EUR/USD Recovers in Asian Trade, Awaits US Data Amid Fed Signals

In the Asian trading hours on Tuesday, the EUR/USD pair halted its four-day downtrend, finding support from a revitalized US Dollar (USD). The major currency pair witnessed a modest uptick, trading around 1.0840 with a 0.05% gain for the session.

Monday’s report from the US Census Bureau indicated a sharp 3.6% month-over-month decrease in US factory orders for October, a significant reversal from the 2.3% increase previously noted. Additionally, Friday’s data from the Institute for Supply Management (ISM) revealed that the US ISM Manufacturing PMI held steady at 46.7 in November, failing to meet expectations.

Federal Reserve Chair Jerome Powell recently confirmed that the current US monetary policy is intentionally slowing down the economy, with interest rates reaching a level considered to be restrictive. Despite Powell’s readiness to further tighten monetary policy if required, market sentiment suggests the end of the rate-hiking cycle, applying downward pressure on the US Dollar.

In Europe, the focus returns to the European Central Bank’s (ECB) inflation target of 2%, which is in the spotlight after a period of heightened inflation. ECB Vice President Luis de Guindos remarked that while the latest inflation figures are encouraging, it’s premature to declare a victory, highlighting a data-dependent approach to future monetary policy.

Market participants are looking forward to the release of the ISM Services PMI and JOLTS Job Openings data due later Tuesday. Additionally, Wednesday’s ADP report and Friday’s much-anticipated Nonfarm Payroll (NFP) report, expected to show 180K new jobs, will provide further direction for the currency pair.

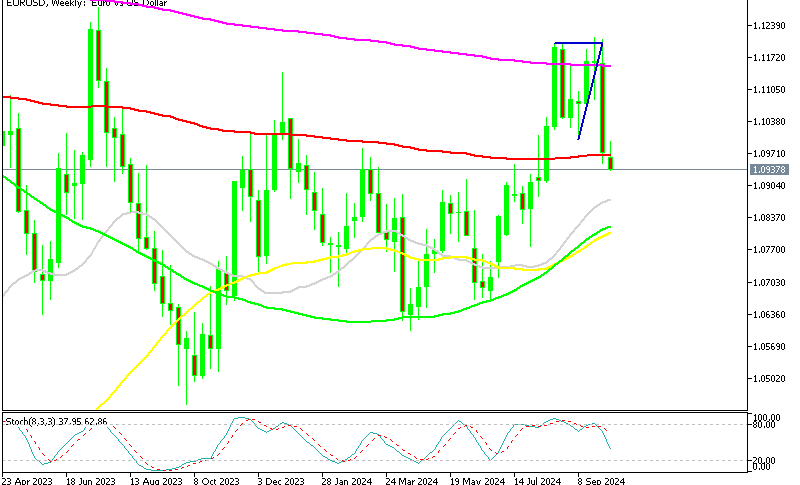

From a technical standpoint, EUR/USD’s break below the 1.0860 level has initiated a bearish movement, with immediate objectives beginning at the 1.0760 support. The 50-day EMA continues to exert downward pressure, suggesting a continuation of the decline.

From a technical standpoint, EUR/USD’s break below the 1.0860 level has initiated a bearish movement, with immediate objectives beginning at the 1.0760 support. The 50-day EMA continues to exert downward pressure, suggesting a continuation of the decline.

A breach of the 1.0760 support could lead to a resumption of the primary bearish trend, whereas a move above 1.0860 would alleviate the bearish pressure and may prompt a corrective rally.

Today’s expected trading range lies between the 1.0750 support level and the 1.0900 resistance, with the day’s trend projected to remain bearish.