Forex Signals Brief October 21: A Light Week, Besides 50 BPS BPS Rate Cut!

Last week started with lower PPI and CPI inflation figures from China, which kept commodity dollars mostly bearish, however, that didn’t stop stock markets from pushing higher for yet another week. S&P 500 and Dow Jones kept making new record highs, closing at 5,836 points and 43,115 points respectively.

CPI consumer inflation reports from Canada, the UK and New Zealand all came below expectations, confirming further that inflation is slowing, which helped keep these currencies bearish against the USD, however, we saw some improvement toward the end of the week. USD/CAD climbed above 1.38 after the softer inflation numbers solidified expectations for a 50 bps cut by the BOC this week.

The European Central Bank meeting was another focal point in forex last week, as the ECB delivered another 25 bps rate cut while president Lagarde delivered some dovish comments, which sent EUR/USD close to 1.10. The US September retail sales came above expectations on Thursday, showing that the US consumer is holding up well, which is another positive factor for the USD.

This Week’s Market Expectations

This week the economic calendar is light, with the Bank of Canada meeting being the main event, which is expected to deliver a 50 basis points rate cut, while on Wednesday we also have the Services and Manufacturing PMI reports. Today it started with the Loan Prime Rate cut of 25 bps.

Upcoming Economic Events:

- Monday: People’s Bank of China (PBoC) Loan Prime Rate (LPR) decision.

- Investors will be watching for any changes in China’s benchmark interest rates, reflecting the country’s monetary policy stance.

- Tuesday: Canada Producer Price Index (PPI) report.

- A key indicator of inflation in Canada, providing insight into the costs of production and future consumer price trends.

- Wednesday: Bank of Canada (BoC) Policy Decision.

- The central bank will announce its interest rate decision, with potential implications for inflation control and economic growth in Canada.

- Thursday: Flash Purchasing Managers’ Index (PMI) reports for Australia, Japan, Eurozone, UK, and US.

- These early PMI reports will offer a snapshot of economic activity in key regions, helping gauge the health of the manufacturing and services sectors.

- US Jobless Claims: Weekly data providing insight into the state of the US labor market and employment trends.

- Friday:

- PBoC Medium Lending Facility (MLF) announcement: Important for understanding China’s liquidity and credit conditions.

- Tokyo CPI: A leading indicator of inflation in Japan’s capital, giving clues about national inflation trends.

- German IFO Business Climate Index: A measure of business sentiment and expectations in Germany, Europe’s largest economy.

- Canada Retail Sales: An indicator of consumer spending and economic activity in Canada.

- US Durable Goods Orders: Data showing demand for long-lasting goods, a key indicator of manufacturing strength and consumer confidence in the US.

Last week the price action was mostly slow in most financial markets, with stock markets and the USD pushing higher again, which made trading easier for us, despite the occasional retreat. We kept long on Dow Jones and bought the retreats in the USD, opening 28 trading signals last week, closing it with 20 winning forex signals and 8 losing ones.

