S&P 500 and DJIA Eye Bullish Start on Monday After Positive Trade Deal Signals?

There are some positive signals for stock markets over the weekend, which could lead to a bullish run in S&P 500 and DJIA next week.

Quick overview

- U.S. equities rebounded strongly on Thursday, recovering losses from the previous session and ending the week with a bullish sentiment.

- Investor optimism is rising ahead of the weekend, with potential positive developments in U.S.-China trade negotiations and Japan trade talks.

- Geopolitical factors, including a possible peace agreement between Russia and Ukraine, could further support equity markets.

- Overall, the market appears poised for a positive start next week, contrasting with previous cautious positioning.

There are some positive signals for stock markets over the weekend, which could lead to a bullish run in S&P 500 and DJIA next week.

Markets Rebound After Powell-Driven Dip

U.S. equities bounced back strongly on Thursday, recovering losses from the previous session that followed Fed Chair Jerome Powell’s comments. The S&P 500 surged to intraday highs, erasing Wednesday’s dip and ending the day on a high note. This recovery brought the index to roughly 0.5% gains for the week — a bullish sign, especially given weakness in major tech names.

While tech stocks struggled, broader market strength points to cautious optimism heading into the weekend.

A Shift in Weekend Sentiment?

In bearish or high-risk market environments, investors typically reduce exposure ahead of weekends — particularly long ones — to avoid being caught off guard by adverse developments. This was evident two weeks ago, when fears of tariff announcements prompted aggressive Friday selling, resulting in gap-down opens the following Monday.

But this time, the tone feels different. Bulls are staying in the game.

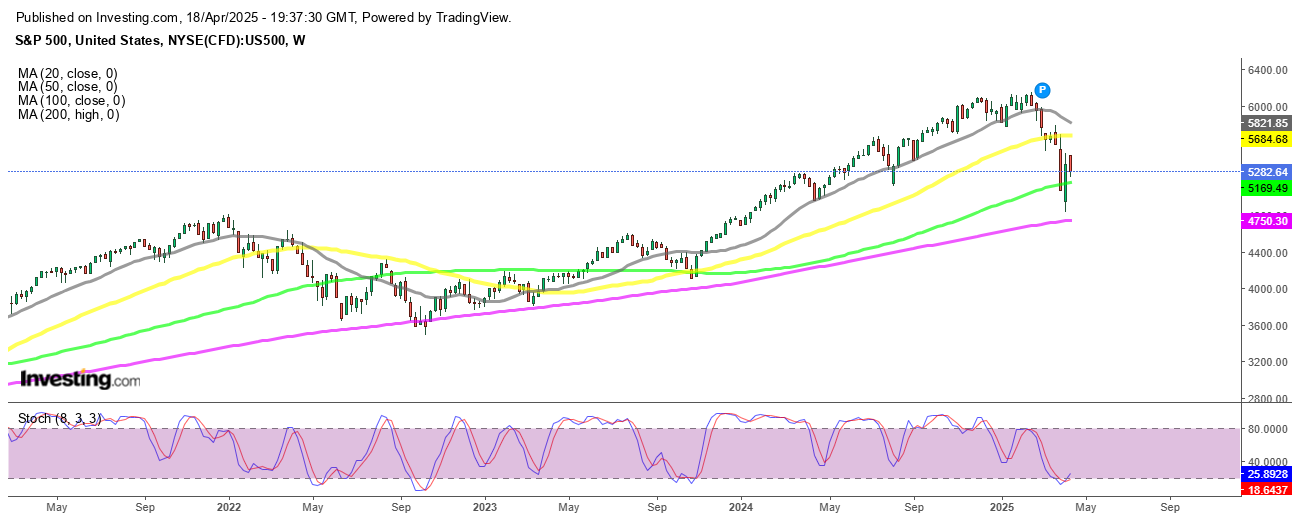

S&P 500 Weekly Chart – Has the Retreat Ended?

Earlier this week, Monday’s trading opened with a sharp bullish gap, driven by Friday’s news that the U.S. would temporarily exempt several tech products — including processors and computer hardware — from planned reciprocal tariffs. Though President Trump later suggested the exemption may only be temporary and Commerce Secretary Lutnick warned tariffs could return within 1–2 months, the optimism was enough to lift sentiment going into the new week.

This pattern of pre-weekend optimism suggests the market may be eyeing further positive developments.

What Could Fuel Another Bullish Open for S&P 500 Next Week?

Several geopolitical and trade-related events over the weekend could provide additional upside catalysts:

U.S.–China Trade Breakthrough?

There are whispers of possible progress on stalled trade negotiations. A breakthrough — or even signs of goodwill — could lift global equities, especially those tied to trade-sensitive sectors.

Japan Trade Talks

The U.S. and Japan are also engaged in high-stakes talks. While an agreement to scrap or soften tariffs may be a long shot, Trump has already hinted at “major progress,” and Japanese negotiators have reportedly requested broader exemptions. A deal that reshapes interest rate policies in Japan could also shift capital flows.

Russia–Ukraine Peace Overture

Markets are also watching the situation in Eastern Europe. President Trump mentioned a “very good chance” for a peace agreement between Russia and Ukraine. Bloomberg added that the U.S. has offered proposals to allies that outline a potential framework for a ceasefire and phased sanctions relief — if Russia agrees to long-term terms.

Each of these developments has the potential to reduce global risk premiums and support equity markets, particularly if any headline breaks before the Monday U.S. open.

Conclusion: Upside Risks Growing into the Weekend

While markets often tread cautiously ahead of weekends, especially with geopolitical tensions running high, this week’s tone is noticeably more optimistic. Strong Thursday gains, recent exemptions from trade tariffs, and the potential for breakthrough diplomacy all point to a market willing to bet on good news.

Unless new shocks emerge, the Dow and S&P 500 could very well start next week on a positive note — a departure from the typical defensive positioning we’ve seen during past periods of uncertainty.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account