aud-usd

AUDUSD Sellers Fail First Test but RBA Hauser Comments Weigh

Skerdian Meta•Monday, October 21, 2024•2 min read

Last week AUDUSD tested the 100 weekly SMA after declining since the beginning of October, however that moving average held as support. The positive employment figures from Australia also helped the AUD, which lost around 30 pips against the USD after all.

For the past three weeks, the AUD/USD exchange rate has been on a downward trend, losing about 2.5 cents. This decline is primarily driven by the rising USD and weakening risk sentiment around commodity currencies. The latter is a result of Chinese authorities failing to meet market expectations with their fiscal and monetary stimulus measures. Geopolitical concerns and a less dovish Federal Reserve have also contributed to the pair’s fall.

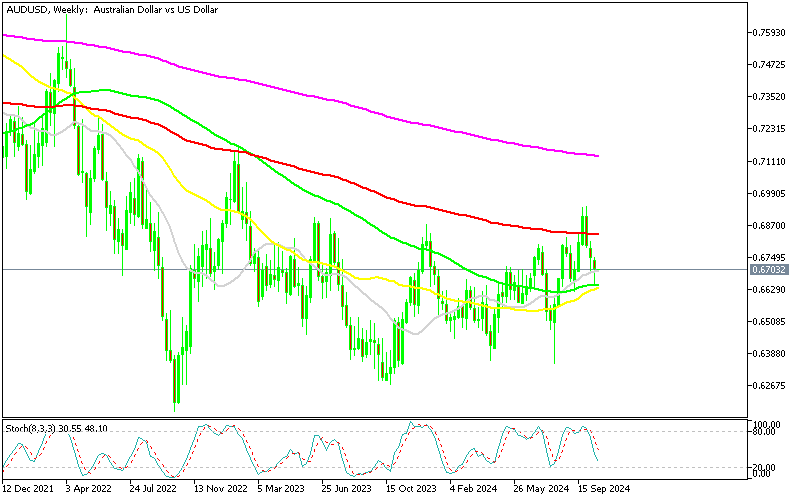

AUD/USD Chart Weekly – The 100 SMA Held as Support in the First Test

Despite these pressures, the AUD/USD found support at the 100-week Simple Moving Average (SMA), ending the week just above this level. This came despite remarks by RBA’s Hunter, which briefly pushed the pair below the 0.67 mark. Australia’s strong employment data last week also provided some support for the Aussie, helping it to limit losses compared to other USD pairs.

Early this morning the RBA Deputy Governor Hauser spoke at the Commonwealth Bank of Australia Global Markets Conference, in Sydney. RBA Deputy Governor Hauser highlighted the unexpected strength of employment growth and the unusually high labor participation rate. While stressing that the RBA closely monitors data, Hauser clarified that policy decisions are not solely dictated by short-term data fluctuations. The Q3 CPI consumer inflation report next week and other data will play a key role in shaping the RBA’s upcoming policy outlook.

Comments from the RBA Deputy Governor Hauser

- RBA Deputy Governor Hauser expressed surprise at the strength of employment growth.

- Noted that the labor participation rate is unusually high.

- Emphasized that while the RBA is data-dependent, it is not “data-obsessed.”

- The RBA will consider Q3 CPI data and other economic indicators when forming future policy decisions.

AUD/USD Live Chart

AUD/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

4 h ago

Save

Save

9 h ago

Save

Save

11 h ago

Save

Save