Forex Signals Brief May 30: US GDP and Home Sales on Agenda

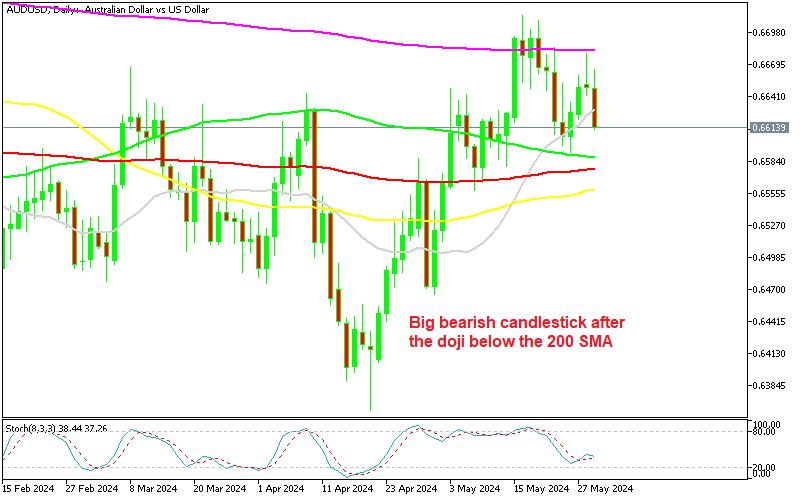

Yesterday started with the inflation report from Australia for April, which came in stronger than expected, but it didn’t help the AUD much. In April, the Australian Consumer Price Index (CPI) registered a year-over-year (y/y) increase of 3.6%, surpassing both the previous reading of 3.5% and the consensus forecast of 3.4%. On a month-over-month (m/m) basis, the CPI grew by 0.76%. Additionally, the trimmed mean CPI, which excludes volatile items, rose to 4.1% y/y from 4.0% in the previous month. Excluding volatile goods and vacation expenses, the CPI remained steady at 4.1% y/y. But, apart from a small reaction the higher numbers didn’t help the Aussie much, which continued down, with AUD/USD falling to 0.66 lows.

The US dollar strengthened in response to the uptick in interest rates. However, the third auction of coupon notes this week saw less-than-optimal demand. The auctions conducted yesterday were for two and five-year notes, while today’s auction focused on the 7-year note. Despite the rise in interest rates, the 10-year yield has not increased by more than 15 basis points this week, while the 2-year yield has risen by three basis points.

Additionally, the Richmond Fed Manufacturing Index improved to 0 from -7 previously, indicating a turnaround in manufacturing sentiment. The Federal Reserve Beige Book suggested a slight tilt towards a slowing economy, but highlighted that growth, employment, and prices are still expanding or rising. This indicates a nuanced view of the economic landscape, with some indicators pointing to moderation while others continue to show resilience.

Today’s Market Expectations

Today we have the Eurozone unemployment rate which is expected to remain steady at 6.5%, maintaining this historically low level for the past year and indicating a tight labor market. In addition, the recent Eurozone Negotiated Wage Growth for Q1 2024 showed an increase compared to the previous quarter. Although the European Central Bank (ECB) downplayed this rise as a one-time event, attributing it to Germany’s delayed wage increases in response to inflation, it nonetheless complicates their outlook. This unexpected wage growth could undermine the ECB’s confidence in pursuing further rate cuts following the anticipated cut in June. Persistent tightness in the labor market and rising wages might fuel inflationary pressures, making it more challenging for the ECB to justify easing monetary policy in the near term.

The US Jobless Claims report is a crucial weekly indicator of the labor market’s health. A weakening labor market could increase the likelihood of achieving the Federal Reserve’s disinflation targets, while a strong employment market could complicate this objective. Currently, Initial Claims are hovering near cycle lows, indicating a robust labor market, while Continuing Claims are stable around the 1,800K level. This week, Initial Claims are forecasted to be 218K, up slightly from the previous 215K. There is no consensus yet on Continuing Claims, but the last report showed a slight increase to 1,794K, compared to the expected 1,794K and the previous 1,786K. These figures suggest that the labor market remains resilient, which might make it more challenging for the Fed to achieve its disinflation goals, as strong employment can exert upward pressure on wages and prices.

Yesterday saw notable price action in the financial markets, with the USD continuing its recovery after Monday’s decline. High volatility persisted until the end of the US session, resulting in numerous trading signals being closed. The day concluded positively with five winning forex signals and two losing ones, reflecting a strong performance amidst the fluctuating market conditions. This indicates that traders were able to capitalize on the volatility and market movements to achieve a net positive outcome.

