CAD to USD Rate Falls to 1.35 Despite Healthy US Services PMI

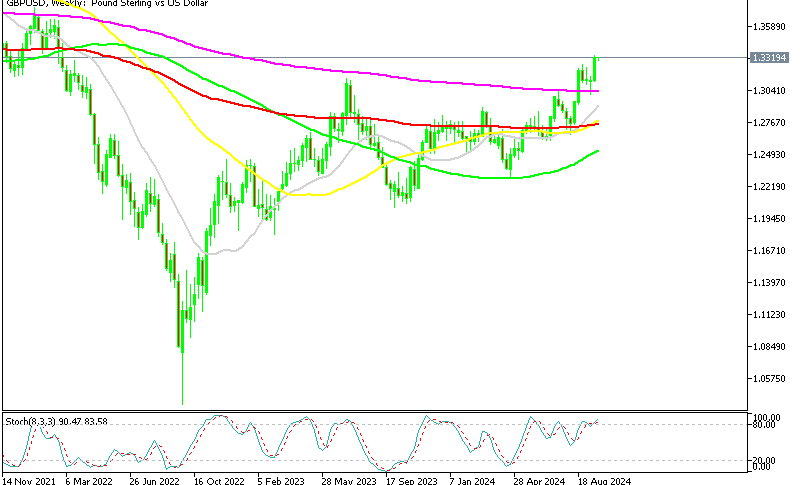

The CAD to USD rate continues to show volatility, as USDCAD slips 80 pips lower, heading for 1.35. US Services PMI for August showed stability in this sector, as it continues to expand at a decent place, however, that is not helping the USD, which is continuing last week’s bearish momentum.

The Canadian dollar (CAD) has been steadily weakening through September, lagging behind other commodity currencies. The USD/CAD pair rose by about 2 cents from its August lows, reaching 1.3647 on Wednesday, shortly after the Federal Reserve’s 50 basis point rate cut. Economic concerns have weighed on the CAD, preventing it from gaining against the USD, even as other risk currencies saw some improvements in recent days.

USD/CAD Chart Daily – The 200 SMA Has Been Broken

However, the CAD has started to recover, surging by 1.5 cents since the FOMC meeting, with USD/CAD now sliding to 1.35. Following the release of the US Services and Manufacturing PMI figures, the market saw another sell-off. The manufacturing sector continued to weaken, falling deeper into contraction, similar to trends in Europe. Despite this, the US services sector remains relatively strong, indicating a healthy performance. However, this resilience in services hasn’t helped the USD, which remains soft in the market.

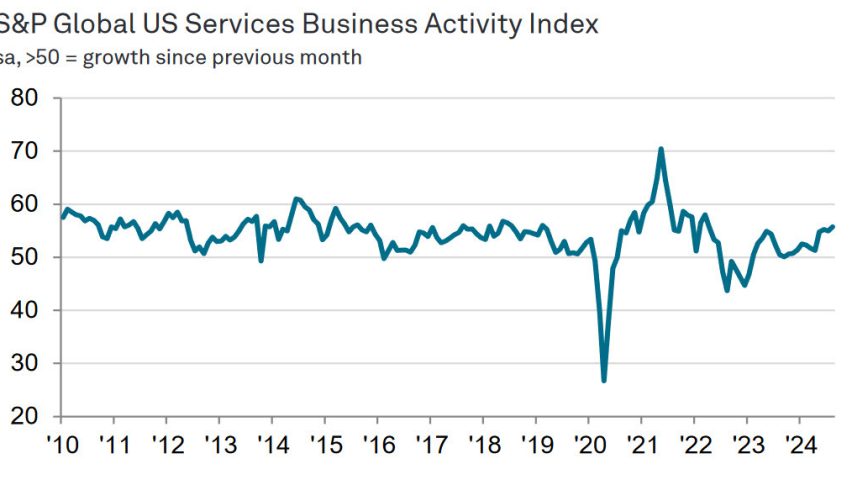

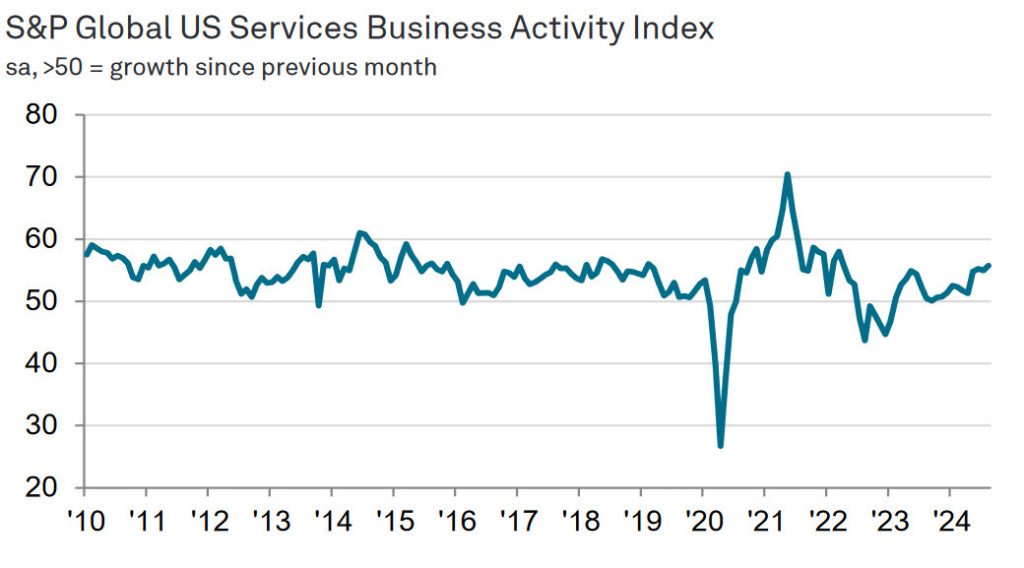

US Services and Manufacturing PMI For August

- US Services PMI (September 2024 Flash):

- Reported at 55.4, slightly above the expected 55.2 but down from the prior 55.7, which had been the highest in two years.

- US Manufacturing PMI:

- Fell to 47.0, below the expected 48.5 and down from the previous 47.9, indicating deeper contraction in manufacturing activity.

- US Composite PMI:

- Registered at 54.4, just below the prior 54.6, reflecting a steady but slightly slowing pace of overall economic activity.

Key Findings:

- Price Inflation:

- The average prices charged for goods and services rose at the fastest pace since March, with selling price inflation hitting six-month highs in both manufacturing and services. Both sectors reported inflation rates above pre-pandemic averages.

- Cost Inflation in Services:

- The service sector saw a one-year high in cost inflation, mainly driven by the need to raise wages for staff.

- Manufacturing Input Costs:

- Input cost growth in manufacturing cooled to a six-month low, signaling some easing in raw material costs.

- Outlook and Optimism:

- Optimism about future output deteriorated significantly, with the future output index reaching its lowest level since October 2022 and the second-lowest since the pandemic began.

- Employment Trends:

- Employment declined for the second consecutive month in September, marking the fourth decline in six months, reflecting the cooling labor market across sectors.

The US flash PMI data for September shows a mixed picture, with the services sector maintaining strong expansion while manufacturing continues to contract. Rising inflation, particularly in services, is being driven by wage pressures, while manufacturing sees a cooling in input costs.

However, optimism for future output has significantly weakened, reflecting growing concerns about economic headwinds. Additionally, the ongoing decline in employment underscores a broader slowdown, raising questions about labor market resilience and overall economic health in the months ahead.

USD/CAD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |