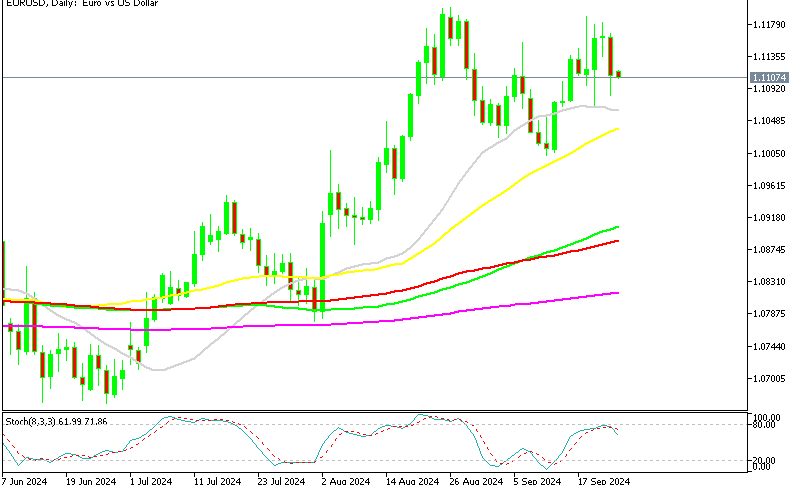

USD Lower as Consumer Reports Show Weakness in September

The USD continues to show weakness, declining further today as the US consumer shows uncertainty, although this comes ahead of the general elections, which is normal. We had two consumer reports today, both of which missed expectations, which gave the USD another push lower.

After the release of weaker-than-expected GDP data, the USD started slipping lower again. The Richmond composite index came in at -21 points, slightly lower than the previous month’s reading of -19 points. Additionally, consumer confidence fell sharply to 98.7 points, down from 105.6 in the prior month and missing the forecast of 104.0 points.

Given the uncertainty surrounding the upcoming election, it’s not surprising that these surveys are showing signs of weakening. Meanwhile, the GBP/USD pair has hit fresh highs as the dollar continues its decline. The DXY index is once again edging toward the 100 level, which served as the rebound point last week.

September Conference Board Consumer Confidence Index

- Registered at 98.7 points (vs. 104.0 points estimated)

- Revised prior month from 103.3 points to 105.6 points

- Present Situation Index:

- Fell to 124.3 points (vs. 134.4 points in August)

- Expectations Index:

- Slightly decreased to 81.7 points (vs. 82.5 points last month)

- Key Insights:

- Consumer confidence dropped sharply, reflecting rising economic concerns

- Present conditions show notable weakening, while future expectations also declined

- Consumer Confidence Decline:

- The headline Consumer Confidence Index dropped significantly in September, falling to 98.7 points, a major miss compared to the estimate of 104.0 points.

- Expectations Index remained at 81.7 points, marking three consecutive months near the 80-point level, which historically signals recession concerns. However, no recession is present at this time.

- Biggest Drop Since 2021:

- The fall in consumer confidence in September was the sharpest since August 2021.

- All five components of the Index declined, indicating broad consumer concerns.

- Labor Market and Economic Sentiment:

- Dana Peterson, chief economist at The Conference Board, noted that while the labor market remains robust—featuring low unemployment, high wages, and limited layoffs—consumer sentiment about the labor market is softening.

- Concerns are rising over fewer work hours, slower payroll growth, and fewer job openings.

- Future Outlook:

- Consumers are increasingly pessimistic about future business conditions and income growth.

- Although the number of consumers believing the economy is in a recession has slightly increased, expectations of a recession in the next 12 months remain relatively low.

GBP/USD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |