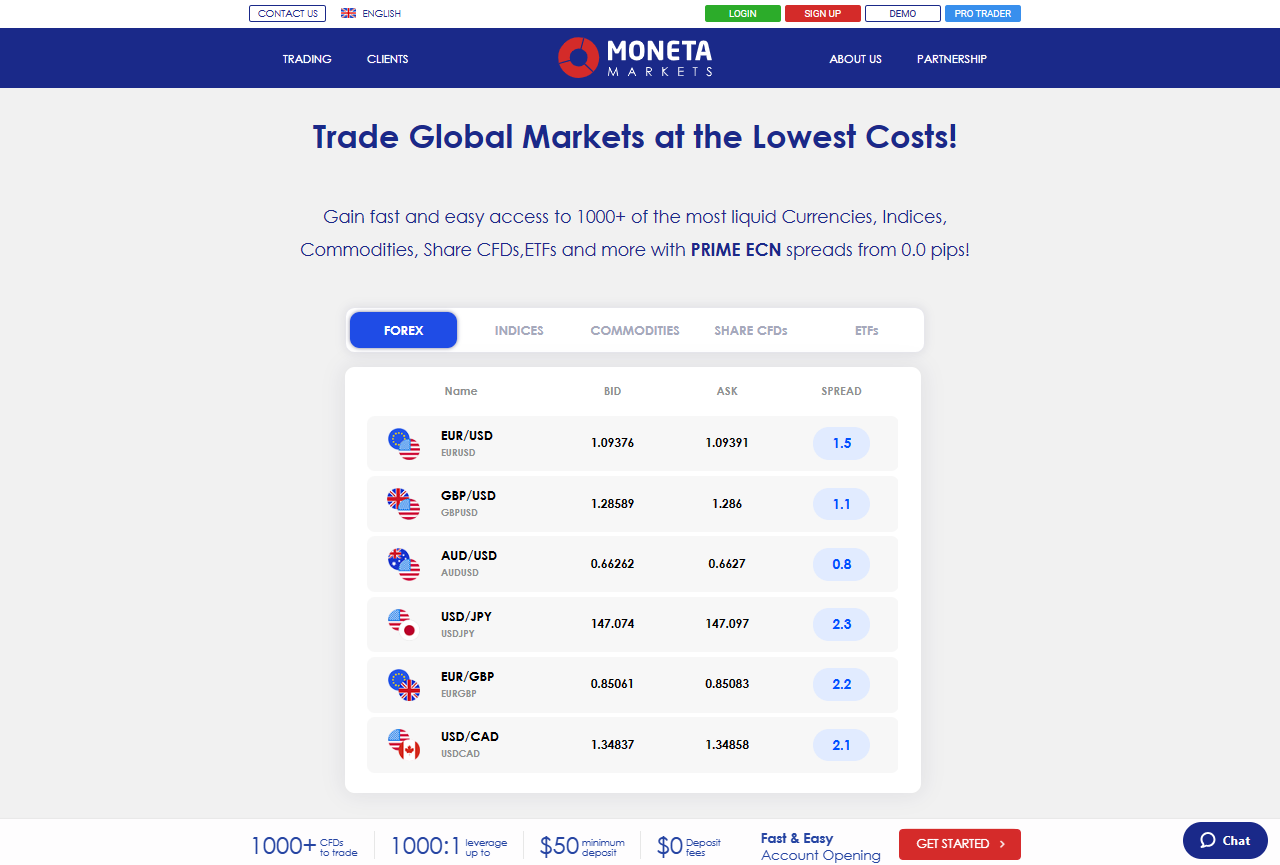

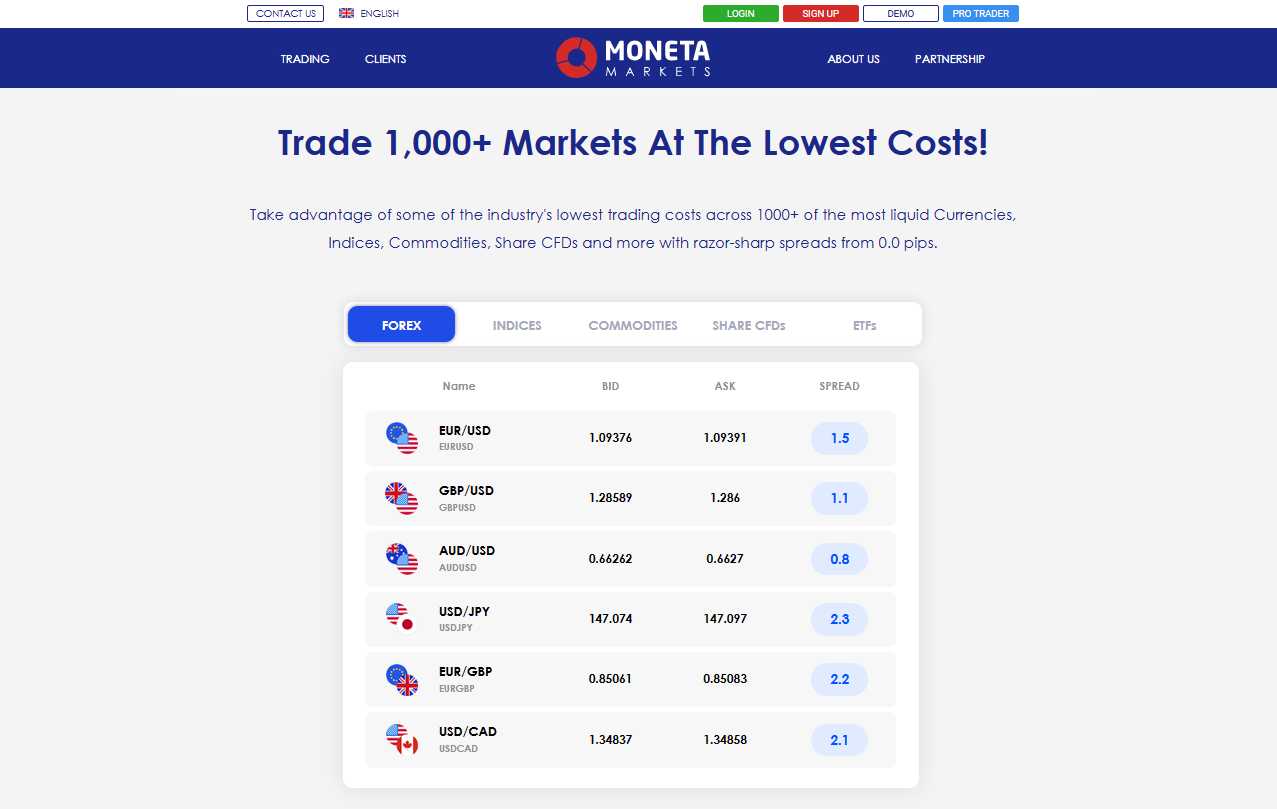

Spreads

Moneta Markets offers cost-effective trading options with reasonable spreads across various account types.

The DIRECT STP account starts at 1.2 pips, suitable for beginners, while the Prime ECN account offers narrower spreads at 0.0 pips, ideal for scalpers and EA users. The Ultra ECN account offers the smallest spreads at 0.0 pips.

Commissions

Traders using Moneta Markets’ Prime ECN account benefit from small spreads beginning at 0.0 pips and competitive fee rates of $3 per lot per side. For Ultra ECN account users, the platform provides even narrower spreads at $1 per lot per side.

Overnight Fees

Moneta Markets’ overnight costs are determined by weekly swap rates adjusted by liquidity providers, affecting rollover interest. Traders can view these rates on MetaTrader 4, promoting transparency and real-time information.

Deposit and Withdrawal Fees

Moneta Markets offers traders convenience and flexibility without internal deposits or withdrawal costs but may incur intermediary transfer costs involving foreign financial institutions.

Inactivity Fees

Moneta Markets offers traders flexibility and peace of mind by not charging inactivity fees for inactive accounts.

Currency Conversion Fees

Moneta Markets charges a Currency Conversion Fee for transactions involving instruments in a different currency, including exchange rates and markup for transparency and accuracy.

How competitive are the spreads offered by Moneta Markets?

Moneta Markets offers competitive spreads across its account types, starting from 0.0 pips on certain accounts.

Does Moneta Markets charge inactivity fees for dormant accounts?

No, Moneta Markets does not charge inactivity fees for inactive accounts.

