usd-cad

USDCAD Remains Supported at 1.36 After Soft Sales in Canada

Skerdian Meta•Monday, July 15, 2024•2 min read

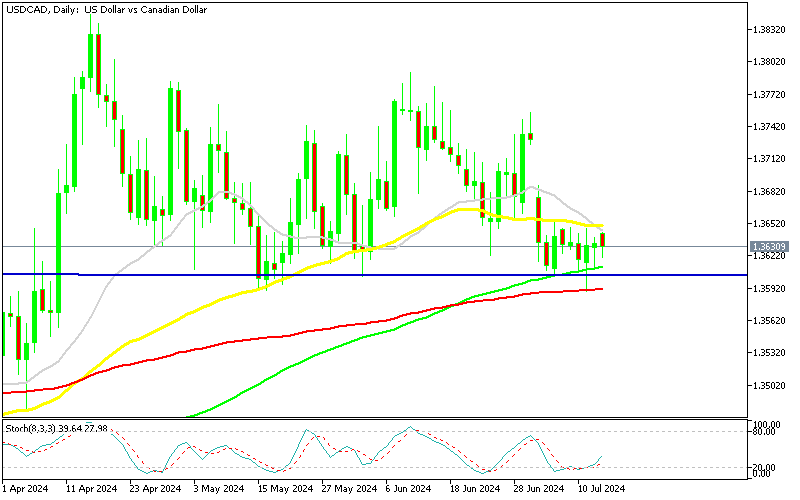

USDCAD has been confined within a 2-cent range for the past two months, after breaching the 1.36 level, which has since become a support zone for the currency pair. This month, the USD has weakened against most major currencies, and USDCAD has been forming lower highs. Nevertheless, support continues to hold above this key level, with moving averages on the daily chart also providing support.

USD/CAD Chart Daily – The 100 SMA Is Holding As Support

In the first quarter of this year, USD/CAD faced resistance at 1.36, but eventually broke through, turning it into a support zone. The trading range expanded by 2 cents, with resistance now around 1.38. This week, the USD declined, pushing USD/CAD to the lower end of the range; however, weak economic data from Canada pressured the CAD, benefiting USD/CAD buyers.

The pair dipped below 1.36 last week following the softer US CPI report, but stronger-than-expected PPI inflation has cast doubt on widespread market speculation that the Federal Reserve will start cutting interest rates at the September meeting, which was initially driven by weaker consumer inflation and a softening labor market. Today we had the Manufacturing and Wholesale Sales report from Canada, both of which were expected to show a slowdown in May.

Canada May Wholesale and Manufacturing Sales

Wholesale Sales

- Actual: -0.8%

- Expected: -0.9%

- Prior: +2.4%

Wholesale sales declined by 0.8%, which was slightly better than the expected drop of 0.9%. However, this marks a significant downturn from the previous month’s increase of 2.4%.

Manufacturing Sales

- Actual: +0.4%

- Expected: +0.2%

- Prior: +1.1%

Manufacturing sales increased by 0.4%, surpassing expectations of a 0.2% rise, though growth slowed compared to the prior month’s 1.1% gain.

Wholesale Inventories

- Inventory Growth: +0.9%

- Inventory-to-Sales Ratio: Increased from 1.53 in April to 1.55 in May

The inventory-to-sales ratio climbed, indicating that inventories are growing faster than sales.

Subsector Performance

Five out of seven wholesale subsectors experienced a reduction in sales. The motor vehicle and motor vehicle parts and accessories subsector saw the largest drop, with a 3.8% decline.

When comparing May of this year to the same month last year, wholesale sales decreased by 0.9%.

Manufacturing Sales Drivers

- Aircraft Product and Components: +11.2%

- Food Products: +1.4%

- Paper Products: +5.5%

Increased output in the aircraft product and components industrial group was the primary driver of manufacturing sales, followed by greater sales in the food and paper product subsectors.

Manufacturing Sales Declines

- Motor Vehicles: -4.2%

- Petroleum and Coal Products: -2.2%

Motor vehicles and petroleum and coal products experienced the largest declines in manufacturing sales.

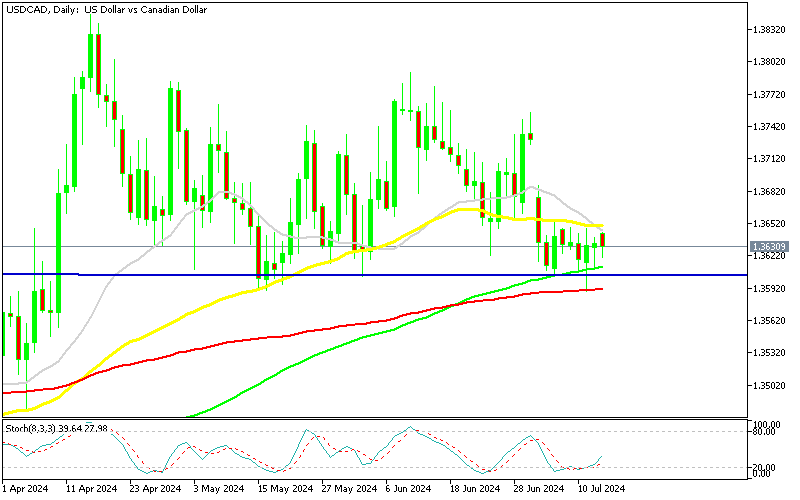

USD/CAD Live Chart

USD/CAD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

23 hours ago

Save

Save

2 days ago

Save

Save

3 days ago

Save

Save