How to Invest in Stocks

Last Update: August 25th, 2025

This is a comprehensive guide on how to invest in stocks. We have researched the process involved with stock investment to give traders a step-by-step guide on how they can start investing in stocks.

How to Invest in Stocks (2026)

- What is Stock Investment?

- Benefits of Stock Investment

- Risks involved in Stock Investment

- Understanding the Stock Market

- How to set your Investment Goals

- The Basics of Stock Research

- Choosing the right Broker Account for Stock Investment

- How to make you First Stock Purchase

- Managing your Stock Portfolio

- The 10 Best Forex Brokers for Stock Investment

Top 10 Forex Brokers (Globally)

10 BEST FOREX BROKERS

| MIN DEPOSIT $100 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $50 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $25 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $200 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $4 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $5 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $0 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $20 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $10 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $1 | SIGN-UP BONUS Yes | Visit Now |

1. What is Stock Investment?

Investing in stocks involves buying company shares, thereby acquiring partial ownership. It allows investors to profit from dividends and stock appreciation linked to a firm’s financial success.

Compared with conventional savings approaches, this form of investment strives for superior returns by taking advantage of global corporate expansion and profitability trends.

However, stock investing can also be risky due to fluctuations in market dynamics and business activities affecting share prices unpredictably.

To engage successfully in the purchase or sale of stocks Investments requires careful analysis, planning as well and risk management strategies that consider long-term wealth creation objectives within personal finance considerations

Therefore, generating income growth opportunities alongside one’s current portfolio holdings is essential.

2. Benefits of Stock Investment

Investors are attracted to the equity markets for many reasons, chiefly the various benefits of investing in stocks. One of the foremost advantages lies in the potential for high profits. Historically, stock market investments have consistently outperformed savings accounts and fixed-income assets such as bonds or bank deposits.

This renders them an enticing alternative for those seeking wealth accumulation and pursuing long-term financial goals like retirement planning.

Moreover, owning shares in a company grants investors ownership stakes, allowing them to reap benefits from earnings through dividends and feel personally involved in the company’s success story. Additionally, liquidity stands as a significant advantage, as stocks offer the flexibility to buy or sell readily on the stock exchange, providing accessibility to cash options while simultaneously minimizing risks.

This is facilitated by the plethora of alternatives available across various sectors, allowing investors to diversify their portfolios effectively and allocate their funds prudently.

Lastly, even novice investors can participate in the equity markets without requiring specialized knowledge. With access to tools and information necessary for informed decision-making, individuals can confidently navigate the complexities of investing.

3. Risks involved with Stock Investment

Investing in stocks can be alluring due to the promise of lucrative profits, but it is important to acknowledge and address potential hazards. Market volatility poses a significant risk as economic shifts, political events, and market sentiment can cause abrupt fluctuations in stock values, resulting in losses for unprepared investors.

Moreover, investing entails taking on the company’s risks, which may involve negative impacts from poor management decisions or industry downturns.

The intricacies of the stock market coupled with information overload lead some individuals towards ill-advised investment choices. At the same time, overconcentration carries an inherent danger when one invests disproportionately in a single entity or sector.

Additional dangers include inflation damage eroding buying power and taxes eating away at dividend returns that further weaken net gain return prospects.

It is essential for anyone who intends to make successful investments via trading shares to take cognizance of these risks while adopting means appropriate enough to manage them suitably before engaging actively within any securities marketplace available anywhere globally.

4. Understanding the Stock Market

The stock market is an intricate system designed to buy and sell publicly listed corporations’ shares using a networked range of platforms where equities are priced, exchanged, and sold throughout trading hours.

It plays a critical role in the world economy by serving as an indicator of economic stability while facilitating wealth transfer and production.

How the Stock Market Works

The foundation of the stock market lies in supply and demand. Companies wishing to enter the public domain offer shares through an initial public offering (IPO), allowing investors to own part.

These stocks are later traded on various exchanges where their price fluctuates based upon how optimistic or pessimistic investors view a company’s outlook, which is influenced by economic indicators, corporate success rates, global affairs, and marketplace tendencies.

Requests for buying/selling shares are handled via brokers using numerous auction models. However, continuous auctions during trading hours are the most commonly used pricing mechanisms.

Types of Stocks Investments: Common vs. Preferred

Two types of stocks exist in the market: common and preferred. Companies frequently issue common stock, granting shareholders voting rights (typically one vote per share) while allowing them to reap benefits from increased stock prices or dividends, which can sometimes be uncertain.