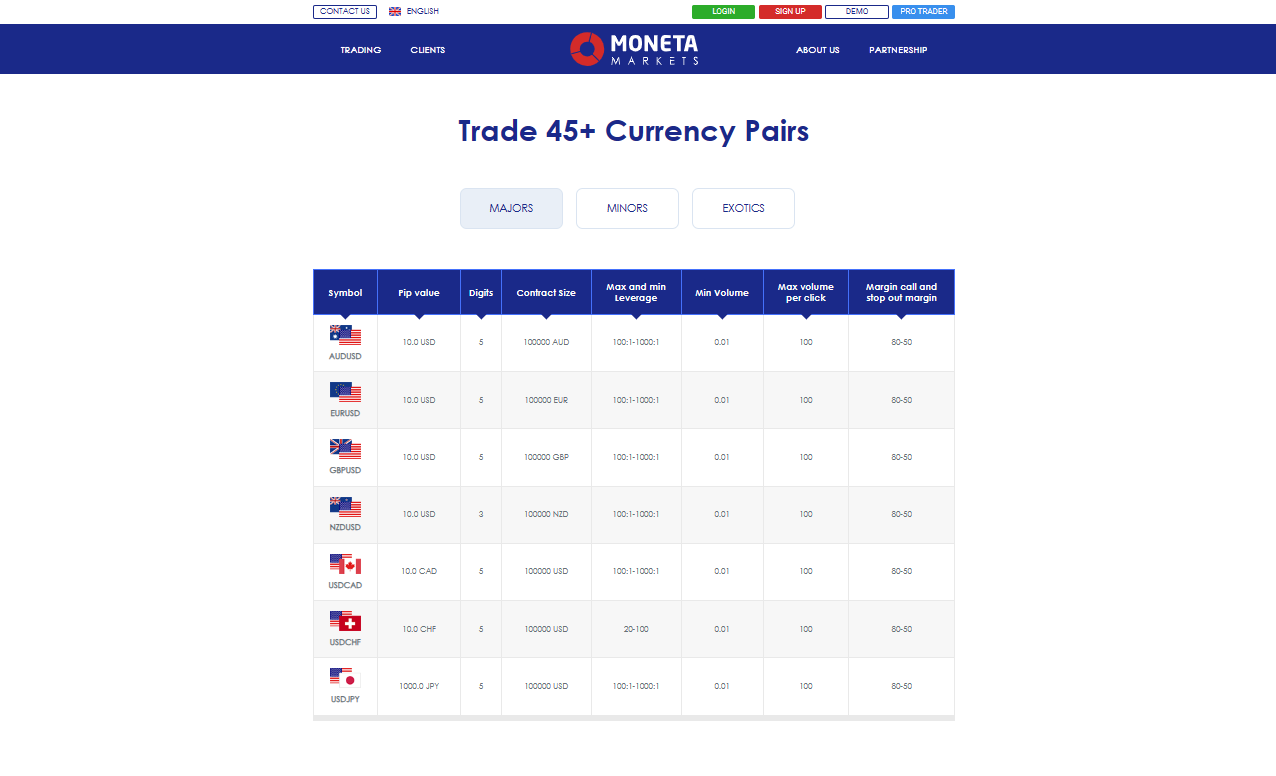

Leverage and Margin

Moneta Markets offers traders various leverage options, ranging from 100:1 to 1000:1, to suit their risk appetite and market conditions.

The platform also provides a Client Portal for easy leverage adjustments, ensuring traders maintain control over their trading activity and make informed decisions based on their own goals and preferences.

Is margin trading available on all account types with Moneta Markets?

Yes, margin trading is available on all account types offered by Moneta Markets.

Can traders adjust their leverage levels on Moneta Markets’ platforms?

Yes, traders can adjust their leverage levels according to risk tolerance and trading strategies.

Trading Instruments and Products

Moneta Markets offers the following trading instruments and products:

- 44 FX pairs. This diverse assortment comprises major, minor, and exotic currency pairings.

- 19 commodities accessible for trade, including hard and soft commodities.

- Sixteen indexes. These indexes are baskets of top firm stocks in certain areas or sectors.

- Over 700 Share CFDs are accessible, offering traders a diverse range of firms from different industries and regions.

- Over 50 ETFs for trading. ETFs (Exchange-Traded Funds) are investment funds that trade on stock markets like stocks.

- Seven bonds for trading, allowing traders to invest in debt instruments issued by governments and enterprises.

With over 30 Crypto CFDs accessible, traders can speculate on cryptocurrency price fluctuations without owning the underlying digital assets.

Does Moneta Markets offer trading opportunities in bonds?

Yes, Moneta Markets offers trading in bonds, providing access to seven different bonds for traders interested in investing in debt instruments issued by governments and enterprises.

