Bitcoin Holds Above $93,000 as Record ETF Inflows and Long-Term Bullish Outlook Drive Momentum

After recovering from what observers call a "fairly normal" 30% fall earlier this year, Bitcoin continues to show remarkable resilience,

Quick overview

- Bitcoin has shown resilience after a 30% fall earlier this year, currently holding steady above $93,000.

- Institutional adoption is rising, with Bitcoin ETFs in the U.S. seeing nearly $1 billion in inflows this week alone.

- ARK Invest has raised its 2030 Bitcoin price target to $2.4 million, citing institutional investment as a key driver.

- Technical analysts emphasize the importance of Bitcoin maintaining support above $93,500 to avoid potential declines.

After recovering from what observers call a “fairly normal” 30% fall earlier this year, Bitcoin continues to show remarkable resilience, holding steady just above $93,000. Data from CryptoQuant shows that long-term holders (LTHs), who saw their total realized market worth rise by $26 billion between April 1 and April 23, may have benefited from this recovery phase.

BTC/USD‘s strong performance comes amid rising institutional adoption, as Bitcoin ETFs listed in the U.S. experienced substantial inflows this week. Tuesday alone saw almost $1 billion in new cash pouring into these funds, which helped to generate weekly inflows of $1.2 billion and drive overall assets under administration to $103 billion.

BTC ETF “Pac-Man Mode” Reflects Broadening Institutional Interest

With year-to-date inflows of $2.7 billion, including $346 million only last week, BlackRock’s iShares Bitcoin Trust (IBIT) keeps leading the ETF market. With ten of eleven spot Bitcoin ETFs drawing additional cash, Bloomberg senior ETF analyst Eric Balchunas characterized the current activity as ETFs entering “Pac-Man mode.”

This wide-based involvement shows that institutional investors are spreading their bets among several funds instead of focusing on one or two products. With net assets currently almost $57 billion, the overall value traded across all Bitcoin spot ETFs came to $496 million.

Bitcoin Price Prediction: ARK Invest Raises 2030 Price Target to $2.4 Million

ARK Invest has boldly projected that by the end of 2030, its “bull case” Bitcoin price goal will rise from $1.5 million to $2.4 million, drawing market interest. The investing company also raised its “base” and “bear” case scenarios to $1.2 million and $500,000 respectively.

Estimating that Bitcoin may reach a 6.5% penetration rate into the $200 trillion financial system in a best-case scenario, ARK research analyst David Puell attributed institutional investment as the main impetus behind these forecasts. With potential to seize up to 60% of gold’s $18 trillion market value, the company’s model also considers Bitcoin’s increasing adoption as “digital gold.”