Conversely, with no right to vote under preferred equity comes greater entitlements on earnings and assets wherein they receive additional dividend pay-outs before other investors do and get compensated first upon liquidation of the company’s assets than others would

However, this provides more stable returns over time but carries little potential for higher price appreciation versus regular shares in general.

Major Stock Exchanges to Know

The financial world is abundant with various stock exchanges, providing a means for trading securities. Major players include the New York Stock Exchange (NYSE) and Nasdaq in the United States.

The NYSE ranks as the top dog worldwide concerning market capitalization, housing some of history’s largest corporations, while the Nasdaq shines with its specialty focus on technology and biotech brands.

Additional testament to economic status are other notable names like the London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and Shanghai Stock Exchange (SSE).

These markets function to enable buying/selling shares and enforce guidelines that help stabilize equities-trade levels while securing investors from unfair practices and regulatory breaches.

5. How to Set Your Investment Goals

Having clear and well-defined investment objectives is crucial for achieving success. Understanding your financial status and goals is important to create a plan that aligns with them. Your purpose and destination will guide your investing decisions, whether saving for a new house, securing an education fund for your child, or ensuring retirement comfortability.

In addition, these objectives help navigate through the complexities of various market conditions effectively.

Short-term vs. Long-term Stock Investments

The assets you add to your portfolio can be heavily influenced by the type of investment horizon you choose. Short-term investments typically last for less than five years and are used when investors have short-term financial goals or need fast access to funds.

Although they offer lower returns, money market funds, CDs, and government bonds provide low-risk options that increase liquidity over a shorter timeline.

Contrarily, long-term investments require an investor’s commitment for at least five years to increase returns via compound interest and capital gains through popular stocks, ETFs, or mutual funds selected primarily because they outperform inflation while creating wealth over time.

Distinguishing between these two types will help balance priorities such as rapid access to money versus seeking greater profits in one’s investment journey.

Assessing Your Risk Tolerance

An individual’s capacity to handle market instability and the possibility of financial loss is known as risk tolerance, which can be influenced by factors such as financial position, investment timeline, and personal aversion toward unpredictability.

Evaluating one’s risk preference is significant in establishing investing goals because it determines the type of investments an individual is comfortable pursuing. Investors with high-risk tolerance may opt for stocks or other unstable assets, while those avoiding risks might choose bonds, CDs, or savings accounts instead.

Awareness of your level of comfort with taking risks helps formulate a well-balanced investment strategy capable enough to brave market volatility while staying aligned with your monetary objectives.

Investment Goals and Financial Planning

Incorporating investment objectives into your overall financial planning is a crucial element. It includes evaluating your current economic standing, defining monetary necessities during different stages of life, and devising strategies to accomplish those desires.

This process considers several factors, including revenue inflow, expenditure patterns, debt circumstances, and personal/family objectives.

Successful wealth management stems from goal-setting preceding resource allocation towards suitable investments adapting to future life shifts or market fluctuations.

Therefore, including investing goals in comprehensive financial planning increases prospects for achieving fiscal self-regulation and reliability.

6. The Basics of Stock Research

To make informed investment decisions, conducting thorough research on stocks is crucial. This involves scrutinizing various aspects of a company and the market to forecast its future performance.

Two key methods used are fundamental analysis and technical analysis, which offer different perspectives on stock value.

In addition, staying up-to-date with financial news and reports is vital as they provide insights into broader economic trends that may impact the industry’s developments, impacting stock prices accordingly.

Fundamental Analysis

Fundamental analysis is a systematic approach employed to assess stocks, emphasizing the factors underlying a company’s present operations and future growth potential. This methodology entails a thorough review of financial documents, such as balance sheets, income statements, and cash flow reports, to gauge the overall financial health of a corporation.

Analysts scrutinize various metrics, including profits, revenue streams, profit margins, and returns on equity, to determine whether a stock is overvalued or undervalued.

Furthermore, this type of analysis extends beyond financial metrics to encompass non-financial elements such as evaluations of management team performance, assessments of competitive positioning, and reviews of general industry trends. These determinants are carefully considered before making investment decisions. Unlike short-term traders who focus on quick gains through market speculation, fundamental analysts adopt a longer-term perspective.

Their objective is to allocate investment resources towards stable companies with promising growth prospects, thereby increasing the likelihood of achieving successful returns on investment.

Technical Analysis

On the other hand, technical analysis scrutinizes price variations and trading volumes in the stock market to forecast future trends.

This approach assumes that all pertinent information has already been manifested in share prices, and these figures will continue oscillating predictably till a certain point. Analysts use charts and statistical tools like indicators to detect motifs that may prophesize forthcoming movement.

