Dogecoin Breaks Key Resistance: Technical Signals Point to Potential 45% Rally Amid Broader Meme Coin Surge

Dogecoin (DOGE) is making waves in the cryptocurrency market today, holding strong above $0.18 and posting impressive gains of approximately

Quick overview

- Dogecoin (DOGE) has surged approximately 13% in the last 24 hours, trading above $0.18 amid a broader memecoin rally.

- The cryptocurrency has broken a crucial declining trendline resistance, indicating bullish momentum and a potential for further gains.

- Despite the positive outlook, overbought indicators suggest a possible short-term correction could occur.

- Fundamental factors, including potential approval of spot DOGE ETFs and increased accumulation by large holders, support the ongoing expansion of Dogecoin.

Dogecoin (DOGE) is making waves in the cryptocurrency market today, holding strong above $0.18 and posting impressive gains of approximately 13% over the past 24 hours. This surge in DOGE/USD comes as part of an improvement in the overall market sentiment and a broader memecoin rally that has seen competitors like Shiba Inu SHIB/USD, PEPE, and BONK skyrocketing to new monthly highs.

DOGE/USD Technical Breakout: Falling Wedge Pattern Signals Bullish Momentum

Dogecoin has at last broken over a crucial declining trendline resistance that had been restricting its price since December following months of stabilization. Since November last year, the bitcoin has developed a typical falling wedge pattern whereby the upper trendline links the highest levels since December 8 and the lower trendline links the lowest points since November.

The breakout of this technical pattern is especially noteworthy since it reflects a similar configuration from October 2024, which earlier started off a 300% increase from $0.11 to $0.48. Technical analysts observe that the present compression has lasted almost six months, corresponding with the period of time following the last year’s explosive movement in previous consolidation periods.

The development of a double-bottom pattern around $0.1445 helps to confirm the breakout and supports the optimistic view even further. Bulls have focused on the next significant resistance level at $0.1809 as DOGE currently trades above its 50-day Simple Moving Average.

Warning Signs: Overbought Indicators Could Signal Short-Term Correction

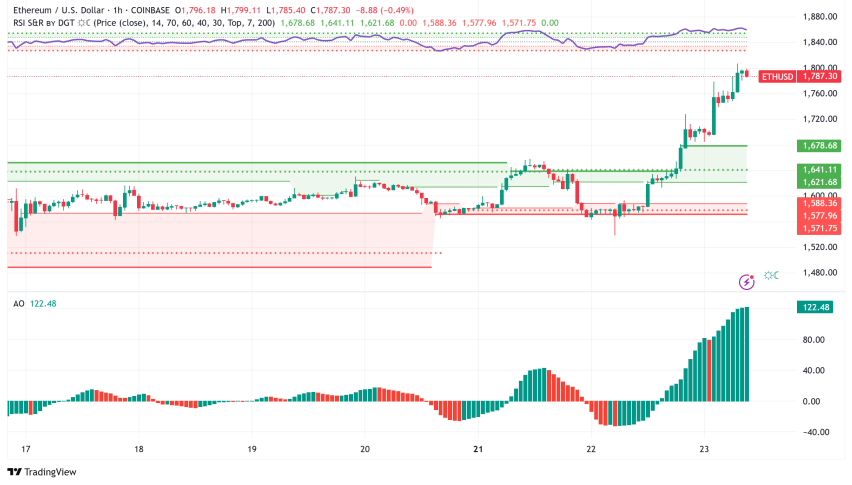

Though the future seems bright, multiple signs point to a brief correction perhaps just around here. While the Stochastic Oscillator has entered overbought territory, the Relative Strength Index (RSI) has risen over the neutral 50 mark, indicating developing momentum.

Comparatively to past months, trading volume is still somewhat modest, indicating that even if optimistic momentum is developing, it might still be in its early phases. The daily Stochastic Oscillators across meme coins show corrections could develop in the short term, maybe offering traders trying to position themselves for the expected bigger movement better entry points.

Fundamental Catalysts Supporting Further Upside

A number of basic drivers could drive Dogecoin’s ongoing expansion. With Grayscale and Rex-Osprey already applying, Paul Atkins’ election as the new Securities and Exchange Commission Chair has generated rumors regarding possible approval of spot DOGE ETFs.

With the number of addresses moving higher between 100 million and 1 billion DOGE tokens, on-chain measurements reveal growing accumulation by big holders. Often ahead of notable price swings in the bitcoin market is this whale build-up.

Furthermore, the slowing American economy might help DOGE in some indirect sense. While the U.S. economy is predicted to drop to 1.8% from 2.8% last year, recent predictions from the International Monetary Fund show that worldwide growth will fall to 2.8% this year, down from 3.3%. This economic background might inspire Federal Reserve action with interest rate reductions, in which case cryptocurrencies have traditionally fared well.

Dogecoin Price Prediction

Should Dogecoin break the $0.1809 obstacle, experts estimate it may prolong its surge by as much as 45%, so approaching the important resistance level at $0.2285 in the next weeks. DOGE would have to surpass extra challenges at $0.2106 and the 100-day Simple Moving Average in order to reach such a move.

The expected measured movement from the falling wedge breakout points to an ultimate objective approaching $0.39, therefore reflecting a 138% gain from present levels. More hopeful forecasts show DOGE might touch the $0.65 level, completing another three-fold rally if the setting exactly reflects last year’s pattern.

What’s Next for Dogecoin Traders?

With short positions accounting for over 85% of the $11.68 million in liquidations, Dogecoin’s explosive surge has set off significant futures liquidations according to Coinglass statistics. Should the surge persist, this squeeze on short sellers could feed it.

As Bitcoin also shows strength close to the $90,000 level, market players will be keenly observing BTC’s movement as it keeps impacting the whole bitcoin market. One analyst said, “If BTC breaks above $89K and shows conviction upwards, I think Dogecoin gets back to $0.26 relatively quick.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account