Can I trade commodities such as gold and oil with Moneta Markets?

Yes, Moneta Markets allows traders to trade commodities such as gold, oil, silver, and agricultural products. It offers 19 commodities for trading on its platform.

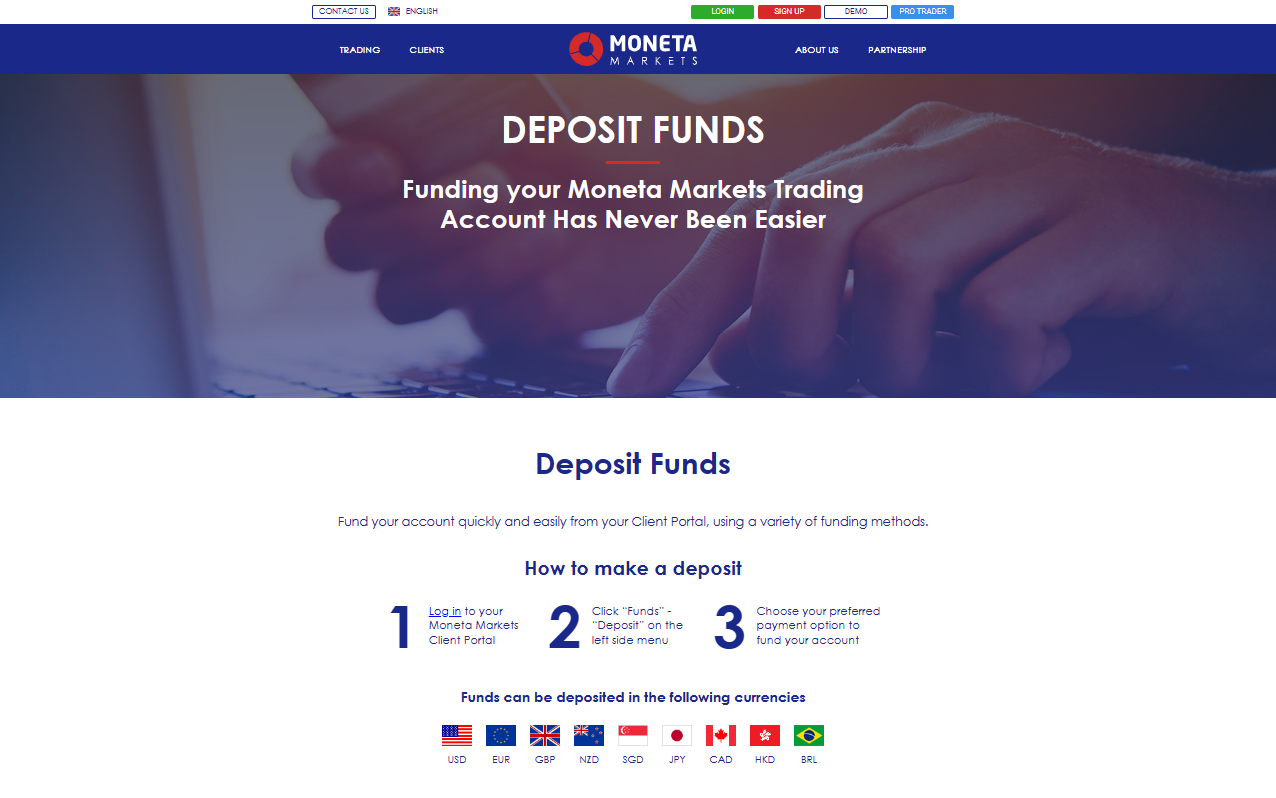

Deposit and Withdrawals

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 📈 Bank Wire Transfer | All | USD, GBP, EUR, SGD, JPY, NZD, CAD | 2 – 3 days |

| 💳 Credit/Debit Card | All | USD, GBP, EUR, SGD, JPY, NZD, CAD | Instant – 3 days |

| 📉 Fasapay | All | USD, GBP, EUR, SGD, JPY, NZD, CAD | Instant – 3 days |

| 📊 JCB | 📍 Japan | 📍 JPY | Instant – 3 days |

| 💶 Sticpay | All | USD, GBP, EUR, SGD, JPY, NZD, CAD | Instant – 3 days |

Deposit Methods

Bank Wire

- Log in to the Moneta Markets Client Portal.

- Click “Funds” then “Deposit Funds”.

- Choose “Bank Wire Transfer” as your deposit option and preferred currency.