Some of the popularly used indicators are Moving Averages, Relative Strength Index (RSI), and MACD. Technical analysis is frequently utilized for short-term investment strategies since it concentrates on pricing adjustments instead of fundamental company attributes.

Utilizing Financial News and Reports

In addition to conducting fundamental and technical analyses of stocks, investors must remain abreast of financial news and headlines.

Earnings releases offer valuable insights into a company’s potential profitability, while merger announcements or significant corporate events can profoundly impact stock prices. Furthermore, economic indicators such as inflation rates, employment data, and GDP growth significantly influence market sentiment and investment decisions.

Investors who stay informed about the latest financial news acquire essential background knowledge concerning external factors that could affect future fluctuations within the stock market or the performance of individual stocks in their portfolios.

With this awareness, investors can adjust their investment plans accordingly, enabling them to anticipate changes in the business landscape and proactively make more informed investment decisions.

7. Choosing the Right Broker Account for Stock Investment

Selecting an appropriate brokerage account holds a significant weightage for all investors, as it lays the foundation to purchase and sell stocks and other assets. Your choice of brokerage can direct your investment strategy, costs involved, accessibility to resources, and support available.

To ensure that you make a wise decision aligning with your objectives and investment preferences, gaining knowledge about different types of brokerage accounts and their associated fees is crucial.

Types of Brokerage Accounts

Two main types of brokerage accounts are available: full-service and discount brokerages. Full-service options offer various financial services, including investment advice, portfolio management, and financial planning.

Typically, these come with personalized suggestions from experienced advisors, making them ideal for clients who prefer not to be hands-on or require comprehensive guidance. However, they involve higher fees in the form of commissions, etc.

Discount brokers may suit you better if you are looking for reduced costs but less personal attention when stock investing.

These provide online platforms allowing investors to conduct their research, handle money management, and make trades independently, making this method more appropriate for portfolio managers seeking autonomy over investments.

Fees and Commissions to Consider

Understanding brokerage cost structures is crucial to optimizing investment returns. Brokerages levy different fees, including account management, transaction fees, and trading commissions.

Select brokerages also offer commission-free trades for stocks and ETFs, thus reducing costs significantly, especially for active investors.

Examination of mutual funds and ETFs expense ratios alongside penalties such as minimum balance requirements or any other activity restrictions must be considered before settling with a particular firm.

To minimize high expenses that could ultimately impact your profit margins, assess several brokers’ fee models against your unique trading frequency combined with the suitable investing strategy you have adopted.

How to Open a Brokerage Account

Establishing a brokerage account is a simple process that can be done online. Initially, choose a broker whose investment objectives align with yours, provide personal details, and consider factors like prior experience, risk tolerance, and financial goals.

Brokers usually require terms and conditions and a minimum deposit before trading. Traders can maximize this opportunity by researching platforms and using educational resources.

8. How to Make Your First Stock Purchase

Purchasing your first stock is a significant achievement in the financial markets.

It involves selecting the right stock and making informed decisions. This solid foundation for successful investment planning is established during these early stages.

How to Place an Order

To buy stocks through a brokerage account, research and analyze the stock to align with your investment goals and risk tolerance. Log in, input details, and verify accuracy to ensure smooth execution.

Monitor trade proceedings and price changes frequently to avoid significant impact on transaction outcomes.

Understanding Market Orders vs. Limit Orders

Stock orders can be made using market or limit orders. Market orders allow immediate purchase or sale at current market prices but do not guarantee execution at desired price points.

Limit orders specify specific buy/sell prices but may prevent actualization due to volatile markets. Proper knowledge and implementation of these strategies can lead to trading success and minimize risks.

Diversifying Your Portfolio

Diversification is a crucial investing strategy to reduce the impact of poor performance from a single investment on your overall portfolio.

It involves investing in equities across various industries, geographies, and asset classes and using mutual and exchange-traded funds to spread investments across multiple markets. This strategy reduces risk and ensures stable returns.

9. Managing Your Stock Portfolio

Investing in stocks requires continuous asset management, including selecting suitable stocks, monitoring their performance, deciding when to sell them, and understanding when adjustments are necessary to rebalance toward financial objectives and risk tolerance levels.

These fundamentals are crucial for establishing a strong investment collection and achieving long-term success in the stock market.

Monitoring Your Investments

Regularly monitoring your assets is crucial for staying informed about investment performance and market trends. This involves observing company performance, major advancements, and macroeconomic changes. It is also important to monitor future outcomes and trading situations.

