Boeing Stock Drops on China Order Freeze, United Airline UAL Jumps 9% on Q1 EPS Surprise

Today stock markets ended lower, with Boeing stock shedding 2.4% on China’s delivery halt, while United Airline shares jumped 9% after the close on higher EPS.

United Airlines Soars on Earnings Beat Despite Revenue Miss

United Airlines shares surged on Tuesday, defying broader market caution, after the company posted stronger-than-expected first-quarter earnings. The stock closed at $67, up $1.31 or nearly 2% from the prior day’s close of $65.69. After-hours trading extended those gains significantly, with United Airlines Holdings Inc. (NASDAQ: UAL) futures climbing more than 7%, pushing prices above $71.50—a clear signal of strong investor optimism.

The rally followed the release of United’s Q1 financial report, which showed adjusted earnings per share of $0.91, comfortably ahead of Wall Street expectations of $0.76. While total revenue came in slightly below forecasts at $13.21 billion versus the expected $13.25 billion, the strong bottom-line performance, alongside operational improvements, stole the spotlight. United also reported a 4.9% year-over-year increase in capacity, robust operating cash flow of $3.7 billion, and free cash flow of $2.3 billion, reinforcing the airline’s post-pandemic recovery trajectory.

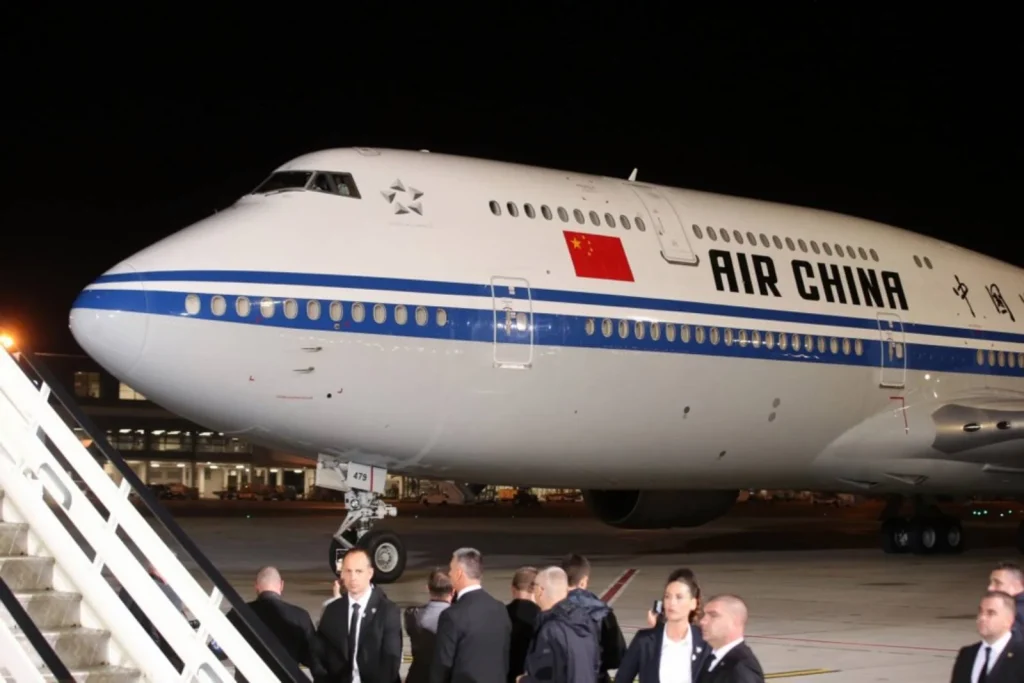

Boeing Struggles as China Curtails Aircraft Deliveries

Meanwhile, shares of Boeing (NYSE: BA) had a more turbulent day, ending 2.5% lower at $155.46. The stock had initially opened higher after upbeat comments from the White House about temporarily lifting tariffs on Chinese electronics, which briefly boosted market sentiment. However, news broke overnight that Chinese authorities had instructed domestic airlines to refrain from placing new orders with Boeing and to seek formal approval before accepting delivery of previously ordered aircraft.

Boeing Stock Chart Daily – Trading Below MAs

The development poses a significant setback for Boeing, which counts China as one of its most important export markets. Although BA shares initially tried to shrug off the news, regaining some early losses during the US session, the optimism faded. By the closing bell, the stock had reversed those intraday gains, settling near session lows.

This is not the first time Boeing has faced delivery hurdles with China. The country has previously slashed aircraft imports from the U.S. manufacturer by more than 80% over the past five years, following the grounding of the 737 MAX fleet after two high-profile crashes in 2018 and 2019. Although deliveries had resumed earlier this year, the latest move by Beijing suggests renewed geopolitical pressure could once again weigh on Boeing’s long-term outlook.

Diverging Paths for Two Aviation Giants

Tuesday’s trading session highlighted diverging investor sentiment toward two major aviation players. United Airlines is enjoying renewed bullish momentum thanks to solid earnings, stronger free cash flow, and signs of operational growth. In contrast, Boeing faces renewed headwinds from geopolitical tensions and trade policy uncertainty, particularly with China.

While United’s outlook appears increasingly favorable amid rising travel demand and efficient cost controls, Boeing’s path remains murkier. Its dependency on international orders—especially from China—means continued vulnerability to shifting political landscapes. Investors will be watching closely to see whether Boeing can weather this latest storm or if further downward pressure is on the horizon.