Solana Poised for Breakout as Network Revenue and Staking Market Cap Surge

Solana (SOL) is showing remarkable resilience, trading above $139 with strong technical indicators suggesting a potential breakout. SOL/USD

Quick overview

- Solana (SOL) is currently trading above $139, showing strong market reliance and potential for a breakout.

- The network recently achieved a milestone with $53.9 billion in SOL staked, surpassing Ethereum in total staked value, which has sparked debate about its impact on the DeFi ecosystem.

- Solana's daily network revenue has reached a two-month high of over $4 million, indicating robust growth in blockchain application income.

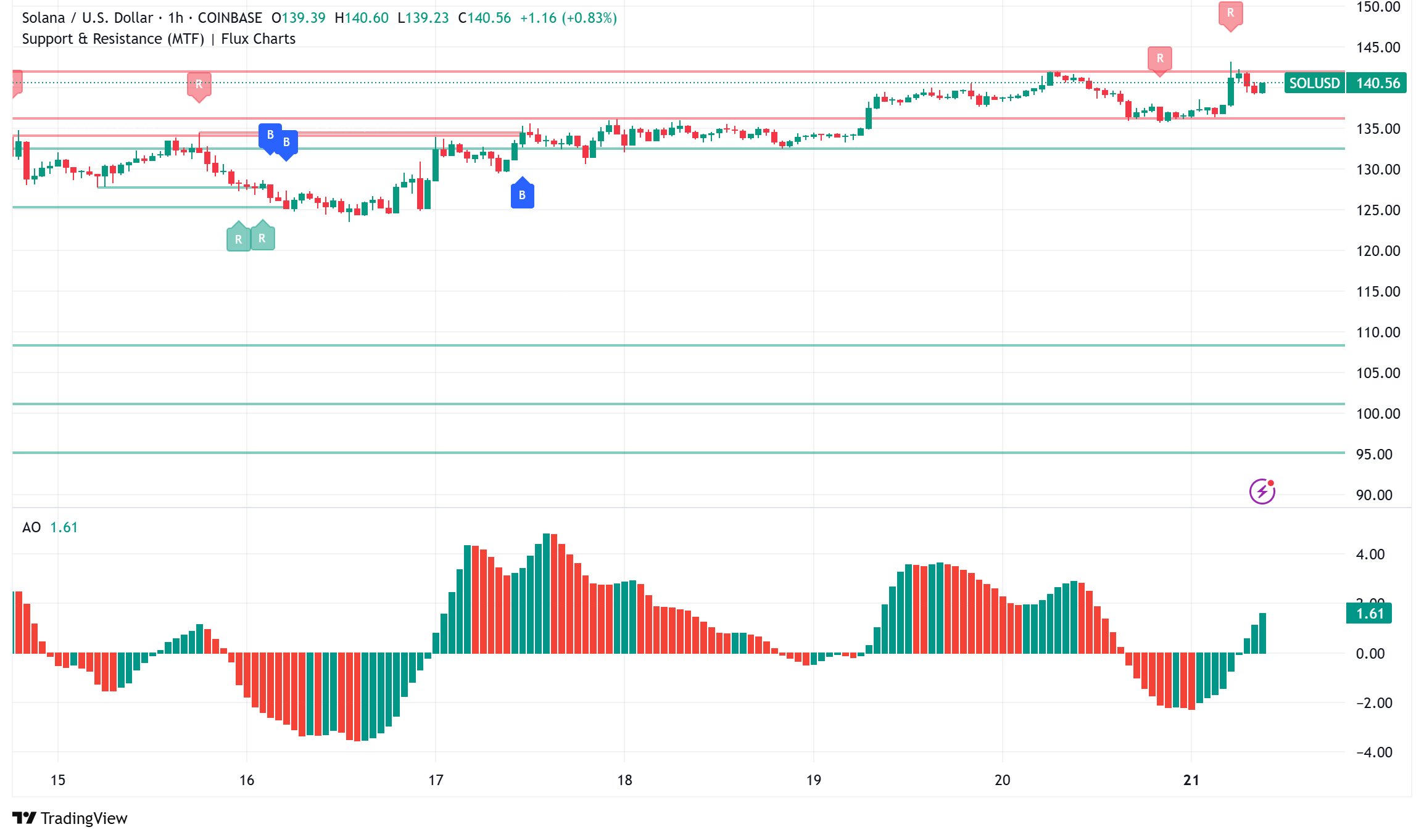

- Technical analysis suggests critical support at $129 and resistance at $144, with potential for a bullish breakout if the resistance is surpassed.

