The FTSE continues to rally today despite poor retail sales data, fueled by AI tech stock rally after a poor start to the week.

- Retail sales were lower than expected

- FTSE gains 1.10% in 2 days

- National budget ways in the background

The FTSE gained 0.42% on today’s open after yesterday’s gain of 0.87%. The recovery was fueled by a rebound in tech stocks.

Retail data released today was lower than the market consensus, creating some volatility shortly after the data. The market recovered all the same as the tech stock rebound continued during the London trading session.

Retail sales ex-fuel came in at -0.9% MoM and at 2% YoY, when the market had expected -0.4% MoM and 3.3% YoY. The data showed a sharp decline from last month’s reading of 0.1% MoM and 4% YoY.

National Budget on Sidelines

The national budget has taken a secondary role as the market views the tech rally as an overwhelming factor. The budget was received as a typical spend more, tax more solution to economic growth.

The reception from the market was bearish to say the least. The FTSE lost 210 points or 2.57% from October 30, the day the budget was presented, to November13.

The recent rally may have corrected the course for the main UK index; however, the FTSE still faces a major hurdle as the BoE has stated that they will be watching for inflationary signs due to the budget.

Technical View

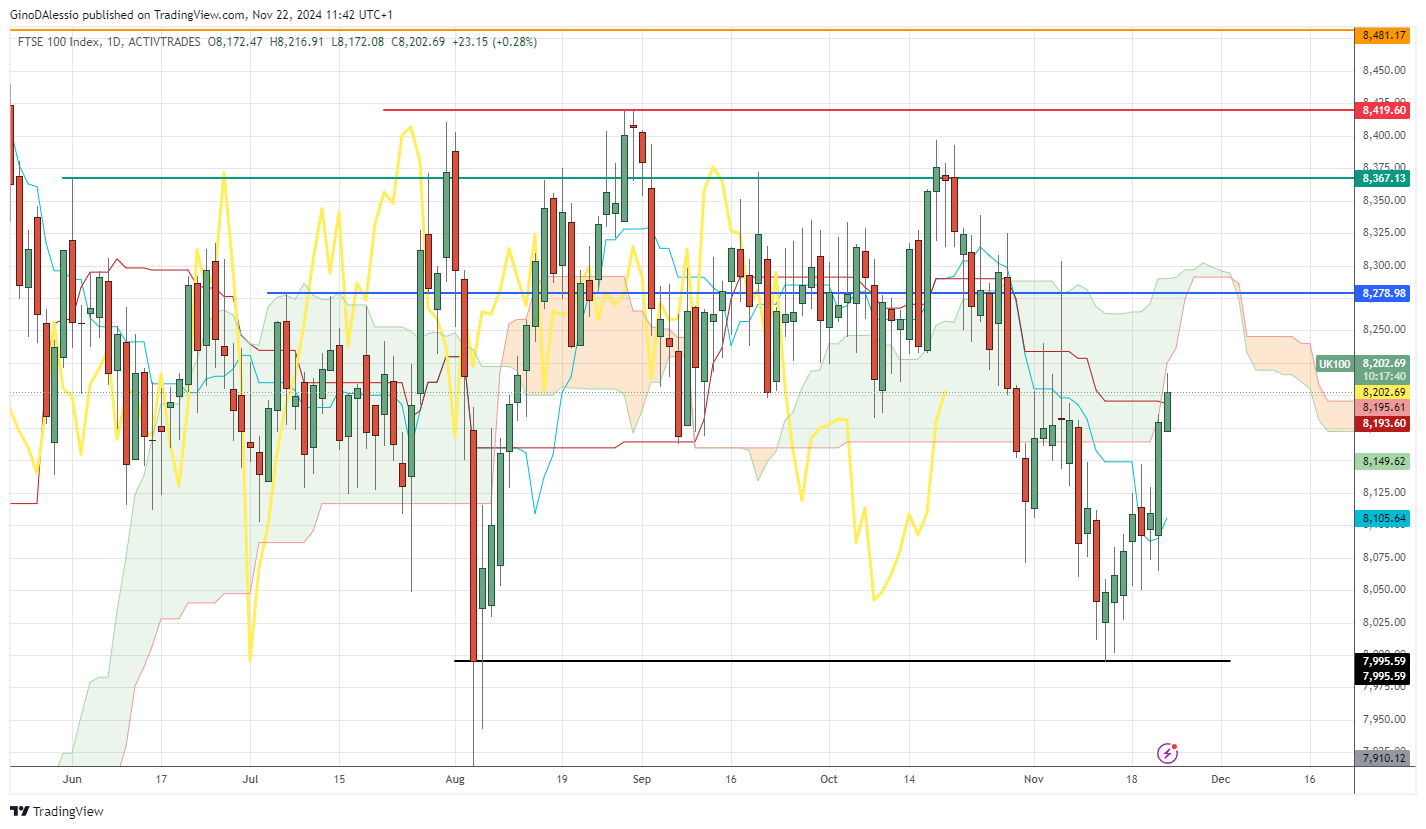

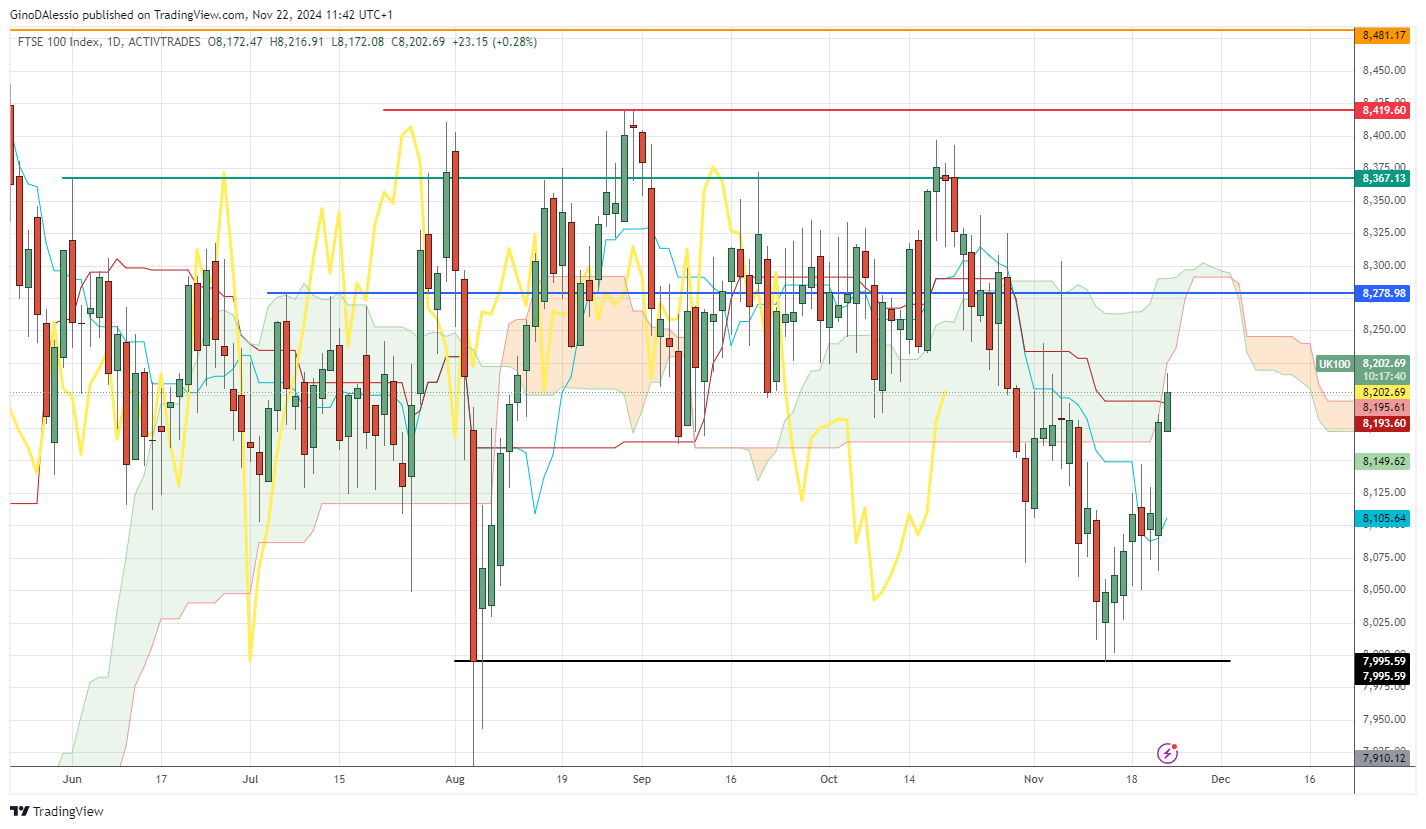

The day chart above for the FTSE shows a market in a bear trend that is undergoing a correction. Price is below the Ichimoku cloud and has retraced higher toward the resistance from the belly of the cloud.

The last dip to 7,995 (black line) on November 13 has created a wide sideways market. That level was the close of a dip in August, which gave way to a major retracement.

Despite that long rally, the market never regained a bullish trend and remained confined to a wide range between 8,419 and 8,166.

The market will find major resistance at the top of the cloud at 8,278 (blue line), which also coincides with a high from July.

To the downside, the next major support will coma at 7,995 (black line), which the market has tested twice.

FTSE