Ethereum Stabilizes Above $1,600 As AI Integration Emerges As Next Frontier

Ethereum (ETH) is exhibiting signs of resilience, currently holding above the $1,600 mark and recording a 1.2% gain over the past 24 hours. This upward movement in ETH/USD occurs alongside discussions about Ethereum’s potential role in decentralizing artificial intelligence (AI) and a recent delay in the SEC’s decision regarding the staking feature for Grayscale’s Ether ETFs.

Ethereum and AI: The Next Mainstream Adoption Catalyst

Former key Ethereum developer Eric Connor has generated debate on Ethereum’s possible contribution to solve basic obstacles in the way artificial intelligence development is progressing. Connor said on April 15 that Ethereum’s “biggest mainstream moment is waiting in the wings with AI,” therefore stressing a “huge opportunity” for the blockchain to become a distributed solution to present AI issues.

Among the various important problems Connor found in the current state of artificial intelligence, “black-box models, centralized data silos, and privacy pitfalls.” He contends that Ethereum’s open smart contract design might offer verifiable documentation of AI model training methods and data sources, therefore directly addressing the opacity afflicting many AI systems.

Agentic AI Development Gaining Traction on Ethereum

On Ethereum’s network, the merging of artificial intelligence and blockchain is already under development. A recent Ethereum blog post claims that on the network AI agents—autonomous software programs that make decisions and change with the times—are proliferating.

Many noteworthy initiatives draw attention to this developing trend:

- Luna, an autonomous virtual influencer handling its own on-chain wallet

- AIXBT, an AI agent offering market analysis on cryptocurrencies

- Botto, a decentralized autonomous artist creating NFTs guided by community voting

Projects like Bankr and HeyAnon are further simplifying blockchain interactions through conversational interfaces that allow users to manage wallets and execute transactions via simple chat commands.

SEC Delays ETH Staking ETF Decision

As Ethereum attempts to increase its utility and adoption, regulatory constraints remain a factor in its market performance. The SEC has delayed a judgment on whether to permit Ether staking in two Grayscale funds until June 1, with a final deadline set for October.

Ethereum ETFs could become more appealing if ETH staking, which provides expected yearly dividends ranging between 2% and 7%, could receive regulatory approval. With $2.28 billion in net inflows, Ethereum ETFs with staking would allow investors to earn higher passive income while retaining the asset, therefore bridging the adoption gap between Ethereum ETFs and Bitcoin ETFs (which have recorded $35.4 billion of inflows to date).

The SEC approved options trading for several spot Ether ETFs—including those from BlackRock, Bitwise, and Grayscale—while postponing the staking decision for now. For institutional investors, its approval increases the usefulness of these funds.

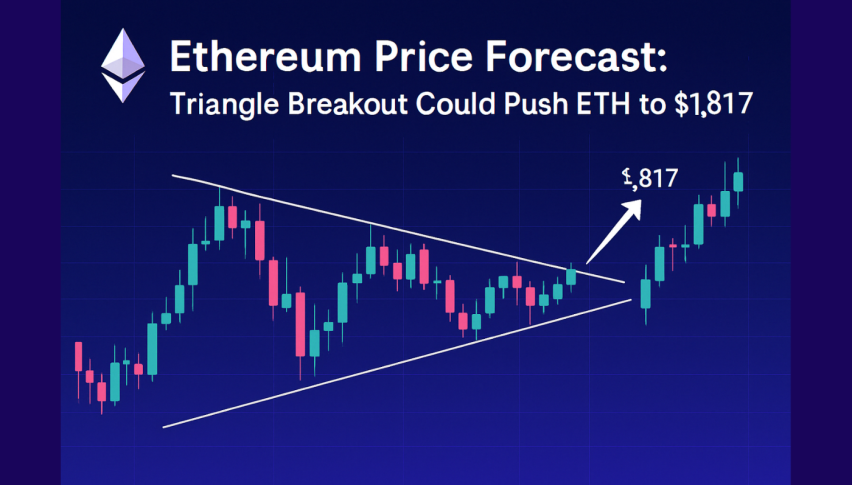

ETH/USD Technical Analysis Points to Consolidation Phase

Ethereum price appears to be consolidating after establishing support above the critical $1,520 level. After overcoming several resistance levels, including $1,580 and $1,600, ETH/USD recently peaked at $1,690 before moving into a corrective phase.

Supported at $1,625, chart analysis suggests a positive trend line above both the $1,625 level and the 100-hourly Simple Moving Average (SMA). This technical framework implies strength in the given current price range.

Currently set resistance levels at $1,656 and $1,680; a breakthrough might target the $1,750 level. Technical analysis envisions routes to $1,800 or possibly $1,880 in the immediate term should momentum keep rising. On the other hand, should positive momentum wane, support zones at $1,610 and $1,575 would most certainly be tested.