10 Best Forex Trading Platforms

The 10 Best Forex Trading Platforms evealed. We have researched and tested several forex trading platforms, from third-party providers to brokers’ proprietary software, to find the 10 Best Forex Trading Platforms.

In this in-depth guide, you’ll learn:

- What is a Forex Trading Platform?

- What are the 10 Best Forex Trading Platforms?

- How to choose the best Forex trading platform.

- Tips for Getting Started with a Forex Trading Platform.

- Are there good forex trading platforms for beginners?

- Popular FAQs about the 10 Best Forex Trading Platforms

And lots more…

So, if you’re ready to go “all in” with the 10 Best Forex Trading Platforms…

Let’s dive right in…

What is a Forex Trading Platform?

A Forex trading platform is a software application that enables traders to access the foreign exchange market, execute trades, analyze market data, and manage their trading accounts efficiently.

Best Forex Trading Platforms – Comparison

| 🔎 Platform | ⬇️ Open an Account | ➡️ Broker with Platform | 🖥️ Windows / Mac Compatible | 💻 Android / IOS Compatible |

| 1. AvaTrade Web | Open Account | 🥇 AvaTrade | ✅ Yes | ☑️ Yes |

| 2. ProRealTime | Open Account | 🥈 Saxo Bank | ☑️ Yes | ✅ Yes |

| 3. MetaTrader 4 | Open Account | 🥉 Pepperstone | ✅ Yes | ☑️ Yes |

| 4. NinjaTrader | Open Account | Interactive Brokers | ☑️ Yes | ✅ Yes |

| 5. cTrader | Open Account | FP Markets | ✅ Yes | ☑️ Yes |

| 6. MetaTrader 5 | Open Account | XM | ☑️ Yes | ✅ Yes |

| 7. TradingView | Open Account | Activtrades | ✅ Yes | ☑️ Yes |

| 8. Interactive Brokers Trader Workstation | Open Account | Interactive Brokers | ☑️ Yes | ✅ Yes |

| 9. SaxoTraderGO | Open Account | Saxo Bank | ✅ Yes | ☑️ Yes |

| 10. CMC Markets Next Generation | Open Account | CMC Markets | ☑️ Yes | ✅ Yes |

10 Best Forex Trading Platforms (2024*)

- ✔️AvaTrade Web – Overall Best Forex Trading Platform

- ✔️ProRealTime – Tailored for Traders who Prioritize Comprehensive Charting

- ✔️MetaTrader 4 – Incorporates a Comprehensive Array of Technical Indicators

- ✔️NinjaTrader – Offers a Versatile and Personalized Platform

- ✔️cTrader – Provides a Seamless and Engaging Trading Experience

- ✔️MetaTrader 5 – Features a Contemporary Interface

- ✔️TradingView – Well-known for its Excellent Charting Abilities

- ✔️Interactive Brokers Trader Workstation – Tailored to cater to the Needs of Professional Traders

- ✔️SaxoTraderGO – Its Design Emphasizes Simplicity

- ✔️CMC Markets Next Generation – Developed with the Contemporary Trader in Consideration

1. AvaTrade Web

User Interface and Experience

AvaTrade’s web interface is a user-friendly tool for traders. It focuses on data and easy market navigation.

Overall, its layout is designed to minimize visual complexity, and it (transition showing addition) offers customizable features for personal workspaces, demonstrating AvaTrade‘s commitment to user-centric design principles.

Technical Indicators and Analysis Tools

Moreover, the AvaTrade Web interface offers a distinct advantage to professionals who rely on technical analysis in their trading approach.

This is due to its expansive collection of sophisticated indicators and analytical tools, which enable users to delve deeply into market trends and make well-informed decisions accordingly.

Additionally, the platform boasts numerous charting functions that provide traders with enhanced visibility over key market patterns.

Order Execution Speed

AvaTrade has established a reputable status for its expeditious order execution, an imperative factor in the rapidly evolving Forex market.

This prompt responsiveness ensures traders can effectively capitalize on market fluctuations as they transpire, mitigating slippage and augmenting potential earnings.

Mobile Trading Support

In addition, AvaTrade Web’s mobile trading capability guarantees that traders are not tied to their computers. The mobile app replicates the online platform’s efficiency, providing a seamless transition between devices.