Engaging regularly allows you to make critical decisions and adjust your portfolio accordingly, avoiding hasty reactions based on temporary market shifts.

When to Sell Your Invested Stock

Portfolio management involves making strategic decisions about when to sell equities, including cashing in on assets that have met or exceeded target prices, minimizing losses from poorly performing equities, and rebalancing the portfolio.

Selling may occur when a company’s financial situation deteriorates, or other investment opportunities become more attractive.

During market uncertainty or volatility, systematic criteria-based actions are crucial. Automated processes like stop-loss orders can limit bias and streamline decision-making, enhancing profit margins through consistent returns over time.

Rebalancing Your Portfolio

Rebalancing is the process of adjusting the weights of assets in a portfolio to align with an investor’s investment plan and risk tolerance. It involves selling assets that have grown too much and buying underrepresented ones, reducing risk and increasing profits.

The frequency depends on investment strategies and market conditions, but it is generally recommended to reassess portfolio allocation at least once a year or after significant market fluctuations. This ensures long-term financial security.

The 10 Best Forex Brokers for Stock Investments (2026)

- IG – Overall, The Best Forex Broker for Stock Investment

- Saxo Bank – competitive pricing, for stocks and ETFs

- Interactive Brokers – $0 commissions on many trades

- eToro – Access to a variety of assets, including stocks

- FP Markets – Regulated by several top-tier authorities

- AvaTrade – Educational Resources and Market Analysis

- XM – Fast execution, and a wide range of account types

- FxPro – Robust educational resources

- IC Markets – Raw spreads from 0.0 pips

- XTB – user-friendly trading platform, xStation 5

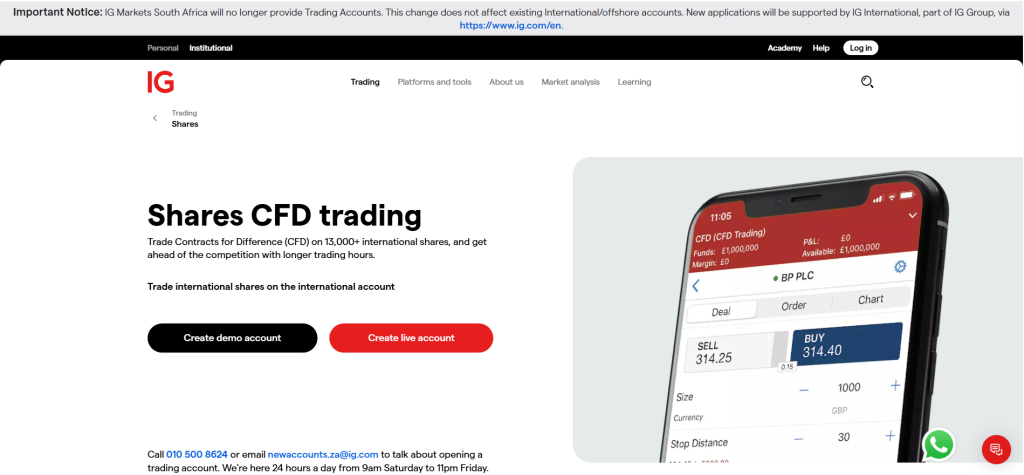

1. IG

IG is a globally regulated broker offering access to stocks, forex, commodities, and indices. Known for competitive pricing, advanced trading tools, and strong research, IG caters to both beginners and professionals seeking diverse stock trading opportunities.

Frequently Asked Questions

What markets can I trade with IG?

IG offers a wide range of markets for trading, including over 17,000 financial instruments. These include forex, indices, shares, commodities, cryptocurrencies, bonds, and other instruments available for spread betting and CFDs.

Does IG charge commissions?

IG charges commissions on certain trades, primarily on shares and ETFs. For other markets like forex, indices, and commodities, IG typically charges a spread rather than a separate commission fee.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Extensive Regulation & Reputation | Variable Fees & Inactivity Charges |

| Vast Market Access | No Swap-Free (Islamic) Accounts |

| Advanced and Selective Platform Support | Market-Maker Execution Model with Conflicts |

| Strong Educational & Research Tools | Occasional Platform & System Issues |

| Competitive Spreads & Fees | Complex Fee Structure |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an authorized and highly regulated global broker offering access to thousands of markets, competitive spreads, and advanced tools. While fees can vary, its strong reputation and extensive resources make it a trusted choice for diverse traders.

