USD to NZD Rate Falls 1 Cent As Calls for a 50 bps RBNZ Rate Cut Increase

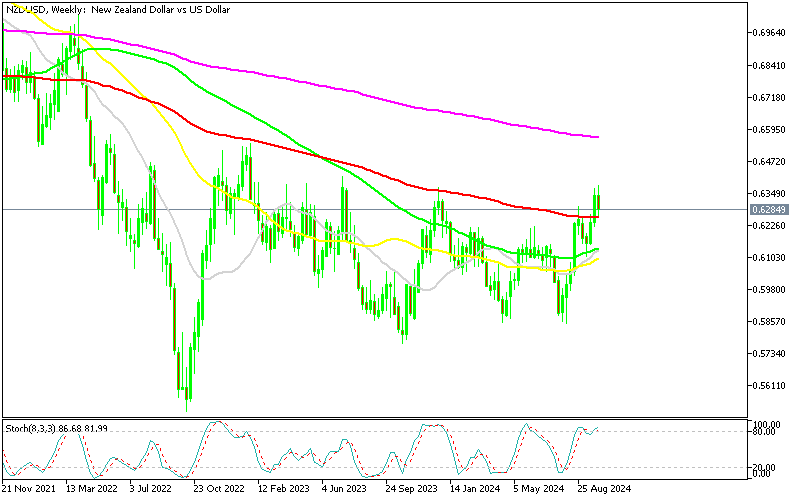

The USD to NZD exchange rate remains highly volatile, largely influenced by China’s economic stimulus efforts and other risk events. After gaining over 4 cents since August, when optimism grew over a potential soft landing for the US economy, the pair fell by 1 cent yesterday due to negative shifts in risk sentiment. NZD/USD recently broke above the 100-week Simple Moving Average (SMA), signaling potential strength.

NZD/USD Chart Weekly – Will the 100 SMA Turn Into Support?

However, Jerome Powell’s recent comments, where he pushed back against a 50 basis point rate cut in November and emphasized a gradual approach to rate reductions, have bolstered the USD and weighed on the NZD/USD pair. Additionally, the Middle East conflict has further dampened risk sentiment, contributing to the pair’s decline. On the technical front, the 100-week SMA, previously a strong resistance level, is now being tested as a support level.

Global Dairy Trade Auction Price Index

- New Zealand GDT price index increased by +1.2%, up from the prior week’s +0.8% gain.

- The whole milk price index saw a notable rise of +3.0%, indicating stronger demand or supply adjustments in the dairy market.

If NZD/USD fails to hold above this key level, the broader bearish trend could resume. The Reserve Bank of New Zealand (RBNZ) has already begun easing monetary policy in response to sluggish economic growth, and there is debate over whether they will opt for a 25 or 50 basis point rate cut at the remaining meetings this year.

HSBC Predicting a 50 bps RBNZ Rate Cut

- HSBC advocating for a 0.5% cash rate cut, citing weak demand as the main issue for businesses.

- Q3 Quarterly Survey of Business Opinion (QSBO) highlights ongoing excess capacity and reduced price pressures, with businesses unable to pass on higher input costs to consumers.

- The ‘selected pricing indices’ point to continued disinflation in Q3, indicating that headline CPI inflation is likely back within the RBNZ’s 1-3% target.

Westpac Also Predicting a 50 bps RBNZ Rate Cut

- Westpac NZ lowers its OCR forecast, expecting 50 basis point cuts in October and November, based on controlled inflation (around 2%) and sluggish economic growth.

- The justification for keeping interest rates above neutral is weakening, especially as global central banks adjust policies in response to similar economic conditions.

- The RBNZ is expected to follow suit, especially considering the long gap between meetings from November to February.