usd-jpy

USDJPY Dips Below 155 Despite BOJ’s Ueda Avoiding FX Talk

Skerdian Meta•Thursday, November 21, 2024•2 min read

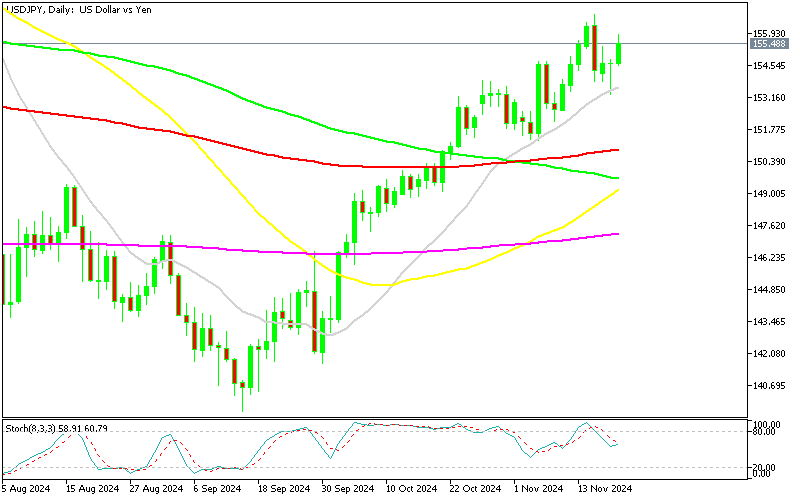

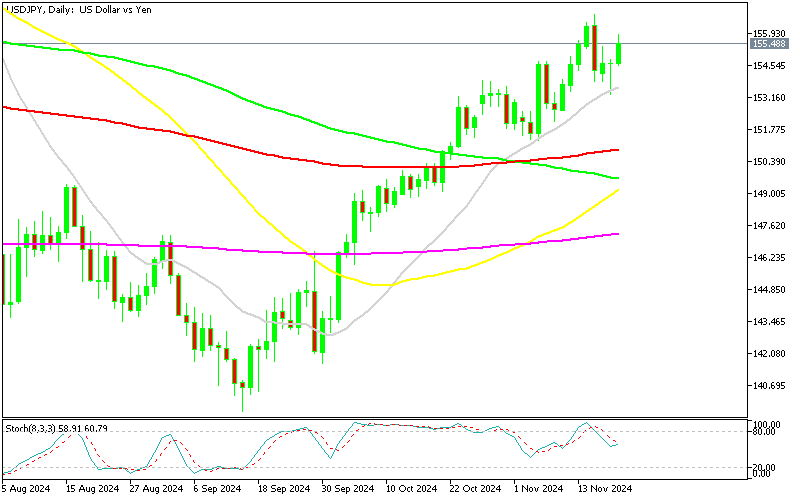

USDJPY retreated 3.5 cents lower but buyers keep coming at technical levels, and they pushed the price above 155 again yesterday, confirming the upside bias in this forex pair.

The USD/JPY pair experienced a sharp drop of 3 cents on Friday, driven by heightened risk aversion. The selloff coincided with a decline in stock markets and extended into early Monday, with the pair sliding to 153.28. However, sellers encountered support at the 20-day SMA on the daily chart, which helped to halt the decline.

Buyers subsequently stepped in, triggering a rebound that pushed the price up by 2 cents over the past two days, suggesting a potential end to the recent downward movement. Meanwhile, Japan’s economic challenges persist. Indicators such as weaker personal spending and consumption reflect a struggling domestic economy.

USD/JPY Chart Daily – The 20 SMA Has Been Acting As Support

Additionally, Q3 GDP growth slowed, and the GDP Price Index pointed to deflationary pressures. The latest data on Core Machinery Orders, a key forward-looking metric for industrial capital spending, showed a further decline in September, continuing a concerning downward trend. This underscores difficulties in Japan’s industrial sector, a cornerstone of its economy, and raises questions about its growth outlook moving forward. Today the BOJ Governor Kazuo Ueda made some comments at the Paris EUROPLACE Tokyo International Financial Forum, in Tokyo.

Comments from the Bank of Japan Governor Kazuo Ueda

Monetary Policy and FX Movements

- No comments are made on short-term FX movements.

- One month remains until the next policy meeting, allowing time for more information to emerge.

- Monetary policy decisions are made on a meeting-by-meeting basis, guided by available data up to that point.

- FX movements are factored into economic and inflation outlooks, including an analysis of their underlying causes.

Insights from BOJ Governor Ueda

- Technology has diversified financial intermediation, influencing the financial industry.

- The rise of generative AI will drive further transformation in the financial sector.

- A regulatory and supervisory framework must adapt to technological advancements.

- Leveraging insights from exports can help fully realize the benefits of new technologies.

- Advancements in technology also introduce new risks to financial stability.

- With the increasing complexity of financial services, risk transmission channels have become less transparent.

- Existing financial regulations may not adequately address emerging types of financial services.

USD/JPY Live Chart

USD/JPY

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 h ago

Save

Save

4 h ago

Save

Save

6 h ago

Save

Save