Pros and Cons

✔️ Pros ❌ Cons Fast order execution reduces slippage Users' customizing possibilities might be restricted compared to desktop programs User-friendly interface appropriate for traders of all levels Professional traders may want more sophisticated features User-friendly interface appropriate for traders of all levels

2. ProRealTime

User Interface and Experience

Overall, the interface of ProRealTime exemplifies a fusion of elegance and practicality, tailored for traders who prioritize comprehensive charting and the availability of diverse technical analysis instruments. This platform represents an avant-garde solution that retains user-friendliness despite its potency.

Technical Indicators and Analysis Tools

This software is exceptionally well-suited for technical traders, offering various indicators and sketching tools. ProRealTime facilitates an intensely analytical approach to markets, cultivating a comprehensive environment for devising and evaluating trading strategies.

Order Execution Speed

ProRealTime is crafted to be quick and responsive. It prioritizes real-time data and swift execution. This ensures traders can act promptly and decide based on the latest market conditions.

Mobile Trading Support

Overall, the mobile version of ProRealTime upholds the essential functionality found in its desktop equivalent while inherently reducing certain complex features to optimize performance for use on limited screen sizes.

Pros and Cons

✔️ Pros ❌ Cons Fast order execution The mobile app does not reproduce the complete PC experience Advanced graphing options for detailed analysis It may provide a high learning curve for novices

3. MetaTrader 4

User Interface and Experience

MetaTrader 4 (MT4) is recognized as a widely accepted industry standard within the Forex trading field due to its capacity and user-friendly features.

While it may not be praised for exceptional design aesthetics, MT4’s efficacy and transparent layout empower traders to focus on pertinent aspects of their activity.

Technical Indicators and Analysis Tools

The MT4 platform incorporates a comprehensive array of technical indicators and analytical instruments, providing users with a robust foundation for conducting technical analysis without overburdening them with intricacy.

Order Execution Speed

Moreover, this platform is widely respected and acknowledged for its unmatched reputation in consistently executing orders precisely. It ensures rapid transaction processing to take advantage of profitable opportunities in favourable market conditions swiftly.

Mobile Trading Support

One of the standout features within MT4’s suite is its mobile application, which offers potent capabilities that effectively mimic those found on the desktop version. In essence, this app provides traders with an optimal experience while away from their workstations.

Pros and Cons

✔️ Pros ❌ Cons High reliability of order execution Limited to the indications and tools given, with little room for customization The user-friendly interface is great for both novice and seasoned traders The interface may seem antiquated compared to current systems

4. NinjaTrader

User Interface and Experience

NinjaTrader is a trading software that offers a versatile and personalized platform with a rich feature set. It surpasses conventional platforms by providing high levels of flexibility in the trading process. The intuitive user interface allows users to organize elements easily.

Additionally, NinjaTrader caters to traders of all levels and backgrounds, offering advanced functionality and customization capabilities for transactions on financial markets.

Technical Indicators and Analysis Tools

NinjaTrader supplies an extensive range of technical resources tailored to meet the needs of traders who adopt a highly rigorous approach rooted in technical analysis. Its analytical functionalities are notably comprehensive, offering prospects for crafting bespoke tools.

Order Execution Speed

Overall, the platform boasts of its prompt order execution, a critical aspect for traders whose methodologies necessitate expeditious market entry and exit.

Mobile Trading Support

Although NinjaTrader is flourishing in the desktop domain, its mobile footprint appears limited. This may impede traders seeking to engage in transactions while on the go.

Pros and Cons

✔️ Pros ❌ Cons Highly customizable UI and sophisticated graphs Mobile capabilities are less complete than the desktop version Fast order execution for time-sensitive strategies The intricacy of the features may overwhelm beginners

5. cTrader

User Interface and Experience

Overall, cTrader is recognized for its contemporary and intuitive interface, which is conducive to providing a seamless and engaging trading experience. The platform’s deliberate design aims to facilitate traders’ quick access to relevant market information and maintain optimal visual aesthetics.

Notably, cTrader attracts a sizable following of users who prefer an uncluttered working environment but also gain from the significant benefits of its wide range of advanced trading tools.

Technical Indicators and Analysis Tools

Moreover, cTrader features a wide range of advanced technical indicators and analytical tools that are thoroughly comprehensive.