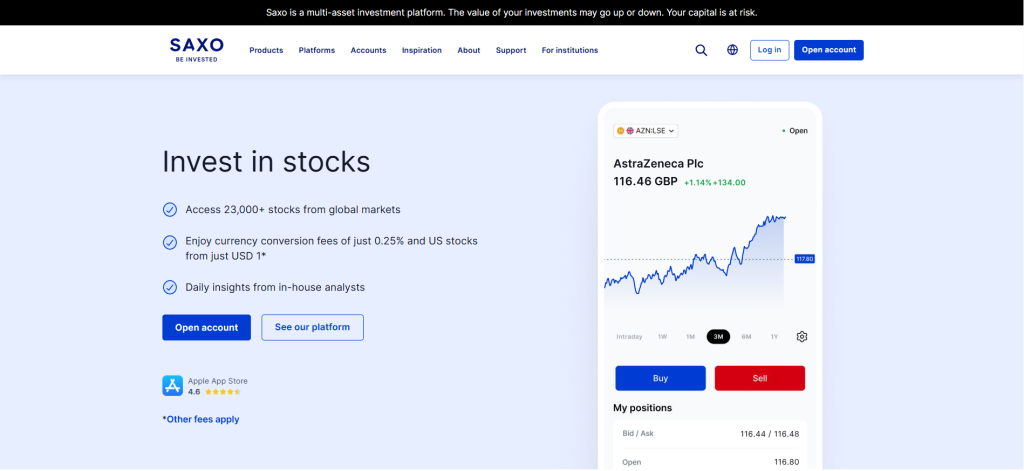

2. Saxo Bank

Saxo Bank is a Danish-regulated investment bank (est. 1992), offering access to over 70,000 instruments, including stocks, ETFs, forex, and CFDs via its proprietary platforms like SaxoTraderGO and SaxoTraderPRO.

Frequently Asked Questions

Does Saxo Bank offer stock trading?

Yes, Saxo Bank offers extensive stock trading. You can access over 23,000 global stocks from more than 36 exchanges, allowing for a wide variety of investment opportunities from a single account.

What trading platforms does Saxo Bank have?

Saxo Bank offers two primary platforms: the SaxoTraderGO web-based and mobile platform for simplified trading and SaxoTraderPRO, a fully customizable, advanced desktop platform for professional traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly regulated | High Fees for Smaller Portfolios |

| Wide range of instruments | Complex Platform for Beginners |

| Professional-grade trading platforms | Lack of Fractional Shares |

| Strong investor protection schemes | Inactivity fees may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Saxo Bank is a legit, multi-regulated broker offering a vast range of stocks, forex, and CFDs with advanced trading platforms. It’s ideal for experienced traders seeking global market access, robust security, and professional-grade tools.

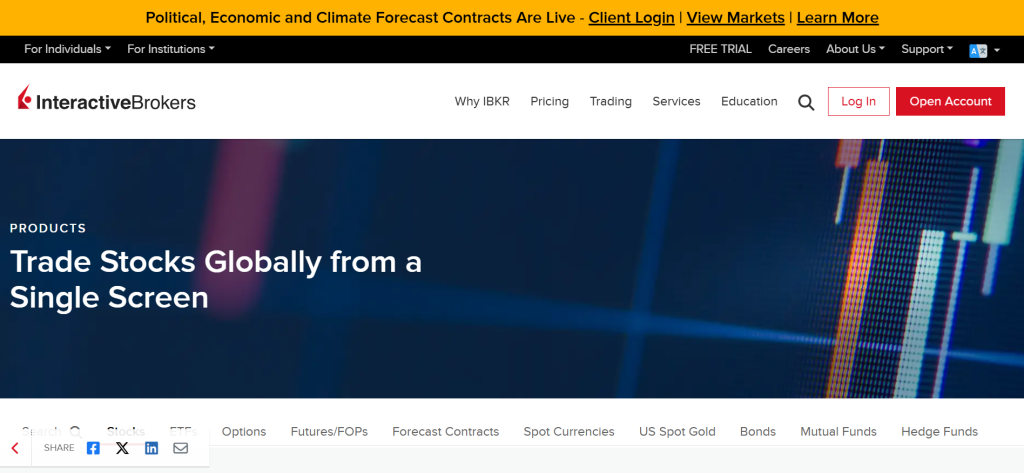

3. Interactive Brokers

Interactive Brokers (IBKR) is a reputable, globally regulated broker (licensed by authorities including the SEC, FINRA, MAS, and IIROC) that features no minimum deposit requirement, commission-free or low-cost stock trading, access to over 90 global markets, fractional shares, and advanced tools such as Risk Navigator and SmartRouting.

