The Gold price has been surging in 2024 and for good reason, as the political, geopolitical, and economic uncertainties keep safe havens in demand. In the US, the presidential elections are approaching which always hold a risk premium, while the escalating tensions in the Middle East are keeping risk sentiment damp. Besides that, the global economy has been slowing which directs investment funds toward safe havens such as Gold.

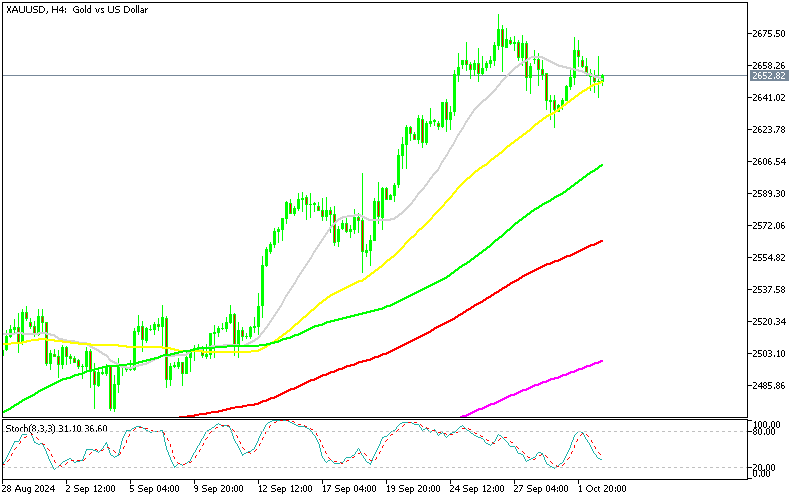

Gold reached a peak of $2,685 last Thursday but pulled back to $2,624 by Monday. Despite the decline, the 50 SMA (yellow) on the H4 chart provided strong support. Escalating tensions in the Middle East, with Israeli forces invading Lebanon and an Iranian missile strike, pushed XAU/USD higher again. However, it failed to hit a new high and reversed lower during the European session.

Gold Chart H4 – The 50 SMA Keeping the Trend Bullish

The 50 SMA acted as support again, prompting traders to open another gold purchase signal. Gold prices took a breather on Monday after a significant rally driven by U.S. monetary easing, but Chinese stimulus measures could shift investments away from gold into Chinese stock markets. China’s markets are currently closed for National Day, so the impact may become clearer next week.

Future Gold Outlook

If gold prices fall, particularly as the yuan strengthens, there may be a resurgence in Chinese physical demand for gold in Q4. Both Goldman Sachs and UBS have raised their gold price forecasts, expecting it to hit $2,900 by Q4 2025 and $2,750 by the end of 2024, driven by rising geopolitical tensions.

Other Precious Metals

Silver has seen a significant rise, with spot prices up about 50% since the start of the year, reaching $31.36 an ounce. This indicates that demand for precious metals is not exclusive to gold.

Gold Live Chart

GOLD