It boasts extensive charting functionalities and algorithmic trading capabilities, enabling traders to devise complex strategies while conducting thorough market research.

Order Execution Speed

cTrader is renowned for its expeditious order execution, an essential attribute in trading strategies that depend on timely market entry and exit to capitalize on minor price fluctuations.

Mobile Trading Support

The cTrader mobile application is designed to replicate the desktop experience, facilitating traders in smoothly transitioning between platforms while retaining full functionality.

Pros and Cons

✔️ Pros ❌ Cons Rapid execution of trades Some advanced features may be too complex for casual traders Sleek and user-friendly interface It may require a learning curve for traders accustomed to more traditional platforms Advanced technical indicators and algorithmic trading support

6. MetaTrader 5

User Interface and Experience

Overall, the MetaTrader 5 (MT5) platform has been designed to enhance and build upon the strengths of its predecessor.

It features a contemporary interface alongside supplementary capabilities that cater to traders seeking greater depth in their analytical toolkit without forsaking the well-recognized layout of MT4 – which remains extensively used within financial markets.

Technical Indicators and Analysis Tools

Additionally, the MetaTrader 5 platform has a broader array of advanced technical indicators, timeframes, and enhanced analytical capabilities. This enables an intricate examination of the market conditions, paving the way for increased adaptability in devising trading strategies.

Order Execution Speed

MT5 features superior order execution capabilities compared to MT4, rendering it a desirable option for traders who prioritize rapidity and dependability within dynamic market environments.

Mobile Trading Support

The MT5 mobile application offers traders access to extensive trading tools and up-to-date market data while on the go. The platform’s interface is optimized for mobile devices, allowing users greater ease of use.

Pros and Cons

✔️ Pros ❌ Cons Comprehensive mobile trading support The complexity of new features may be unnecessary for those with simpler trading strategies More advanced features than its predecessor The transition from MT4 might be challenging for some traders Improved order execution speed

7. TradingView

User Interface and Experience

TradingView is well-known for its excellent charting abilities and social networking functions, making it a preferred platform among traders who appreciate cooperative insights and interaction.

Moreover, its interface boasts exceptional user-friendliness while incorporating an extensive selection of charting tools and technical indicators in a style reminiscent of popular social media sites.

Technical Indicators and Analysis Tools

Overall, the platform impresses with its wide range of technical indicators and cutting-edge charting tools. Additionally, traders can leverage the shared strategies and analyses contributed by the TradingView community to enhance their trading experience through a collaborative approach.

Order Execution Speed

Although TradingView is primarily recognized for its charting capabilities, it offers broker integration that can impact the speed of order execution depending on the selected brokerage firm.

Mobile Trading Support

TradingView’s mobile application offers traders immediate access to live data and graphs, fostering collaboration and enhancing their trading experience through social interaction with the community, making it more integrated and sophisticated.

Pros and Cons

✔️ Pros ❌ Cons Effective mobile application with comprehensive features The platform may be more suitable for analysis than direct trading for some users State-of-the-art charting and technical analysis tools Order execution speed is broker-dependent Strong community and social sharing features

8. Interactive Brokers Trader Workstation (TWS)

User Interface and Experience

Overall, the Interactive Brokers Trader Workstation (TWS) is tailored to cater to the needs of professional traders and investors who demand a sturdy, all-embracing trading platform.

Additionally, TWS offers an extremely versatile interface with numerous tools and asset classes that can be customized to meet discerning market participants’ complex requirements.

Technical Indicators and Analysis Tools

The TWS platform offers a variety of technical indicators and analysis tools to cater to the diverse analytical needs of experienced traders. It enables thorough chart studies, which is crucial for developing detailed trading algorithms and enhancing the overall trading experience.

Order Execution Speed

Interactive Brokers is renowned for its superior order execution speed, which is crucial in markets that emphasize timing.

Leveraging this advantage, the Trading Workstation (TWS) incorporates an intricate order routing system geared towards augmenting quality optimization of executions.

Mobile Trading Support

The mobile version of TWS is not an incidental addition but a deliberate and well-designed product that offers traders significant features typically found on the desktop platform. This enables traders to maintain seamless connectivity and productivity while on the go.