Frequently Asked Questions

Does Interactive Brokers have a minimum deposit?

Interactive Brokers does not have a minimum deposit to open a standard cash account. However, a minimum deposit of $2,000 is required for a margin account. Other account types and certain professional accounts may also have minimum funding requirements.

Can I trade stocks with Interactive Brokers?

Yes, you can. Interactive Brokers offers extensive stock trading across over 150 exchanges in 33 countries. You can access a wide range of global stocks and even trade fractional shares of US and European equities.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Globally regulated | Platforms can be complex for beginners |

| $0 minimum deposit | No MT4/MT5 support |

| Very low trading fees and tight spreads | Inactivity fees for certain accounts |

| Huge range of instruments | Limited leverage for retail clients due to regulations |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is a highly legal and trustworthy trading platform, offering access to global stocks, forex, and more. With strong regulation, low fees, and advanced tools, it suits both professional and active traders worldwide.

Top 3 Forex Brokers for Stock Investments – IG vs Saxo Bank vs Interactive Brokers

4. eToro

eToro is a globally regulated, multi-asset broker best known for commission-free stock trading and social investing features. It offers access to thousands of stocks from global markets, enabling both beginners and experienced traders to invest easily.

Frequently Asked Questions

Does eToro charge commissions on stocks?

eToro’s stock trading is generally commission-free. However, for certain regions and stock exchanges, a flat commission fee of $1 or $2 per trade may be applied when you open or close a position.

Can I trade cryptocurrencies on eToro?

Yes, eToro supports cryptocurrency trading. You can buy and hold the underlying cryptoassets directly or trade them as CFDs, depending on your location and the asset. They offer over 140 cryptoassets, including popular ones like Bitcoin and Ethereum.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong multi jurisdiction regulation | No Islamic/swap-free account option |

| Zero-commission real stock investing | Higher spreads |

| User-friendly platform with social trading features | Limited leverage |

| Wide asset range | No MT4 or MT5 platform support |

| Negative balance protection and segregated client funds | Overnight swap fees on leveraged positions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is an approved, globally regulated broker offering commission-free stock investing, social trading, and diverse CFDs. While spreads are slightly higher and MT4 is unavailable, its user-friendly approach makes it attractive for beginners and experienced traders alike.

5. FP Markets

FP Markets, established in 2005 in Australia, is a regulated multi-asset CFD broker providing access to more than 10,000 stocks through both stock CFDs and direct share trading. Its platforms include IRESS, MT5, MT4, and cTrader, supporting major global exchanges such as ASX, NASDAQ, NYSE, and LSE.

Frequently Asked Questions

Does FP Markets offer stock trading?

Yes, FP Markets offers extensive stock trading, but exclusively through Contracts for Difference (CFDs). This allows you to speculate on price movements of over 10,000 global shares without owning the underlying asset, available on both MT4 and MT5.

What types of accounts does FP Markets offer?

FP Markets offers three main account types: Standard, Raw, and IRESS. The Standard account is commission-free with wider spreads, while the Raw account features raw spreads and a commission. The IRESS account is for share CFDs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight spreads from 0.0 pips on Raw accounts. | Swap fees apply to overnight positions |

| Regulated in multiple jurisdictions | Limited educational resources |

| Wide range of instruments and trading platforms. | IRESS platform has higher costs and deposit requirements |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a globally trusted and registered broker, offering competitive spreads, diverse platforms, and extensive CFD instruments. With strong regulation and robust trading conditions, it appeals to both beginner and professional traders worldwide.

6. AvaTrade

AvaTrade is a globally regulated online broker offering forex, CFDs, and stock trading. It provides access to major global stocks via CFDs, competitive spreads, and user-friendly platforms, catering to both beginners and experienced traders.

Frequently Asked Questions

Is AvaTrade authorized and regulated?

Yes, AvaTrade is a highly regulated broker. It holds licenses from multiple top-tier financial authorities globally, including the Central Bank of Ireland, ASIC in Australia, the FSCA in South Africa, and the FSA in Japan.

What is the minimum deposit for AvaTrade?

The minimum deposit at AvaTrade is $100 for credit card and e-wallet deposits, and $500 for wire transfers. However, to access the full range of products, they recommend a starting balance of $1,000 to $2,000.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and authorized | Inactivity fee charged after 3 months |

| Wide range of trading platforms | Limited product range |

| Commission-free trading | Spreads on some assets can be higher than competitors |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorized and well-regulated broker offering secure trading, multiple platforms, and commission-free pricing. While some fees and spreads could be better, it remains a reliable choice for both beginners and experienced traders globally.

