How to use crypto signals when trading with Bittrex

The trading of cryptocurrency was relatively easy in the initial days of Bitcoin’s launch. You only had to pick a crypto coin on any exchange, and its value would exponentially grow within a couple of days.

Today it’s different.

The market has undergone its moments of boom and recession. Bitcoin has hit peak levels, stagnated at times and sunk to a bottom. Exchanges have listed thousands of more altcoins, adding up to the complexity of trading. As a result, traders have looked towards trading signals as a popular method for automating processes so as to free up adequate time for market analysis. Thereby eliminating excessive hopes and psychological traps that only favour short-term trading, and hence enabling traders to adopt more long-term strategies.

If you are interested in trading crypto and do not have the time for technical analysis and market research, this article is for you. Here, you will learn how to use crypto signals when trading on the Bittrex Exchange.

Crypto Signals When Trading with Bittrex

Before we delve into the ins and outs of utilizing crypto signals when trading with Bittrex, first let’s look at how you choose a convenient crypto signal provider.

Remember it’s important to carefully choose your source. One dubious crypto signal could appear tiny but the effect could implicate you into perhaps losing all your capital. I recommend choosing a premium solution.

There are a couple of free services but you need to look really hard to identify a free quality crypto signal. However, premium solutions pay off much quicker and are reliable. When an ingenious trader matches his energy with a competent crypto signal, they gain several benefits. Including high profits, confidence in the journey and slim chances of dumping all your capital.

In this section, I will teach you how to identify a quality trading signal from the best crypto provider. All of these will play a great role in your journey, as you continue trading on Bittrex with crypto signals.

A highlight of factors that define a good crypto signal provider:

- Reputation – First comes the reputation of a crypto provider. Is it legitimate? Conduct a quick search query on Google to check whether a provider is legit or just another dubious scheme to reap you off. Most reviews and testimonials on Google are legit and come from real people that have already tried and tested the provider. If you find any red flags, move on to the next provider.

- Quality technical analysis – The best crypto signal providers have an in-house team of experienced and highly skilled analysts and traders. All of whom have a successful track record of creating profitable and reliable crypto signals.

- Good blend of fundamentals and technical analysis – Fundamental analysis involves all the news and events surrounding the price action of an asset. Fundamentals help you define and relate microeconomic factors with the direction of a cryptocurrency. This could be an event in the United States, a policy change in the U.K or a public holiday in Australia. A good provider will help you remain on the lookout for such fundamentals that could affect the price direction of an asset class.

- Paid subscription – Premium subscriptions to Crypto Signals Plus offer many benefits. While the free version of the program is limited in the number of signals offered, the premium subscription unlocks all long-term crypto signals as well as the added bonus of real-time hot coin information. A fancy chart on the website allows you to keep track of over 1,000 cryptocurrency tickers. You can create your own cryptocurrency watchlist and use technical and fundamental analysis to predict future prices.

The main advantages of crypto signals are:

Expert analysts –An in-house team of highly skilled traders and analysts has spent years perfecting their cryptocurrency trading skills.

Have a precise entry and exit goals When a competent trader uses a good trading signal, it will always include an offer to enter and exit. It helps to eliminate the guesswork of when is the best time to enter or exit the market.

Position to buy or sell For example, if your signal tells you to go long, our analysts believe Binance Coin is undervalued.

For this reason, we advise you to place a buy order with your chosen broker.

Likewise, if your signal is short, we think Binance Coin is overvalued.

Thus, we recommend a sell order. In the case of a sell position, we will seek to profit from the fall in the pair’s value.

Registering and using crypto signals on the Bittrex exchange

In the following section, I assume you already have an account with Bittrex and you have already validated all KYC requirements.

How to Generally Trade on Bittrex

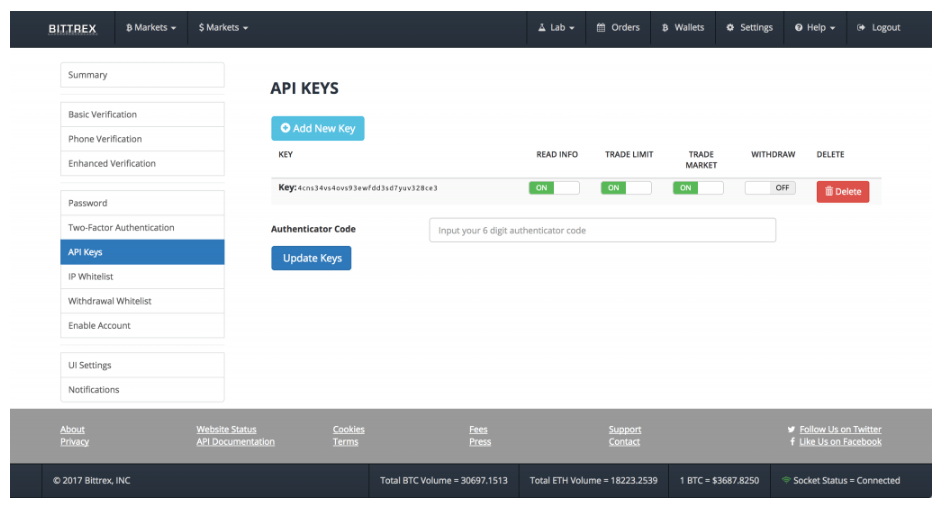

Before making your first trade on Bittrex, you have to make a few configurations on the exchange so that you can legitimately trade on the platform. Thereby, head out to the API KEYS and turn everything ON except WITHDRAW. Have a look at the picture below to see what I mean.

