Ethereum Price Prediction: BlackRock’s ETH Bet Sparks Rally, Eyes $2,470 Breakout

Ethereum (ETH) extended its overnight bullish rally, gaining positive traction around the $2,445 level and reaching an intra-day high of $2,469.

This upward trend can be attributed to the overall bullish sentiment in the crypto market, fueled by China’s stimulus announcement and other positive developments. Bitcoin’s strong performance, surpassing the $63,000 mark, has also contributed to the bullish momentum across other cryptocurrencies, including Ethereum.

#BTCUSDT BIG NEWS👨💻

BTC bounced 4% Up🚀

The Indicators say that is very Bullish Momentum😉

I think the Bull Run can start with the election of the USA

Stay Chilled and Buy every DIP🧘 pic.twitter.com/cxdtjDxm9O— Rakowicz (@crypto_rakowicz) October 12, 2024

Moreover, ETH’s gains were further supported by BlackRock’s significant purchase of 7,574 ETH, highlighting strong institutional interest in the asset. This shift in focus from Bitcoin to Ethereum indicates a growing bullish sentiment surrounding ETH, suggesting the potential for continued price appreciation and increased investor interest.

BlackRock’s Shift to Ethereum Signals Growing Institutional Confidence and Potential Price Appreciation

On the positive side, LookOnchain reported that BlackRock has recently sold 182 Bitcoin worth $11.34 million while still holding over 369,640 BTC valued at around $23 billion. Simultaneously, the hedge fund made a significant purchase of 7,574 Ethereum for $18.52 million, bringing its total Ethereum holdings to 414,168, worth about $1.01 billion. This shift in BlackRock’s investment strategy has sparked speculation in the crypto market, suggesting that investors may be leaning more bullish on Ethereum compared to Bitcoin.

BlackRock's big bet on Ethereum: They're buying more ETH than BTC now. That's huge for ETH holders 🔥

Ethereum’s role in DeFi, NFTs, and Layer 2 solutions is drawing massive institutional interest, positioning it as the key player in the blockchain space. #Ethereum #Blackrock… pic.twitter.com/YCmAfcjw9T

— Bitcoin Buddha (@Bitcoin_Buddah) October 12, 2024

BlackRock’s decision to sell Bitcoin while buying Ethereum comes after the firm aggressively purchased BTC earlier this month, acquiring over $388 million in just four days. Despite these trades, BlackRock’s head of digital assets, Robbie Mitchnick, emphasized that Bitcoin remains a valuable asset, often seen as “digital gold” during economic uncertainty.

However, he noted that institutional investors have different views on Ethereum, given its less established infrastructure. Following the launch of BlackRock’s spot ETFs, both Bitcoin and Ethereum have seen price increases, with BTC rising 49% this year and ETH gaining 15%, indicating a growing interest among investors in diversifying their cryptocurrency portfolios.

BlackRock’s substantial investment in Ethereum, alongside its strategic shift from Bitcoin, signals growing institutional confidence in ETH. This positive sentiment, coupled with rising demand and the launch of spot ETFs, is likely to drive further appreciation in Ethereum’s price.

Ethereum Poised for a Rally Amid Market Challenges and Growing Interest in Cutoshi

Despite the unstable conditions in the crypto market and increased selloffs among whales, Ethereum may be poised for a significant rally. Analysts like Mikybull on X suggest that Ethereum could soon reach $5,000, especially with support holding strong at $2,300. If Ethereum maintains this support, it may trigger a bullish reversal, leading to substantial price increases in the near future.

Furthermore, the Ethereum-based meme coin Cutoshi is gaining traction, attracting attention during its presale phase. Unlike many other meme coins that lack utility, Cutoshi combines fun and practicality by adhering to core DeFi principles like freedom and anonymity.

Therefore, the positive outlook from analysts regarding Ethereum’s potential rally to $5,000, combined with its strong support at $2,300, could boost investor confidence. This sentiment, along with the growing interest in projects like Cutoshi, may drive further demand for ETH.

