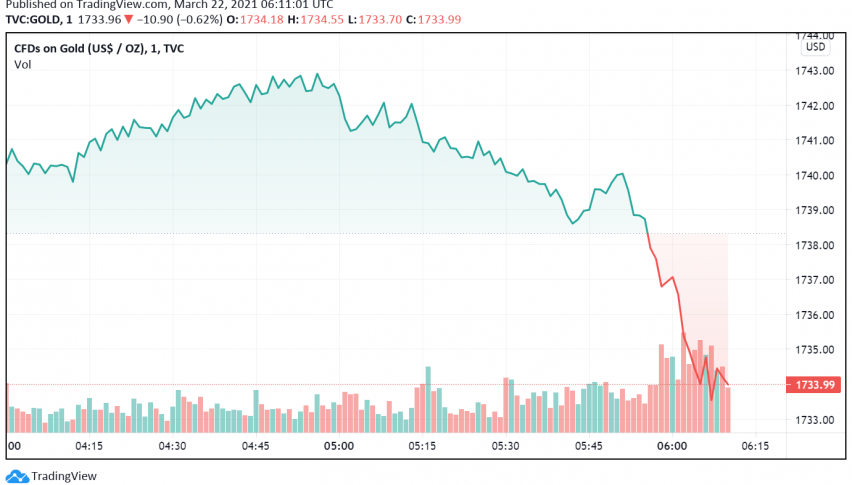

Gold Trades Bearish as Developments in Turkey Strengthen USD

At the start of a brand new trading week, gold prices are sliding lower as investors move towards the US dollar in response to Turkish president sacking the country’s hawkish central bank governor over the weekend. At the time of writing, GOLD is trading at a little above $1,733.

In response to the latest in a round of several rate hikes through his tenure, the previous central bank governor Naci Agbal was replaced via a decree of President Erdogan on Saturday. In his place, he appointed Sahap Kavcioglu, a legislator from the ruling party and a critic of high interest rates.

This sudden and unexpected development sent global markets into a risk-off mood, driving investors away from riskier instruments and towards the safety of currencies like the US dollar and Japanese yen. As we know, gold shares a negative correlation with the dollar, as a stronger greenback makes it more expensive for holders of other currencies to invest in the yellow metal.

Gold has also been trading bearish in the past few sessions on the back of a strengthening in US Treasury yields which hike the opportunity cost of holding non-yielding bullion. A dovish Fed and expectations for stronger economic recovery in the US have sent the benchmark 10-year US Treasury yields to an over one-year high, putting pressure on the yellow metal lately.