Pros and Cons

✔️ Pros ❌ Cons Robust mobile application with extensive functionality The platform's vast array of features may be overwhelming for non-professional traders Highly customizable and comprehensive trading environment Interface complexity can be daunting for new users Top-tier execution speeds and order routing

9. SaxoTraderGO

User Interface and Experience

SaxoTraderGO represents the leading platform of Saxo Bank, providing traders with a seamless and intuitive user experience.

Its design emphasizes simplicity while maintaining full functionality, making it ideal for those who prioritize ease of use while requiring access to an extensive suite of trading tools.

Technical Indicators and Analysis Tools

Additionally, the platform possesses an extensive range of technical indicators and analysis tools. SaxoTraderGO streamlines market analysis for optimal efficiency, enabling traders to employ strategies guided by comprehensive data and intricate technical insights.

Order Execution Speed

Overall, SaxoTraderGO prides itself on its reliable and efficient order execution capabilities, which are critical in capitalizing upon market opportunities. This is especially crucial during periods of volatility in trading conditions.

Mobile Trading Support

The mobile user interface of SaxoTraderGO is remarkably smooth and efficient. What’s more, it exhibits a close semblance to the desktop variant, thereby providing a seamless trading experience across various devices.

Pros and Cons

✔️ Pros ❌ Cons Consistently fast order execution The platform's simplicity might limit certain analytical methodologies User-friendly interface suitable for traders of all levels Advanced traders may seek more customization options Comprehensive selection of technical indicators and tools

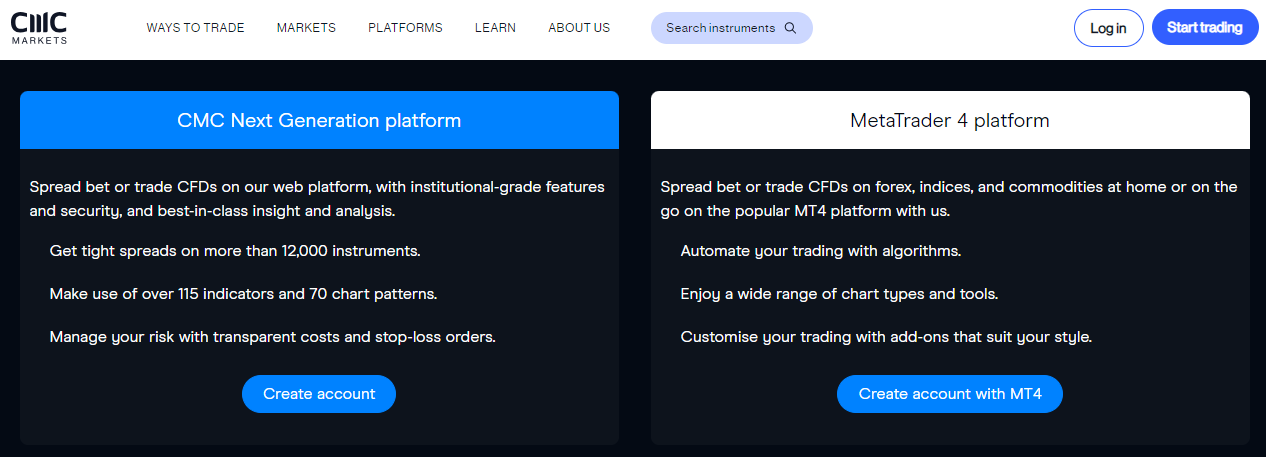

10. CMC Markets Next Generation

User Interface and Experience

Overall, the Next Generation platform from CMC Markets has been purposefully developed with the contemporary trader in consideration.

Its streamlined interface is highly customizable and prioritizes user-friendliness while retaining high functionality. It should be noted for its refined design and intuitive navigation system.

Technical Indicators and Analysis Tools

The Next Generation platform presents an extensive range of technical indicators and charting tools. In addition, it sets itself apart with its unique ‘Client Sentiment’ functionality that provides valuable insights into the positioning strategies of other traders.

Order Execution Speed

The efficiency and reliability of order execution at CMC Markets is a key factor active traders depend on to maintain their competitive edge within the fast-paced trading arena.

Mobile Trading Support

The mobile application by CMC is a robust complement to its desktop platform, providing traders with comparable tools and an intuitive interface that enables them to remain connected while away from their workstations.

