Stellar (XLM) Bullish Outlook: Key Support Holds, Signs of Bottoming Emerge

Quick overview

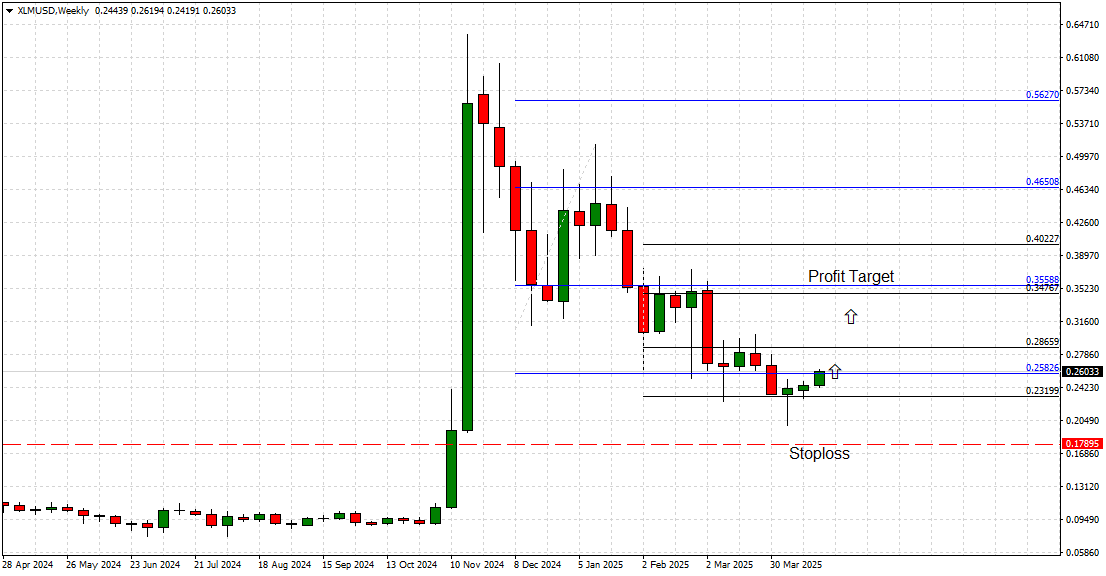

- Stellar (XLM) is showing early signs of a potential market bottom, trading around $0.2603 above key support levels.

- The price has respected major support at $0.2320 and $0.2582, indicating a possible trend reversal and bullish momentum.

- Stellar's fundamentals, including strong partnerships and a focus on low-cost cross-border transactions, support a positive outlook.

- A weekly close above $0.2582 could confirm a breakout, with a profit target of $0.3559 in sight.

Stellar (XLM) is beginning to show early signs of a potential market bottom, following weeks of downward pressure

As of today, XLM is trading around $0.2603, hovering just above two major support levels at $0.2320 and $0.2582, both of which have held firmly in recent weeks. This development suggests that bearish momentum may be fading, with the market gearing up for a potential long-term upside reversal.

Technical Overview: Key Support Levels Remain Intact

After a sharp correction from its multi-month highs near $0.6471, Stellar found strong buying interest near $0.2320, a major key support level. Notably, the price also tested and respected the $0.2582 horizontal support—a previous breakout level now acting as a floor.

The double-layered support structure helped XLM establish a solid base, with current weekly candles showing small-bodied bullish momentum just above those key areas.

The fact that XLM failed to sustain a breakdown below this confluence of supports is a bullish signal in itself, especially on the weekly and monthly charts.

This could be the beginning of a trend reversal, potentially leading to a rebound towards the next significant resistance zone at $0.3585, which now stands as a logical profit target for swing traders.

Key levels to watch:

Next Immediate Resistance: $0.2866

Breakout Target: $0.3559 (Profit Target)

Next Key-Resistance: $0.4022 and $0.4650

Key Support Below: $0.2320

Stoploss Recommendation: Below $0.1789

Fundamentals & Vision: What Makes Stellar Different

While technicals offer signs of reversal, Stellar’s long-term fundamentals further support a bullish stance. The Stellar Development Foundation (SDF) has continued to build strong partnerships across financial sectors, promoting the adoption of blockchain-based payment systems.

Stellar focuses on facilitating fast, low-cost cross-border transactions, making it a key player in financial inclusion, particularly for underbanked regions around the world.

What separates Stellar from many other projects is its built-in decentralized exchange (DEX) and its support for issuing custom tokens—from stablecoins to tokenized assets.

Its consensus protocol, the Stellar Consensus Protocol (SCP), is also a unique value proposition, enabling ultra-fast transactions without relying on energy-intensive mining.

In 2025, the crypto world is gravitating towards scalability, interoperability, and regulatory alignment—and Stellar ticks all three boxes. With growing institutional interest in compliant and scalable blockchain solutions, Stellar’s roadmap looks more promising than ever.

Conclusion: Bulls May Be Waking Up

From a technical standpoint, the ability of Stellar (XLM) to hold above critical support zones signals a shift in market sentiment. This is compounded by growing interest in its real-world utility and blockchain vision. A weekly close above $0.2582 could confirm the breakout and open the gates toward $0.3559 and beyond.

As always, risk management is key—consider a stoploss below $0.1789, in case support gives way. But for now, bulls have a technical and fundamental case to ride.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account