Gold Returns to the 20 SMA

Over the past two weeks, gold prices have struggled to resume their upward momentum. After reaching a record high of $2,450 on May 20, XAU/USD reversed lower and has since been trading in the lower $2,300s, influenced by global concerns that continue to keep gold traders cautious. Geopolitical tensions, particularly in the Middle East, and increased central bank demand from BRICS countries have significantly bolstered gold’s appeal as a safe-haven asset. In response to heightened sanctions on Russia and Iran, these countries are diversifying their reserves away from the US dollar, further supporting gold. Earlier this week, gold prices were on the rise after finding support at the 20-day Simple Moving Average (SMA). However, they encountered resistance on Wednesday, preventing further gains.

XAU/USD – Daily chart

AUD/USD Heads Below 0.66

Since April, USD/AUD has been in a bullish trend. However, the pair’s failure to surpass the 200-day Simple Moving Average (SMA) on Tuesday led to a negative reversal yesterday. The daily chart indicates that buyers have repeatedly attempted to push the exchange rate above this key technical level but have been unsuccessful, resulting in a decline in price. This was evidenced by a significant bearish candlestick observed yesterday. Despite the announcement of higher-than-expected Australian CPI inflation statistics, which indicated an increase in April, the AUD did not strengthen considerably. This continued weakness can be attributed to a low risk appetite, which has suppressed commodity-linked currencies like the AUD. Additionally, strong US Treasury rates and a robust US dollar have maintained pressure on the AUD, further contributing to its underperformance.

GBP/USD – Daily Chart

Cryptocurrency Update

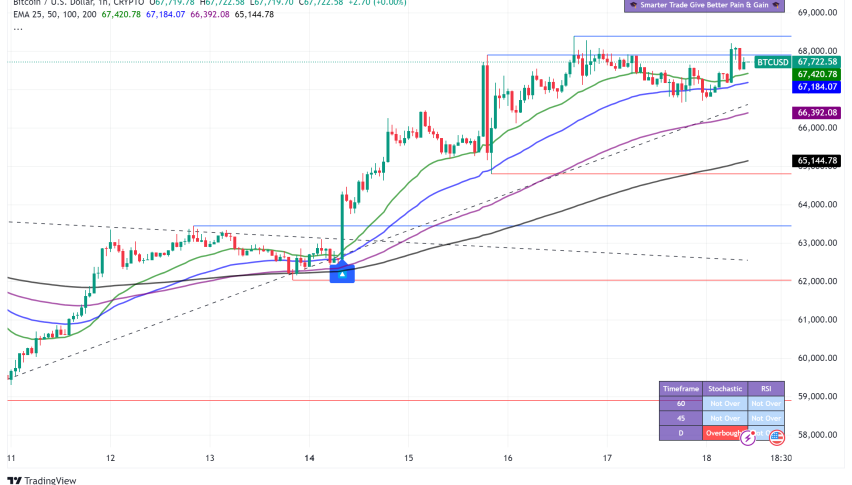

Bitcoin Continues the Consolidation

Bitcoin’s long-term trend remains upward, with the 100-day Simple Moving Average (SMA) acting as a crucial support level. Historically, technical indicators such as the 20-day and 50-day SMAs have moderated Bitcoin’s upward momentum. However, the daily chart indicates that Bitcoin has managed to break through these resistance levels, suggesting that the 50-day SMA is likely to become a new support level. Despite a three-day downturn, Bitcoin resumed its upward trajectory on Monday, breaking the $70,000 milestone. However the price has returned below this major level and is in a consolidating mode.

BTC/USD – Daily chart

Ethereum Within Reach of $4,000

The heightened confidence stemming from the SEC’s more bullish stance on spot Ether ETFs has propelled Ether (ETH) to a new high of $3,832.50. This substantial increase from its previous high of around $3,000 marks a remarkable 25% rise in Ethereum’s value. Capitalizing on this favorable momentum, we closed our buy Ethereum signal at a profit yesterday. The approval of the Ethereum ETF is viewed as a significant milestone, likely facilitating larger institutional investment and broader adoption of Ethereum. This move is expected to enhance market stability and liquidity, further driving prices upward. The current upward trend in Ethereum, fueled by the ETF news, indicates strong market confidence and investor interest. Given this positive environment, the momentum for Ethereum may continue, although traders should remain cautious of potential market corrections. The broader cryptocurrency market could also benefit from this development, as increased institutional interest in Ethereum might spill over into other digital assets, contributing to overall market growth.

ETH/USD – Daily chart