- You will get Moneta Markets’ bank information to initiate the transfer from your bank account.

- Allow for regular bank wire transfer processing timeframes of a few business days.

Credit or Debit Card

- Log in to the Moneta Markets Client Portal.

- Go to “Funds,” then “Deposit Funds.”

- Choose your desired deposit method (Visa or Mastercard) and currency.

- Enter your card details (number, expiry date, CVV code) and deposit amount.

- Funds should appear in your trading account instantly.

e-wallets or Payment Gateways

- Log in to the Moneta Markets Client Portal.

- Go to “Funds” then “Deposit Funds”.

- Choose your chosen e-wallet or payment channel from the choices available.

- To finish the deposit procedure, follow the onscreen instructions related to your chosen payment source.

- Funds usually arrive in your trading account immediately after completion.

Withdrawal Methods

Bank Wire

- Log in to the Moneta Markets Client Portal.

- Select “Funds” and then “Withdraw Funds”.

- Select “Bank Wire Transfer” as your withdrawal option.

- Enter your bank account information properly (including the SWIFT/BIC code).

- Please provide the withdrawal amount and currency.

- Withdrawals by bank wire take around 3-5 business days to complete.

Credit or Debit Cards

- Log in to the Moneta Markets Client Portal.

- Go to “Funds” and then “Withdraw Funds”.

- Choose the same card used for the deposit and enter the withdrawal amount.

- Withdrawals to cards may be restricted according to the amount and timing of your original investment.

e-wallets or Payment Gateways

- Log in to the Moneta Markets Client Portal.

- Click “Funds” then “Withdraw Funds.”

- Select your favorite e-wallet or payment gateway.

- To finalize the withdrawal, follow the instructions given by your selected payment provider.

Is there a minimum withdrawal amount with Moneta Markets?

No, Moneta Markets does not specify a minimum withdrawal amount.

How long does it take for withdrawals to be processed by Moneta Markets?

Withdrawal processing times with Moneta Markets typically range from 3 to 5 business days for bank wire transfers, while withdrawals via other methods may be processed instantly or within a few days.

Educational Resources

Moneta Markets offers trading methods, market analysis, and platform usage teaching tools on its YouTube channel, providing traders with live and recorded video streams. Moreover, Moneta Markets delivers frequent market updates and analysis on Forex, commodities, indices, and share CFDs via its website and other digital communication channels.

Can traders access market analysis and research reports on Moneta Markets’ website?

Moneta Markets provides regular market updates, analysis, and research reports on forex, commodities, indices, and share CFDs.

Does Moneta Markets offer demo accounts with educational resources for practice?

Indeed, Moneta Markets provides demo accounts with educational resources such as video tutorials and trading guides.

Pros and Cons

| ✅ Pros | ❎ Cons |

| Offers more than 1,000 tradable assets, including forex, commodities, indices, share CFDs, and more | Some account types may have volume constraints |

| Multilingual support is provided around the clock during market hours | Online reviews include both good and negative experiences |

| Offers seminars, market analysis, and other resources to help traders improve their expertise | Moneta Markets is a newer broker than some of the more known ones |

| Competitive spreads and commissions are especially appealing on their ECN accounts | There are fewer educational materials available than with other brokers |

| Regulated by renowned agencies like as ASIC (Australia) and FSCA (South Africa), | Certain instruments or features might be unavailable in specific locations |

| Provides access to MetaTrader 4, MetaTrader 5, CopyTrading App, and its own ProTrader platform | Some users claim poor website performance during peak hours |

In Conclusion

According to our findings, Moneta Markets is a comprehensive Forex and CFD broker offering a wide range of trading products and platforms tailored to individual traders’ needs. Its strong regulatory framework and commitment to trader safety ensure peace of mind for traders.

In our experience, the platform’s low spreads, bilingual support, and user-friendly design make it popular among beginners and experienced traders.

Faq

Yes, Moneta Markets offers negative balance protection, ensuring your account balance does not drop below zero.

Moneta Markets normally processes withdrawals in 3 to 5 business days by bank wire transfer. Withdrawals made using credit/debit cards or e-wallets can be completed immediately or after a few days, depending on the provider.

Moneta Markets provides MetaTrader 4, MetaTrader 5, and a unique web-based platform called ProTrader. These platforms appeal to a variety of tastes and experience levels.

The minimum deposit for the Direct STP account is $50, while the Prime ECN account needs $200, and the Ultra ECN account requires $20,000.