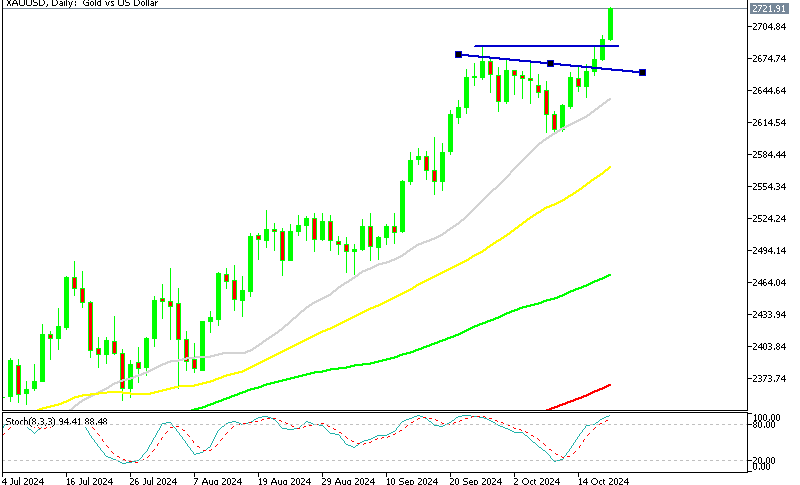

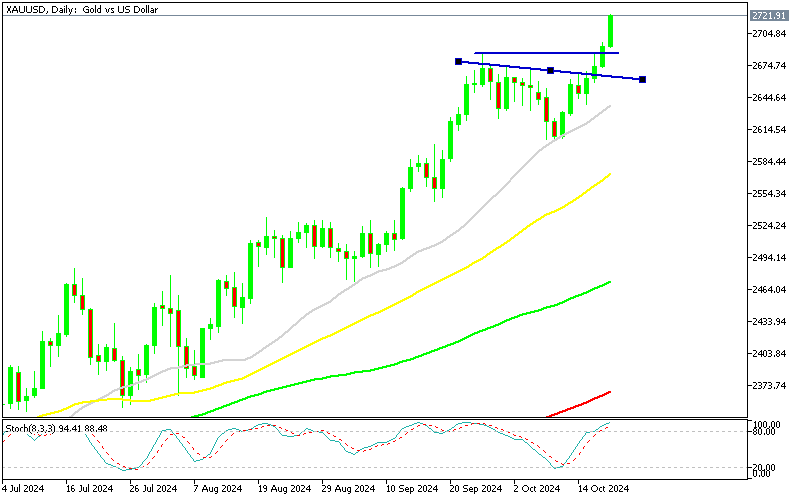

Gold marches Higher Toward $3,000

Early last week, gold prices saw a decline as markets shifted away from a risk-averse stance, driven by the absence of a broader crisis in the Middle East. However, gold found support near the 20-day Simple Moving Average around $2,605, allowing for a rebound. This recovery was further boosted by developments in China. As geopolitical tensions continued to rise and central banks maintained accommodative monetary policies, safe-haven assets like gold and silver gained more appeal. Gold surpassed its September high of $2,685, reaching a new record at $2,721.60, as investors sought refuge amidst global uncertainty.

XAU/USD – Daily Chart

AUD/USD Sellers Stop at the 100 Weekly SMA

Meanwhile, the AUD/USD exchange rate has been on a three-week downtrend, losing about 2.5 cents during this period. The decline is largely due to the strengthening of the USD and a weakening appetite for commodity currencies, primarily driven by disappointment over China’s fiscal and monetary stimulus measures, which failed to meet market expectations. Geopolitical tensions and a less dovish stance from the Federal Reserve have further weighed on the AUD/USD pair. Last week, the pair tested the 100-week Simple Moving Average, which provided some support. Australia’s strong employment data helped limit the losses, with the AUD ending the week around 30 pips lower against the USD, remaining better supported than other risk currencies.

AUD/USD – Weekly Chart

Cryptocurrency Update

Bitcoin Continues to Push Toward Above $70K

In the cryptocurrency market, Bitcoin has been under pressure since April, dropping from nearly $70,000 to below $50,000 by August. After a temporary surge above $60,000 following the Federal Reserve’s rate cut in September, Bitcoin fell back but has since begun to recover, climbing past $68,000 this week. Following a brief dip toward $66,000 yesterday, buyers returned, pushing Bitcoin back above $67,000.

BTC/USD – Daily chart

Ethereum Consolidates Below the 100 Daily SMA

Ethereum has faced similar selling pressure, with its price rebounding to the 50-day Simple Moving Average in June but struggling to break through overhead resistance at $2,500, defined by the 100-day SMA. Despite consolidating around $2,200, broader economic concerns have prevented a decisive move above key resistance levels.

ETH/USD – Daily chart