IMF Cuts U.S. GDP by 0.9% for 2025—Trump Tariffs to Blame?

IMF Issues Warning on Global Economy—Cuts US Growth Forecast by Nearly a Full Percentage Point The International Monetary Fund (IMF)...

Quick overview

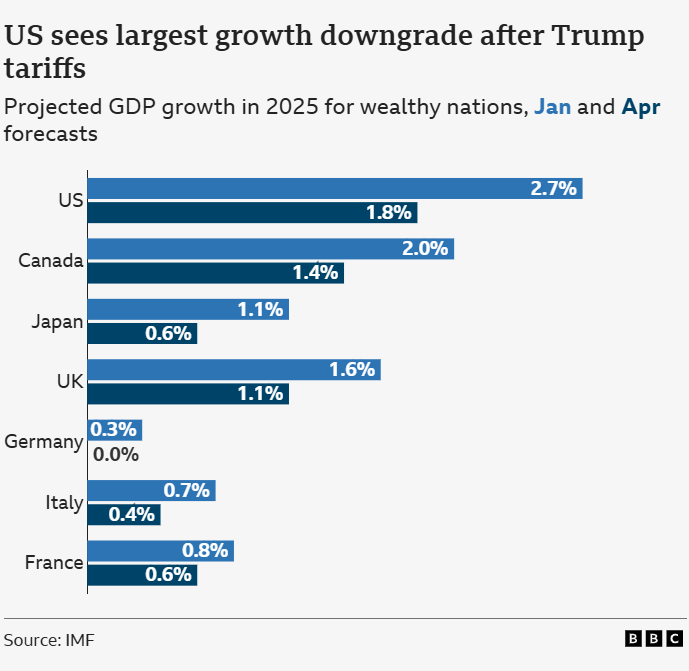

- The IMF has downgraded its US growth forecast for 2025 from 2.7% to 1.8%, the largest cut among developed nations.

- Global GDP growth is now expected to be 2.8%, down from 3.3%, largely due to trade tensions between the US and China.

- Rising policy uncertainty and higher input costs are squeezing businesses, leading to delayed investments and reduced consumer confidence.

- The IMF warns of a 40% chance of a US recession in 2025 as global economic conditions continue to deteriorate.

IMF Issues Warning on Global Economy—Cuts US Growth Forecast by Nearly a Full Percentage Point

The International Monetary Fund (IMF) has issued a sharp warning about the state of the global economy—cutting its US growth forecast for 2025 by nearly a full percentage point. The downgrade, from 2.7% in January to 1.8% in April, is the largest among developed nations and directly tied to the fallout from President Donald Trump’s new tariffs.

Earlier this month, the Trump administration announced tariffs on more than 180 countries, including a 145% duty on Chinese goods. According to the IMF, this policy shift has spooked markets and injected uncertainty into global supply chains.

“Businesses are pulling back,” said IMF Chief Economist Pierre-Olivier Gourinchas. “Investment is being delayed, consumption is slowing and the outlook is getting more fragile.”

Global Growth Outlook Darkens

The US isn’t alone. The IMF now expects global GDP to grow 2.8% in 2025—down from 3.3% previously. The trade tensions between the US and China are a major reason for the cut, with retaliatory tariffs threatening to drag down cross-border investment and consumer spending.

Other big economies are feeling the pinch:

Canada: Growth revised down from 2.0% to 1.4%

Japan: Cut to 0.6% from 1.1%

UK: Trimmed to 1.1%, ahead of Germany (0.0%) and France (0.6%)

Spain: The only one up, to 2.5% thanks to reconstruction stimulus after natural disasters

UK inflation is now 3.1%—the highest in the G7—driven by living costs. But Chancellor Rachel Reeves says Britain’s “competitive edge and structural reforms” are helping to weather the global storms.

Why the US Cut Matters Most

While several countries are slowing down, the US cut is the biggest. The IMF points to a mix of rising policy uncertainty, falling consumer confidence and the risk of tariffs backfiring. Businesses are being squeezed by higher input costs and supply chain disruption and consumers are pulling back.

Despite Trump’s claim that the tariffs would “bring manufacturing home”, economists say the strategy may end up reducing demand and tightening financial conditions.IMF sees 40% chance of US recession in 2025

Key Points:

US growth forecast cut to 1.8% from 2.7%

Global GDP 2.8%

Trade tensions are hitting investment, supply chains and sentiment

IMF sees rising recession risk in the US

Conclusion

The IMF’s latest forecast is a warning to the global economy is walking a tightrope. With trade tensions rising and consumer momentum fading, policymakers have a tough job: support domestic industries without pulling the rug from under global growth.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account