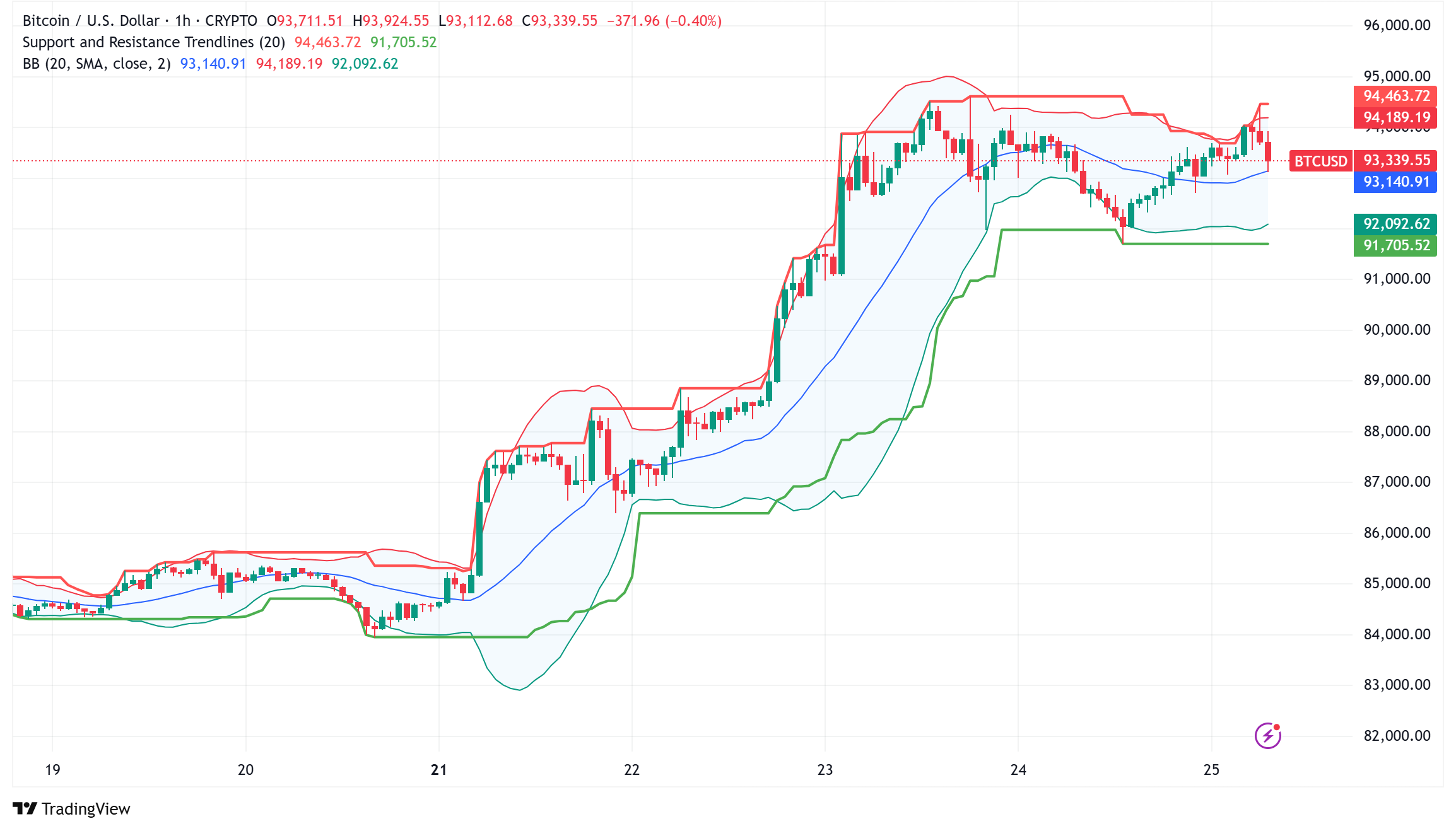

BTC/USD Technical Analysis: Key Support Level Emerges at $93,500

Technical analysts stress the need of Bitcoin keeping support over $93,500 to prevent another possible collapse. To “resynchronize with the former Reaccumulation range,” crypto analyst Rekt Capital said BTC must stabilize above this crucial level and preferably secure a weekly closure above it.

This week the bitcoin has already shown its capacity to surpass this level since investors see it as a safe refuge among market uncertainties brought on by geopolitical issues and trade worries. Should Bitcoin be able to maintain this vital support level, experts predict it will shortly recover the $100,000 barrier and maybe set new all-time highs.

Market Structure Suggests Continued Upside Potential

Several technical indications show that the structure of Bitcoin’s market is still showing constant strength. With 16.7 million BTC now in profit across many addresses, the supply of the cryptocurrency in profit has exceeded the “threshold of optimism.” According to historical data from 2016, 2020, and 2024, Bitcoin often causes notable price increases within months when it regularly holds above this crucial bullish zone.

traders are looking for validation of the breakout pattern as Bitcoin tests weekly resistance levels. To validate the positive trend, several analysts—including CrediBULL Crypto—suggest BTC need “one more leg on the lower timeframes,” which may perhaps propel values toward $150,000 should momentum keep.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account