Pros and Cons

✔️ Pros ❌ Cons Innovative sentiment analysis tools The range of advanced customization options might fall short for certain professional traders Reliable order execution Some traders may require a period of adaptation to the platform's unique features Intuitive and aesthetically pleasing interface

The Features of a Good Forex Trading Platform

A proficient trading platform is crucial for foreign currency trading, as it plays a vital role in market implementation, market scrutiny, and trade prosperity. Moreover, the platform’s effectiveness depends on its functional attributes and adaptability to an investor’s strategic approach and velocity.

User Interface and Experience

A reliable Forex trading platform should balance complexity and user-friendliness. In other words, it should be powerful enough for experienced traders yet easy to navigate for beginners. This ensures accessibility for traders of all levels. To achieve this, the site should prioritize simplicity, allowing quick access to trading tools, market information, and account management options.

Customization is crucial, ensuring the platform accommodates individual preferences and offers versatile organization and presentation capabilities. Therefore, the platform should align with default configurations to suit each trader’s unique style preference.

Technical Indicators and Analysis Tools

Overall, in the Forex market, accurate decision-making is crucial, and technical indicators and analytical tools are essential.

A proficient trading platform provides a range of resources, including trend indicators, oscillators, and scripts. This allows traders to analyze historical data and forecast future market movements precisely.

In consequence, these tools enhance traders’ ability to craft or adjust their trading strategies based on relevant information.

Order Execution Speed

The Forex market’s volatility means that even a few seconds can significantly impact trading outcomes. Efficient order execution is crucial for success, minimizing slippage risk and ensuring transactions are executed at or near targeted prices.

This is especially important for traders using scalping strategies or automated electronic trading systems, which rely on swift entry and exit of positions based on price fluctuations.

Mobile Trading Support

In today’s mobile-first environment, top-tier Forex trading platforms must offer robust mobile trading support, ensuring a smooth transition from desktop trading.

This includes a consistent user experience, access to important tools and real-time data, and the ability to respond quickly to market moves, even when away from a desktop trading environment.

Tips for Getting Started with a Forex Trading Platform

Forex trading offers potential for profit and growth, but novice traders must approach it with prudence and expertise. This involves understanding trading platforms, practising, managing financial input, and committing to continuous study.

Utilize Demo Accounts for Practice

Overall, new traders can benefit from opening a demo account, which provides a realistic market replica with no financial risk.

These accounts allow users to familiarize themselves with the platform’s UI, test trading techniques in real time, and reduce the learning curve of forex trading. Consequently, this experience boosts confidence in decision-making processes.

Start with Small Investments

To transition from a demo to a real trading account, start with minimal bets to reduce risk and gain valuable experience.

This strategy allows traders to focus on learning rather than potential profits or losses. It helps understand the psychological aspect of trading, as actual earnings and losses can influence decision-making.

Continuously Educate Yourself on Forex Trading

Forex trading constantly evolves due to new techniques, advanced technology, and economic events. To stay competitive, traders must stay updated with market trends, data, and geopolitical developments.

This can be achieved through several methods. These methods include active financial news consumption, peer interaction, webinars, and thorough market analysis reports. In turn, these tools enhance decision-making and help traders respond swiftly to market changes, ensuring a competitive edge.

Conclusion

Overall, Forex trading platforms are a mix of intricacy and usability that appeal to both beginners and experienced traders. They offer quick order execution, comprehensive analytical tools, and strong mobile support.

However, these powerful systems may have learning curves and may not be suitable for highly specialized trading methods. Despite these limitations, the benefits of these platforms, such as assisting educated trading choices and market accessibility, often outweigh the cons.

Faq

Yes, you can. Most brokers provide mobile trading applications that are simplified versions of their desktop or web-based platforms.

Forex trading platforms are classified into four types: web-based, downloadable desktop platforms (such as MT4 and MT5), proprietary platforms designed by brokers, and mobile trading applications. Each offers unique benefits and best-suited applications.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used owing to their vast functionality and customization opportunities, therefore many brokers provide them, making them viable options.

Yes. Some platforms include simple interfaces, integrated instructional tools, and good customer service, focusing on beginning traders.

Consider your trading expertise, the features you need, your chosen platforms (desktop, online, mobile), and if you focus on what matters most.