USDJPY retreated sharply and fell 3 cents on Friday on risk aversion, as stocks also tumbled, however the decline might be over after last night’s rebound off the 50 SMA.

After a 20-cent decline during the summer, USD/JPY rebounded strongly, climbing 17 cents to reach 156.74 during the European session on Friday, including a 4-cent rise earlier that day. This surge was supported by weaker-than-expected Q3 data from Japan, including slower GDP growth and a declining GDP Price Index, which bolstered bullish sentiment. However, sellers regained control later in the European session, pushing the pair down to 153.86. Despite the pullback, the US dollar closed the week higher against the yen though.

USD/JPY Chart H4 – The 20 SMA Has Turned Into Support

In the short term, the pair faces the risk of a deeper correction within its longer-term upward trend. The USD/JPY H4 chart highlights key technical levels, with Friday’s drop stalling just below the 50 SMA (yellow). While there was an attempt to recover on Monday, the 100 SMA (green) at 153.40 remains a critical support level that could come into play. Market participants are also weighing the possibility of intervention by Japanese authorities, which could limit further upside in USD/JPY. Analysts suggest that while the pair might temporarily rise above 155, any sustained gains could be capped by the potential for government action and the likelihood of rate hikes from the Bank of Japan.

The economy of Japan continues to display weakness, with personal spending and consumption slowing, while the GDP was also soft. Last night we had the Core Machinery Orders which showed another decline for September, against expectations, continuing the negative trend, which is a negative sign for the Japanese economy which relies heavily on industrial production and this is a leading indicator of capital spending in the sector for the coming 6-9 months.

Japanese Core Machinery Orders for September

- Month-on-Month (MoM):

- September: -1.7% (below the +1.9% expectation)

- August: -1.9% (prior reading)

- Year-on-Year (YoY):

- September: +4.8% (exceeding the +2.2% forecast)

- August: -3.4% (prior reading)

- Quarterly Trends (July-September):

- Machinery orders fell -1.3% quarter-on-quarter (q/q).

- Forecast (October-December):

- Machinery orders are projected to rise +5.7% q/q, but there is skepticism about achieving this growth.

Japanese machinery orders showed mixed results in September. While the annual figure surpassed expectations (+4.8% YoY), the monthly decline of -1.7% highlights ongoing fragility in domestic demand. Quarterly data confirms this weakness, with orders down -1.3% in Q3. The optimistic forecast for a +5.7% q/q recovery in Q4 may face challenges, given subdued economic momentum and uncertainty in global demand. Overall, machinery orders reflect a cautious outlook for Japan’s industrial activity heading into year-end.

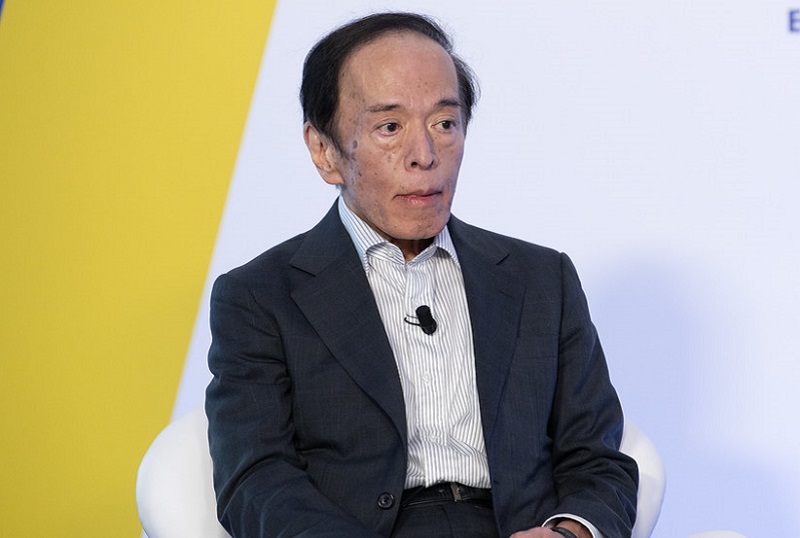

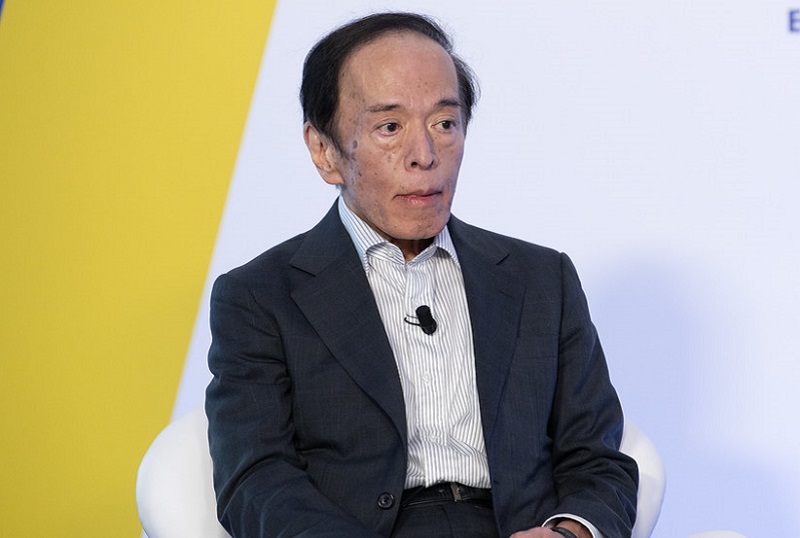

Bank Japan Gov Ueda Speech Highlights

- Japan’s inflation drivers are shifting from cost-push factors to domestic wage increases.

- Business sentiment continues to improve alongside rising corporate profits.

- Firms are prioritizing investments in future growth areas such as digitalization and decarbonization.

- Private consumption is on a moderate upward trend, supported by higher nominal wages and summer bonuses.

- A virtuous cycle of income growth boosting spending is strengthening.

- Real GDP growth is expected to reach approximately 1% over the coming fiscal years.

- September 2024 CPI (excluding fresh food) increased by 2.4% year-on-year.

- While import price pressures are easing, services prices remain stable, reflecting a shift in inflationary dynamics.

- CPI is projected to rise moderately as the output gap improves and medium- to long-term inflation expectations increase.

- In July 2024, the Bank of Japan raised the policy rate to 0.25% and reduced government bond purchases.The Bank plans to continue gradual rate hikes while maintaining accommodative financial conditions to support economic activity and sustainable inflation growth.

USD/JPY Live Chart

USD/JPY