7. XM

XM is a globally recognized, regulated forex and CFD broker offering over 1,000 instruments, including currencies, commodities, indices, cryptocurrencies, and stocks. It provides commission-free trading, multiple platforms (MT4/MT5), negative balance protection, and low minimum deposits.

Frequently Asked Questions

Is XM a legit broker?

Yes, XM is considered a legitimate broker. It is regulated by several financial authorities globally, including the FSCA in South Africa, CySEC in Cyprus, and ASIC in Australia. Client funds are also held in segregated accounts for security.

What is XM’s minimum deposit?

XM’s minimum deposit is very low, starting at just $5 for most of its account types, including the Standard and Micro accounts. However, the Shares Account requires a much higher minimum deposit of $10,000.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated in multiple jurisdictions | Inactivity fee after 90 days |

| Low minimum deposit | Very high leverage only for certain jurisdictions |

| Over 1,000 CFDs including 600+ stocks | Limited non-CFD assets compared to some brokers |

Final Sore

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legit, well-regulated broker offering low entry costs, a wide range of CFDs including stocks, and solid client protections. While leverage and asset range vary by region, it remains a trusted global trading platform.

8. FxPro

FXPro is a globally regulated forex and CFD broker offering over 2,100 instruments, including forex, commodities, indices, futures, cryptocurrencies, and stocks. It provides multiple platforms (MT4, MT5, cTrader, FxPro App), competitive pricing, and strong client fund protection.

Frequently Asked Questions

Is FxPro a legal broker?

Yes, FxPro is a legal and highly regulated broker. It operates under strict oversight from multiple top-tier financial authorities globally, including the FCA in the UK, CySEC in Cyprus, and the FSCA in South Africa.

Does FxPro charge commissions?

FxPro’s commission structure depends on the account type. Their Standard and FxPro MT4 accounts are commission-free, with costs built into the spread. The cTrader and Raw+ accounts, however, offer tighter spreads in exchange for a commission fee.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated in multiple jurisdictions | Higher minimum deposit for Raw+/Pro accounts |

| Over 2,100 CFD instruments, including stocks | Professional leverage (up to 1:10,000) carries high risk |

| Multiple platforms | Inactivity fees apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is a legal, multi-regulated broker offering a wide range of CFDs, strong safety measures, and multiple platforms. While some account types require higher deposits, it remains a solid choice for both retail and professional traders.

9. IC Markets

IC Markets is a globally regulated forex and CFD broker offering over 2,200 instruments, including forex, commodities, indices, cryptocurrencies, and stocks. It provides ultra-low spreads, fast execution, multiple platforms (MT4, MT5, cTrader), and strong client fund protection.

Frequently Asked Questions

What is the minimum deposit for IC Markets?

The minimum deposit for IC Markets is $200 for all account types, including the Standard and Raw Spread accounts. This deposit is required to activate and begin trading on a live account.

Is IC Markets an approved broker?

Yes, IC Markets is an approved broker regulated by several top-tier global authorities, including ASIC, CySEC, and the FSA. Although it is not regulated by the FSCA in South Africa, it is considered a safe broker to use.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated in multiple jurisdictions | No official investor compensation in ASIC/FSA jurisdictions |

| Very low spreads from 0.0 pips | Minimum deposit of USD 200 may be higher than some brokers |

| Over 2,300 CFDs, including stocks | Limited educational resources |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is an approved, multi-regulated broker offering ultra-low spreads, fast execution, and a wide range of CFDs including stocks. While investor protection varies by region, it remains a top choice for cost-conscious and active traders.

10. XTB

XTB is a globally regulated forex and CFD broker offering over 2,100 instruments, including forex, commodities, indices, cryptocurrencies, ETFs, and stocks. It provides commission-free stock and ETF CFDs, competitive spreads, advanced xStation platforms, and strong client fund protection.

Frequently Asked Questions

Is XTB a registered broker?

Yes, XTB is a registered broker. It is regulated by several top-tier financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, the Polish Financial Supervision Authority (KNF), and the Financial Sector Conduct Authority (FSCA) in South Africa.

Does XTB offer real stocks?

Yes, XTB offers both real stocks and CFDs on stocks. You can invest in over 6,100 real stocks from 14 global exchanges with zero commission for monthly turnovers up to €100,000.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and widely approved across multiple jurisdictions. | Currency conversion fees |

| Offers real stocks and ETFs alongside CFDs | Platform may be less intuitive for beginners |

| Highly competitive spreads and transparent, mostly commission-free fee structure. | Maintenance downtime can impact trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is a registered and globally regulated broker providing forex, stocks, ETFs, and CFDs with competitive spreads and strong client protection. It caters to both beginners and professionals, offering user-friendly platforms and commission-free real stock trading options.