Now, go to CONFIG and select Bittrex as your exchange. I hope you’re still awake because you’re ready to start trading!

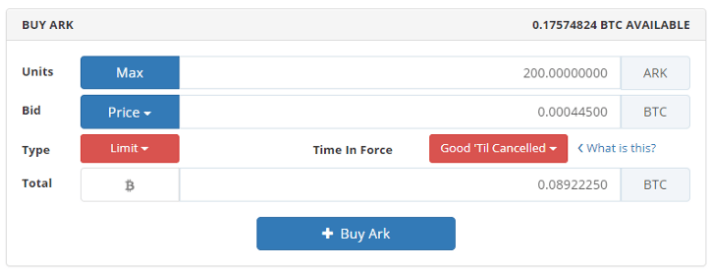

Select MARKETS to choose the currency you want to trade. We’ll use Ark as our example. You can check what price Ark is being sold for in the ORDER BOOK. Now you can choose the amount you want and make a bid by clicking BUY ARK.

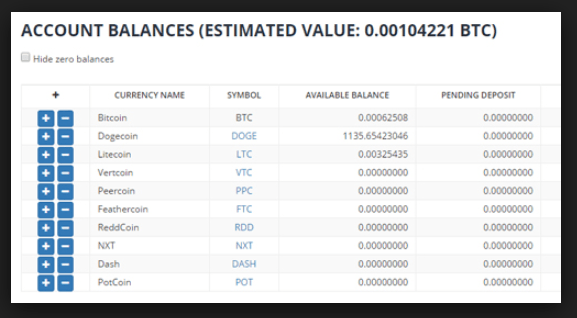

When your bid is accepted your new currency will be sent to your Bittrex wallet. When you’ve been trading for a while your wallet will look something like this.

How To Generate Crypto Trading Signals

There exist a couple of ways for generating cryptocurrency trading signals. Unlike the age-old stock or forex market, the cryptocurrency market is pretty nascent. This means most traders have not yet cultivated the art of generating crypto trading signals. Therefore, this is the reason why the majority of the traders out here are making use of signal providers so as to win in the market.

Automated trading bots are one of the most popular generators of trading signals. They are all designed to recognize a specific chart pattern based on a set of indicators and either automatically open/close the trade on behalf of a trader, or send a trade signal to a trader, who will then make a final decision.

Influenced by social media networks, “copy” trading is becoming more and more popular, especially amongst younger trading generations. Certain platforms allow their users to replicate trades of the other users automatically. In essence, it works similarly to crypto trading bots as trades are automatically opened, after being generated by someone else than the trader himself.

Still, the most popular type of generating trading signals is by applying technical analysis. By analyzing the historical price action of a digital asset, traders use different indicators and tools to forecast future trends and find market opportunities, for example, drawing the trend-based Fibonacci extension.

Charting tools on most signal providers offer a long list of available indicators, amongst which the most popular are the moving average, trend lines, Fibonacci, Elliot Wave, average true range (ATR) as well as oscillators etc. Of course, all these indicators can be applied across different time frames.

Using Crypto Signals to Trade on Bittrex

- A Bittrex account. Sign up on the Bittrex Official Website, You’ll need to verify your identity in order to pass the Know-Your-Customer (KYC) step in order to begin trading.

- Funds. We’d recommend depositing $50+ to start with, although you can deposit as much or as little as you like.

- A Bittrex trading signal. Let’s assume that the FXLeaders team has issued an alert to buy Ethereum (ETH) at $1500 using 2x leverage, with a target of $2000 and a stop loss of $1300.

2-steps for using crypto signals on Bittrex

- Navigate to the spot trading drop-down navigation bar on the Bittrex homepage and automate your trades.

- Next locate on the right bar, Grid Trading and click the manual button. Here you need to key in the details of the crypto signals from FXleaders.

There are instances where a trading signal provider will recommend the amount of capital you require to spend on a given trade. Sometimes newbies might not have that full amount and I would advise them to trade with what they have depending on their tolerance for risk.

Since we already recommended that you have at least $50 on your account for this trade, open the position with at least $25.

Once you have initiated the position, the order will remain in the Open Orders section and wait to execute until the price of the Ethereum coins hits $1500. The order will buy ETH at that price and then wait for a given amount of time until it hits $2000. Whereby the position will execute a take profit at $2,000. If the price drops, the stop loss at $1300 will prevent further losses.

FXLeaders Trading Signals

At FXLeaders, we offer a set of free and paid crypto trading signals that have performed exceptionally well over the years. They’re crafted by our handpicked team of industry experts that have been in the crypto markets since the beginning. Using a combination of proprietary tools, technical analysis, and fundamental analysis, we’ve built a fantastic strategy that has been consistently netting profits for our followers for years now.