RWA: Ondo Finance set to conquer U.S Treasury Bond Market with Mastercard

Ondo Finance set to conquer the U.S Treasury Bond Market with Mastercard.

Quick overview

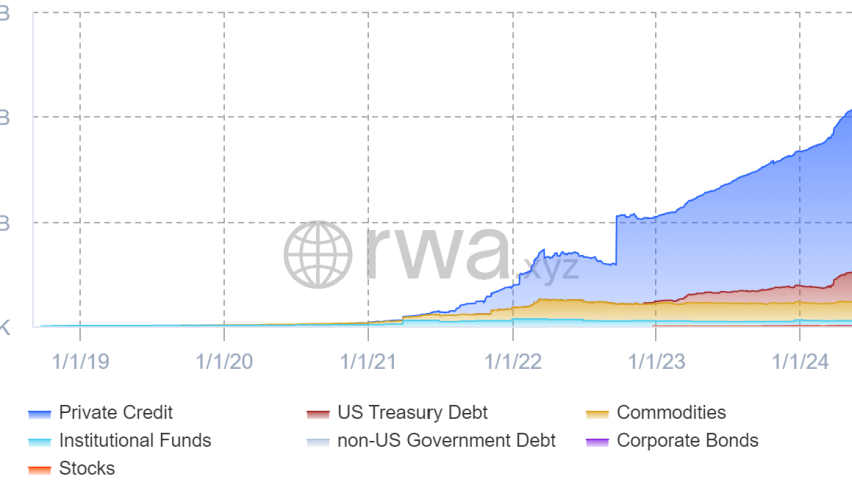

- Ondo Finance has surpassed $2.5 billion in total value locked, establishing itself as a significant player in Real World Assets.

- The project is preparing to launch Ondo Global Markets, which aims to revolutionize traditional financial assets.

- Mastercard has partnered with Ondo Finance to offer US Treasury bonds through RWA tokenization, enhancing access to blockchain benefits.

- The Real World Assets sector is showing consistent growth, distinguishing itself from the volatility of the broader cryptocurrency market.

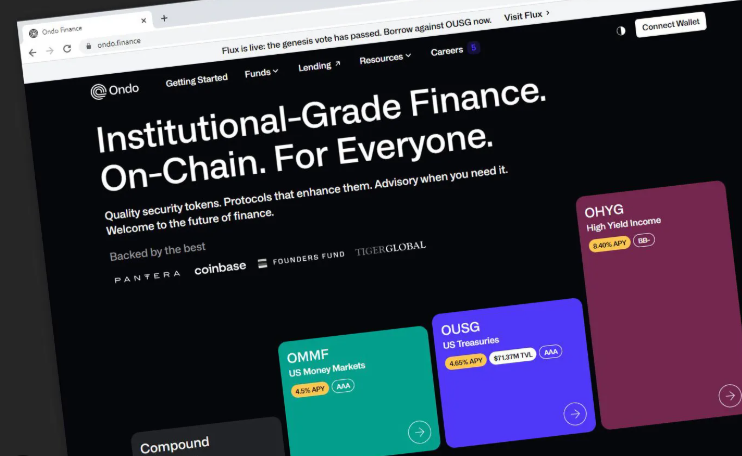

Ondo Finance set to conquer the U.S Treasury Bond Market with Mastercard. Ondo Finance surpassed $2.5 billion in total value locked (TVL), solidifying its position as a key player in Real World Assets (RWA).

Even though the token’s price has moderated amid ongoing market correction, the project is moving more quickly and getting ready to launch Ondo Global Markets, which has the potential to transform conventional financial assets.

Mastercard has been a major player in the cryptocurrency space for several years, and recently announced a partnership with Ondo Finance to offer US Treasury bonds via RWA tokenization.

The expansion of its projects about this new and innovative digital economy, including its Multi-Token Network (MTN), which was introduced last June, indicates this in any event. a network created to give organizations access to the benefits of blockchain technology.

The evolving financial asset class offers safe, quick, and round-the-clock transactions. Mastercard also announced a collaboration between its MTN network and the cryptocurrency project Ondo Finance (ONDO). This is to provide a tokenized, digital version of its US Government Treasuries Fund (OUSG) for short-term investments.

The Real World Assets (RWA) sector stands out from the daily turbulence of the cryptocurrency market by exhibiting consistent growth, despite the market’s unpredictable direction. This development appears more natural than other cryptocurrency subsectors, which might be likened to speculative bubbles.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account