Criteria for Choosing a Forex Broker for Stock Investments

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is regulated by a reputable authority to guarantee security of funds. | ⭐⭐⭐⭐⭐ |

| Stock Range | Variety and number of stocks available for trading, including global markets. | ⭐⭐⭐⭐⭐ |

| Trading Costs | Includes spreads, commissions, and overnight swap fees for stock positions. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Quality, speed, and reliability of the platform, plus charting and research tools. | ⭐⭐⭐⭐☆ |

| Leverage Options | Availability of flexible leverage for stock CFDs, keeping risk in mind. | ⭐⭐⭐☆☆ |

| Order Execution Speed | Fast and reliable order execution to avoid slippage in volatile stock markets. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal | Easy, secure, and low cost payment methods with quick processing times. | ⭐⭐⭐⭐☆ |

| Customer Support | Availability of responsive, multi language support for resolving issues quickly. | ⭐⭐⭐⭐☆ |

| Educational Resources | Quality of learning materials and stock trading guides for all levels. | ⭐⭐⭐☆☆ |

| Investor Protection | Segregated accounts, compensation schemes, and negative balance protection. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers for Stock Investments – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From where to start to what type of stocks beginners should invest in, we provide straightforward answers to help you understand stock investments and choose the right broker confidently.

Q: How do I start investing in stocks with little money? – Sarah J.

A: You can start with small amounts by using brokerage platforms that allow fractional shares or low minimum deposits. Begin by setting clear goals and choosing stable stocks or ETFs to minimize risk.

Q: What types of stocks should beginners consider? – Mike L.

A: Beginners should focus on blue-chip stocks, dividend-paying stocks, and ETFs. These options tend to be more stable and provide steady growth over time. Avoid highly volatile stocks when starting out.

Q: How important is diversification in stock investing? – Priya K.

A: Diversification is crucial as it spreads risk across different sectors and companies, reducing the impact if one stock performs poorly. Investing in index funds or ETFs is an easy way to diversify.

Q: How do I choose a reliable broker for stock trading? – James T.

A: Look for brokers regulated by reputable authorities, with low fees, good customer service, and easy-to-use trading platforms. Reading reviews and using demo accounts can help assess suitability before investing real money.

Q: What are dividend stocks, and should I invest in them? – Linda M.

A: Dividend stocks belong to companies that regularly pay a portion of profits to shareholders. They provide a steady income stream and can be reinvested to grow your investment, making them a good choice for long-term investors.

Pros and Cons

| ✓ Pros | ✕ Cons |

| High Growth Potential | Market Volatility |

| Ownership in Companies | Risk of Loss |

| Liquidity | Requires Knowledge & Research |

| Diversification Opportunities | Emotional Decisions |

| Dividends | No Guaranteed Income |

You Might also Like:

- IG Review

- Saxo Bank Review

- Interactive Brokers Review

- eToro Review

- FP Markets Review

- AvaTrade Review

- XM Review

- FxPro Review

- IC Markets Review

- XTB Review

In Conclusion

Investing in stocks offers beginners a chance to grow wealth, but it requires patience, research, and risk awareness. With the right strategy and discipline, stock investing can be a smart way to achieve long-term financial goals.

Frequently Asked Questions

What’s the difference between short-term and long-term investing?

A key difference is the time horizon. Short-term investing focuses on gains within a few months to a year, often using technical analysis. Long-term investing holds assets for years or decades, prioritizing fundamental analysis and growth.

Do I need a broker to invest in stocks?

Yes, you do. A broker acts as an intermediary, giving you access to financial markets and exchanges where you can buy and sell stocks. Without a broker, you cannot place trades directly.

What risks are involved in stock investing?

The main risks include market risk (value declines due to overall market downturns), company-specific risk (a single company’s poor performance), and liquidity risk (difficulty selling shares quickly), which can lead to capital loss.

Can beginners invest in stocks safely?

Yes, beginners can invest safely by starting small, diversifying their portfolio to spread risk, and focusing on a long-term strategy rather than on speculative, short-term trading for quick gains.

Is stock investing better than saving money in the bank?

Stock investing offers the potential for much higher returns than a bank account but involves significant risk of losing capital. Saving in a bank is low-risk, secure, and provides guaranteed, albeit very low, returns.