Solana (SOL) is trading above $139, displaying significant reliance in the market; key technical indicators are suggesting a potential breakout. SOL/USD briefly flipped Ethereum ETH/USD in staked token value while maintaining dominant positions in blockchain revenue and application development, signaling growing institutional confidence in the network.

Solana vs. Ethereum: Historic Staking Milestone Sparks Debate

With $53.9 billion worth of SOL now staked across 505,938 distinct wallets, Solana recently reached a major milestone, momentarily outpacing Ethereum in total staked value. This amounts to about 65% of Solana’s whole market capitalization, a statistic that has generated discussion among crypto enthusiasts.

While some see this as a positive sign of investor confidence and network security, others believe it may really limit Solana’s DeFi ecosystem. Critics note that the appealing 8.31% yearly staking return—much greater than Ethereum’s 2.98%—may be pulling money away from key DeFi projects.

Developer “JC” on social media said, “Solana having 65% of its market cap staked means there’s no other use of its token; it’s actually bearish.”

Comparing liquid staked assets across both networks helps one to see the difference: Against just $7.22 billion in liquid staked SOL on Solana, Ethereum boasts $21.5 billion in liquid staked ETH tokens.

Solana Network Revenue Hits Two-Month High

Solana’s network foundations keep getting stronger even as liquidity distribution raises questions. Recently exceeding $4 million, daily income is highest it has been since February 21. Since late March, this measure—which includes transaction costs and out-of-protocol recommendations—has been rapidly rising.

The income explosion fits Solana’s leadership in blockchain application revenue distribution. As of April 16, Solana accounted for an amazing 70.4% of all blockchain application income according DeFiLlama data; Hyperliquid came in at 13.7%; Ethereum came in at 7.35%.

SOL/USD Technical Analysis Points to Critical Support and Resistance

Price analysis from Glassnode shows Solana is trading within a critical range, with major support at $129 and resistance close at $144. These levels show notable accumulation zones; roughly 33.7 million SOL (5.75% of total supply) collected around $129 and 28.8 million SOL (4.92% of supply) purchased at $144.

If the $144 resistance is broken, short-term charts reveal the development of a possible cup and handle pattern, a bullish indicator implying ongoing upward momentum. Technical indicators are pointing in good direction; the Alligator indicator starts to fan upward and the Awesome Oscillator becomes green—both implying increasing momentum.

Derivatives Data Reveals Short Squeeze Potential

Fascinatingly, derivatives data shows quite different picture of spot market behavior. The funding rate weighted by open interest has plummeted to -0.0116%, suggesting negative attitude among prospective traders mostly engaged in short positions.

This negative financing rate, combined with significant spot market accumulation and increased whale wallet activity (up 1.53% to 5,019 wallets holding above 10,000 SOL), provides conditions ripe for a potential short squeeze. If SOL breaks above the $144 mark, these short bets could be compelled to cover, perhaps propelling price movement toward the $179-$200 zone.

Solana’s Strategic Developments Attract Industry Recognition

Renowned business leaders still find great interest in Solana’s technological developments. Hayden Adams, founder of Uniswap, has highlighted Solana’s benefits for Layer 1 DeFi, stating: “Solana has a better roadmap, a better team, and a better approach for L1 DeFi.”

This support emphasizes Solana’s monolithic approach’s increasing acceptance against Ethereum’s modular design. Solana keeps optimizing its basic layer for speed, efficiency, and cheap transaction costs while Ethereum depends more and more on Layer 2 solutions for scalability.

The network is also tackling earlier complaints about its economic stability. Solana Labs CEO Anatoly Yakovenko has said that although Solana has been under fire for lacking automatic cutting systems (penalties for validator misbehavior), a complete slashing solution is coming later this year with a “correlated slashing” mechanism.

The next weeks will be vital in deciding whether Solana can maintain its growth trajectory and challenge its past highs above $190 as it keeps strengthening its basics while negotiating important price levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account