WTI Crashes 16%—$59 Breakdown Has Traders on Edge

WTI crude (USOIL) has plunged to $59.66, marking its sharpest monthly decline since 2021. April alone saw a 16% drop in WTI and a 15%

Quick overview

- WTI crude has dropped to $59.66, experiencing its sharpest monthly decline since 2021 with a 16% drop in April.

- The decline is driven by renewed U.S.-China trade tensions and a significant drop in U.S. consumer confidence.

- Supply pressures are exacerbating the situation, with a reported 3.8 million barrel build in U.S. crude inventories and potential OPEC+ output hikes.

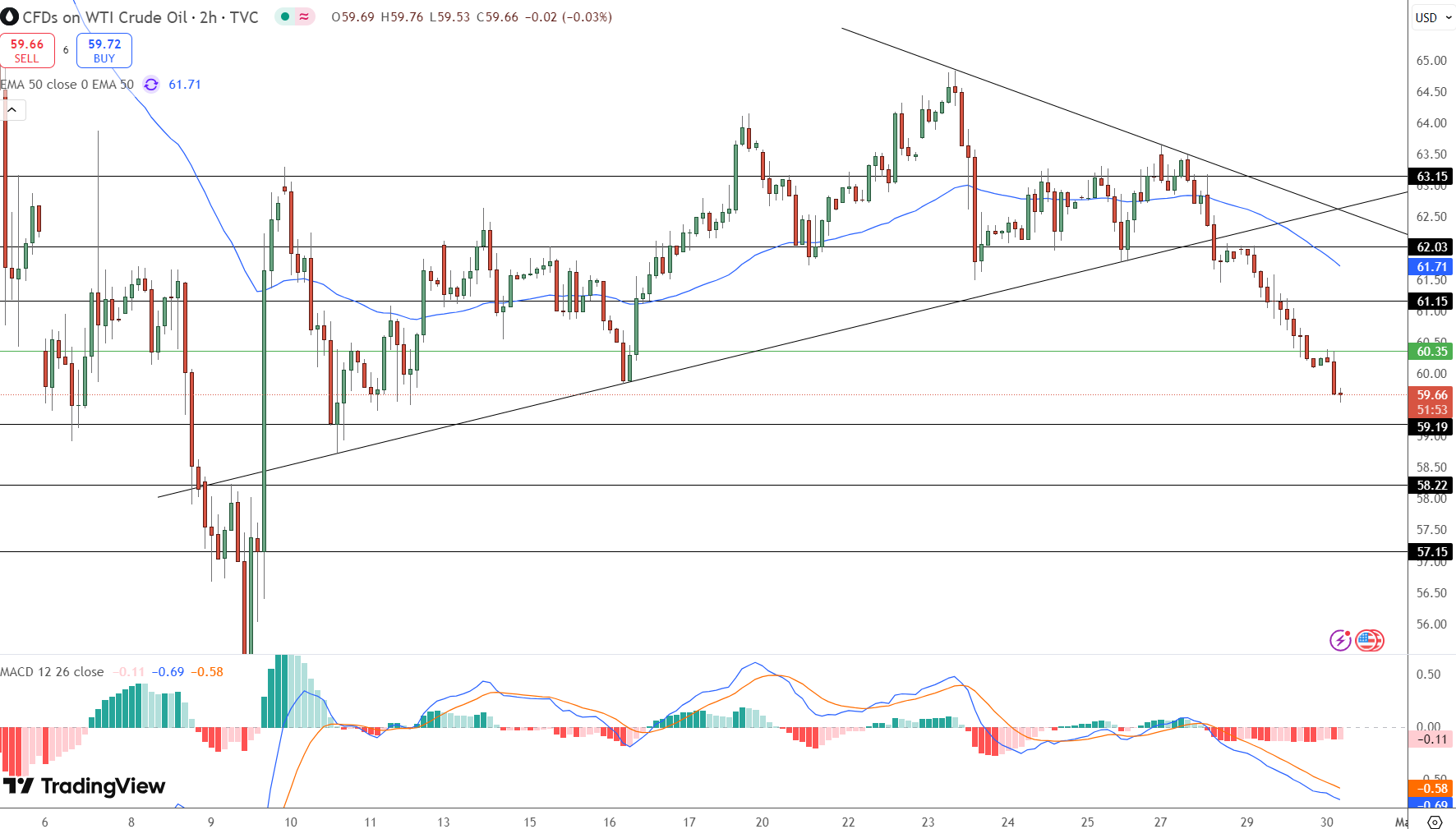

- Technically, WTI has entered bear territory, with critical support levels at $59.19 and resistance at $60.35.

WTI crude (USOIL) has plunged to $59.66, marking its sharpest monthly decline since 2021. April alone saw a 16% drop in WTI and a 15% fall in Brent, as the oil market buckled under the weight of renewed geopolitical tensions and mounting economic headwinds.

The immediate catalyst? A full-scale U.S.-China trade war, reignited by President Donald Trump’s April 2 tariff announcement. China responded with retaliatory measures, intensifying concerns over global demand destruction. The result: a broad risk-off sentiment across commodities.

Adding to the pressure, U.S. consumer confidence has tumbled to a five-year low, and China’s factory output is shrinking at its fastest pace in 16 months. According to ANZ strategist Daniel Hynes, early signs of demand resilience were likely driven by pre-tariff stockpiling—a temporary boost that’s now reversing.

Rising Supply Amplifies the Bear Case

It’s not just demand that’s weighing on oil. Supply-side pressures are compounding the selloff. Last week, the American Petroleum Institute (API) reported a 3.8 million barrel build in U.S. crude inventories, reinforcing fears of oversupply.

To make matters worse, OPEC+ is reportedly considering an output hike at its May 5 meeting, a move that could flood the market further just as demand falters.

Although Trump’s recent easing of auto tariffs has offered a glimmer of relief, analysts caution that political efforts to curb inflation by keeping fuel prices low may continue to pressure oil prices in the short term.

Technical Breakdown: WTI Slides into Bear Territory

From a technical perspective, WTI’s clean break below $60.35 confirms bearish momentum. The next support sits at $59.19, a critical level that, if breached, could accelerate downside pressure.

MACD has crossed into bearish territory

50-day EMA at $61.71 now acts as resistance

Price action suggests fading momentum with lower highs forming

Key Levels to Watch:

Support: $59.19, $58.22, $57.15

Resistance: $60.35, $61.71

Trade Setup: Bearish Bias with Confirmation

This is a market for patient traders. With both technical and fundamental factors aligned to the downside, the setup favors short trades—but only on confirmation.

Entry: Short on a confirmed break below $59.19

Stop-loss: Above $60.35

Targets: $58.22, $57.15

Oil is entering a high-volatility phase, driven by macro uncertainty and shifting supply dynamics. For traders, that means opportunity—but only if they let the chart lead the way.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account