Daily Technical Outlook: Ethereum (ETH/USD) – October 12, 2024

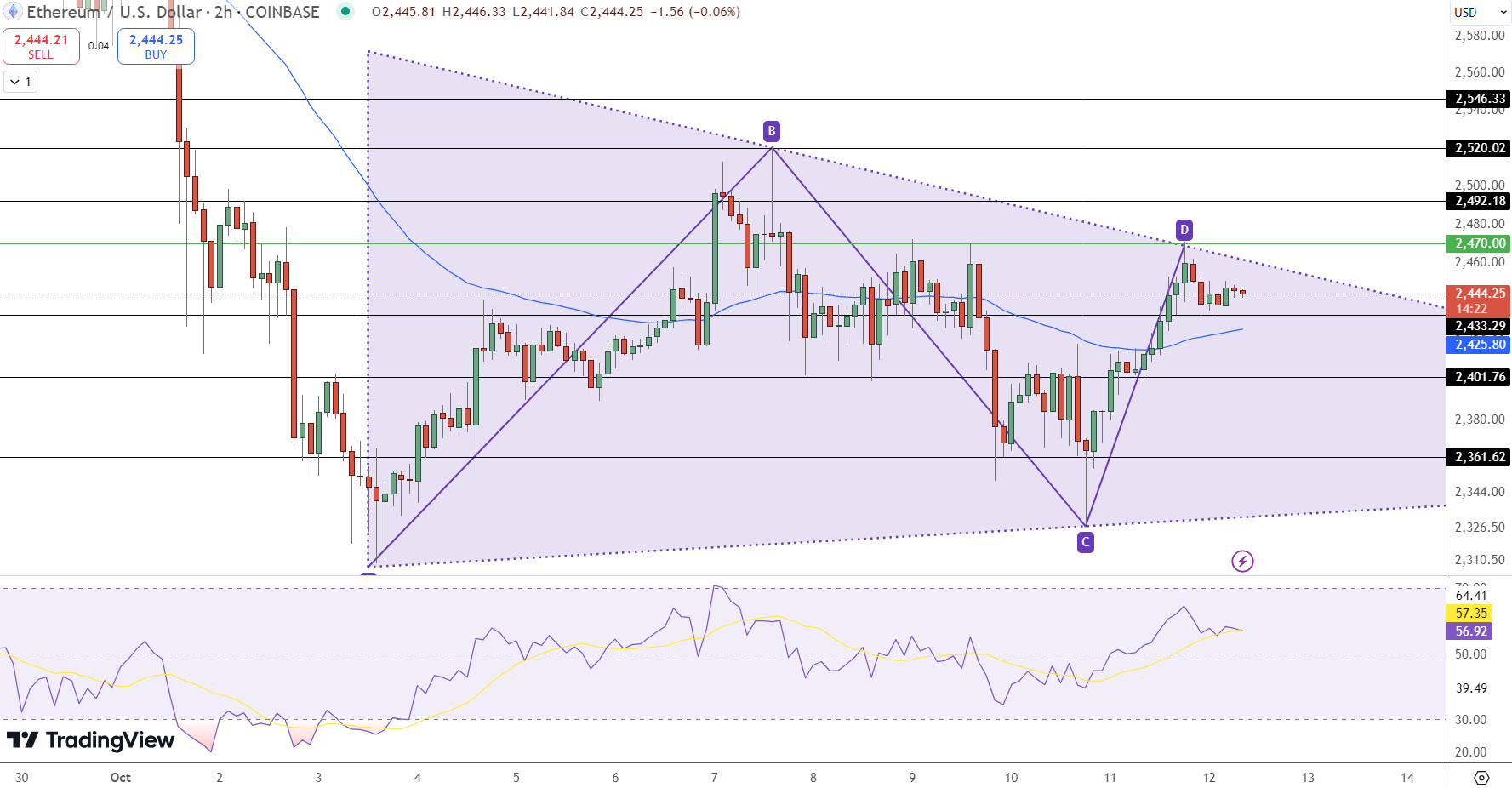

Ethereum is currently trading around $2,444 as it forms a symmetrical triangle pattern, signalling a possible breakout in either direction. The key level to watch is the immediate resistance at $2,470, which also aligns with the triangle’s upper boundary.

A break above this level could open the doors for a bullish rally toward the next resistance at $2,492, followed by a move to $2,520.

However, failure to break the $2,470 resistance may lead to a retest of immediate support at $2,425, followed by the lower boundary of the triangle near $2,401.

The RSI currently sits at 64, indicating mildly overbought conditions but leaving room for further upside. The 50-day EMA is positioned at $2,433, providing strong nearby support.

In conclusion, Ethereum’s price action is coiling, with the symmetrical triangle extending resistance near $2,470. A breakout above this resistance would signal a bullish continuation, while a breakdown below $2,425 could trigger a bearish trend reversal.