U.S. vs. China: The Second Phase of the Tariff War Begins

According to China’s National Bureau of Statistics, Chinese exports to the U.S. totaled nearly $525 billion in 2024.

Quick overview

- The U.S.-China tariff war has entered a critical second phase, testing both nations' resilience.

- China is employing a three-step strategy of retaliation, economic stimulus, and negotiation to address the trade conflict.

- Chinese exports to the U.S. reached nearly $525 billion in 2024, with companies needing to adapt to higher tariffs and explore new markets.

- Support measures for small and medium-sized enterprises and interventions in capital markets are being implemented to mitigate the trade war's impact.

The tariff war between the United States and China has entered its second phase, a stage that will test the resilience and strength of both sides.

China is taking a deliberate three-step approach: retaliation, economic stimulus, and negotiation, rather than hastily seeking deals. Chinese policymakers have long recognized that they cannot safeguard their core interests while making concessions merely to satisfy U.S. demands. Their retaliatory tariffs are designed to push both parties back to the negotiating table sooner rather than later.

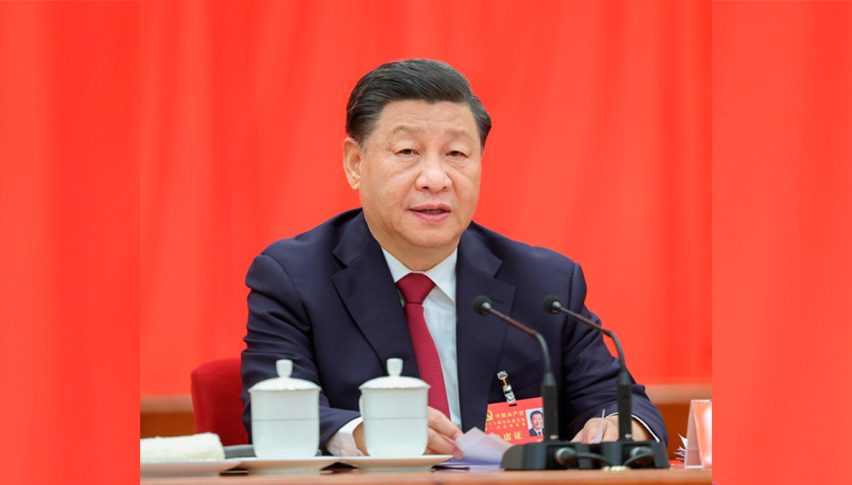

Indeed, the U.S. Secretary of Commerce has confirmed that negotiations between the two sides have been ongoing through intermediaries. Meanwhile, China is expected to roll out additional stimulus measures to prevent a sharp slowdown in its GDP growth and financial markets. China is also working to diversify its exports beyond the U.S. market, focusing more on neighboring countries, as reflected by the recent “Central Conference on Work Related to Neighboring Countries” and President Xi Jinping’s scheduled visits to Vietnam and other Southeast Asian nations.

Impact on Chinese Exports to the U.S.

According to China’s National Bureau of Statistics, Chinese exports to the U.S. totaled nearly $525 billion in 2024. Most Chinese exporting industries have only a limited to moderate ability to pass on higher tariff costs to their customers.

Chinese companies need to enhance the value of their products, explore new markets, optimize supply chains, and reduce dependence on the U.S. market. On the governmental side, support measures for small and medium-sized enterprises (SMEs) in affected sectors are critical.

What Immediate Support Has Been Seen?

- Capital Markets: Central Huijin Investment Ltd. (an arm of China’s Ministry of Finance) and other state-owned enterprises made a coordinated effort to intervene in domestic stock markets to counteract the sell-off triggered by the trade war.

- Chinese Currency: Managing the yuan’s exchange rate is delicate; while a combination of currency depreciation and interest rate cuts could help exports, it also risks provoking U.S. retaliation. Thus, the optimal strategy for China appears to be maintaining exchange rate stability within a controlled range.

- Industrial Self-Help Initiatives: JD.com announced plans to purchase RMB 200 billion worth of export goods throughout the year to support exporters. Over a dozen other online platforms—including Alibaba’s Freshippo, Meituan, Douyin (ByteDance), Kuaishou, and VIP.com—as well as traditional retailers like Yonghui, CR Vanguard, and Lianhua, have launched similar initiatives.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account