Daily Crypto Signals: Bitcoin Faces Death Cross, Ethereum Eyes AI Role, and ZKsync Hit by Hack

Bitcoin’s recent rally to $85,000 has reinvigorated market sentiment, but Ethereum faces significant challenges as its market dominance approaches all-time lows. Meanwhile, Solana gains momentum with new ETF offerings and ZKsync suffers a $5 million security breach.

Crypto Market Developments

In mid-April, the market for cryptocurrencies is displaying conflicting signals; Bitcoin is proving resilient while Ethereum finds it difficult to stay in the ecosystem. Macroeconomic challenges for the wider crypto market include rising trade tensions and recession concerns that have resulted in a $872 million outflow from spot Bitcoin ETFs between April 3 and April 10.

Over the past five weeks, Bitcoin has held mostly stable around the $83,000 level in spite of these obstacles. Although this lower volatility indicates Bitcoin is developing as an asset class, it has disappointed some investors expecting better performance as a “digital gold” substitute. By 2025, gold itself has increased by 23%; on April 11, it reaches an all-time high of $3,245.

Regarding regulations, Ethena Labs is leaving the German market after reaching an agreement with Germany’s Federal Financial Supervisory Authority, BaFin. Following authorities found “deficiencies” in its dollar-pegged USDe stablecoin last month, the synthetic stablecoin developer will stop running activities of its local company.

Bitcoin Death Cross Lingers Despite Recovery Attempts

From its annual low of $74,500, Bitcoin’s BTC/USD price has recovered and is now trading around $83,400 at the time of writing. This comeback occurs in spite of a “death cross” formation on April 6, when the 50-day moving average (MA) dropped below the 200-day MA, a pattern historically associated with bearish trends.

On the importance of this technological indication, experts are still split nonetheless. Should Bitcoin find bear territory, CryptoQuant CEO Ki Young Ju cautions that this death cross might indicate six to twelve months of declining price activity. By contrast, Coin Shares head of research James Butterfill downplays the significance of the signal, pointing out that empirically, prices are only somewhat lower one month after a death cross (-3.2%). Often three months later, prices are much higher.

The present surge seems to be driven more by leverage than by robust spot demand. Axel Adler Jr., a bitcoin expert, pointed out that on April 11, coinciding with the price change from $78,000 to $85,000, Bitcoin’s total net taker volume jumped to $800 million. Still, 30-day apparent demand stays below net positive territory, implying little retail activity.

Although analysts estimate Bitcoin’s comeback might reach $90,000, breaking beyond this level could remain difficult in the near run without more market involvement. Large liquidation clusters between $80,000 and $90,000 might cause notable market volatility, hence possibly trapping traders on both sides.

Ethereum Eyes AI Decentralization Amidst ETF Staking Delay

Ethereum ETH/USD is facing increasing difficulties as its market share approaches historic low points. Just above its all-time low of 7.09% from September 2019, Ethereum’s share of the overall crypto market capitalization on April 9 came out to be 7.18%.

Weak institutional demand shown by negative ETF flows, a slow derivatives market, and growing competition from other layer-1 blockchains have several elements explaining Ethereum’s underperformance. With 51.7% of total value locked (TVL) across distributed finance systems, Ethereum maintains leadership; nonetheless, this marks a notable drop from 61.2% in February 2024.

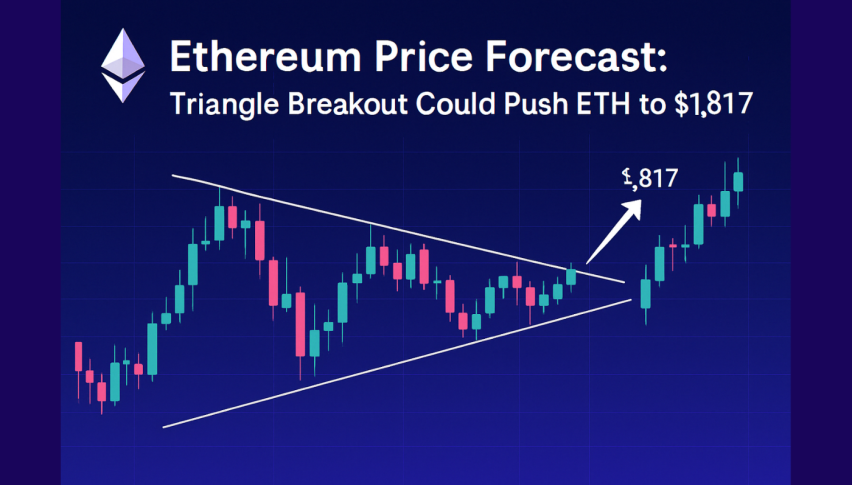

Technical analysis reveals more potential downside for ETH price, which is now trading at $1,592 at the time of writing. The formation of a bear flag pattern on the daily chart predicts a potential 33% decline to $1,100 should prices fall below the pattern’s lower border at $1,600. The relative strength index (RSI) stays below 50, meaning sellers still get momentum’s favor.

Canadian Solana ETF Launch a Bright Spot

While Ethereum suffers, Solana SOL/USD keeps getting institutional acceptance with more financial products coming out of Canada. Among the Solana ETFs approved by the Ontario Securities Commission is 3iQ’s SOL Staking ETF, which will start trading under the symbol SOLQ on the Toronto Stock Exchange on April 16.

The staking provider for 3iQ’s fund has been chosen as Blockchain Infrastructure Provider Figment; estimated yield is between 6% and 8%. The permission also covers other fund managers looking to provide SOL ETFs, including CI, Purpose, and Evolve.

Solana’s market position has greatly changed over the previous year; its domination climbing by 344% from 2023. Demonstrating increasing popularity inside the DeFi ecosystem, its proportion of total value locked has likewise jumped by 172% since February 2024.

ZKsync Suffers $5 Million Hack

On April 15, ZKsync experienced a security breach when a hacker broke into an administrative account creating unclaimed airdrop tokens at $5 million. An official statement claims that the assailant used sweepUnclaimed() to mint 111 million unclaimed ZK tokens, therefore augmenting the total token supply by 0.45%.

According to the protocol, the assault was isolated with no effect on token contracts or governance or user monies compromised. Working with the Security Alliance (SEAL), ZKsync is organizing recovery initiatives and said that the compromised vector cannot allow any more exploits.

After the hack discovery, ZK token saw erratic market behavior; it dropped 16% to $0.040 then rebounded to $0.047. The token continues to be down 7% over the past 24 hours even with recovery.

With $2 billion already lost to breaches in the first quarter of 2025 alone—just $300 million less than the whole losses for all of 2024—the incident adds to mounting security issues in the crypto ecosystem.