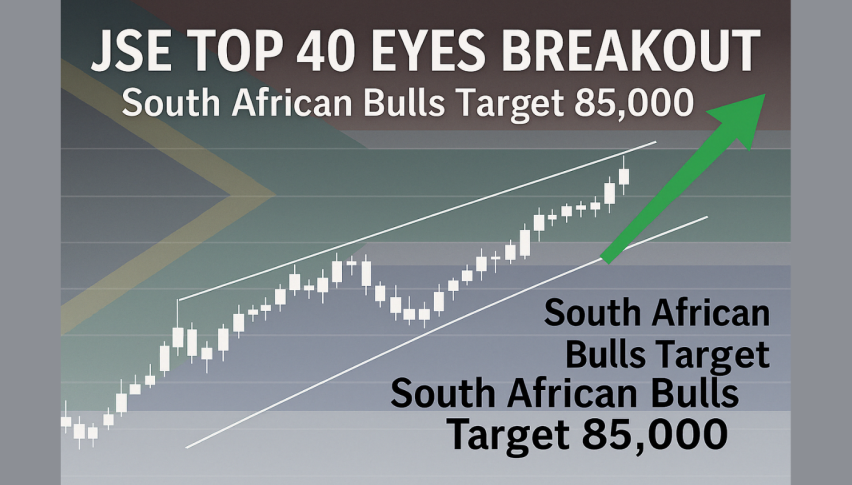

JSE Climbs to 79,312 as Top 40 Eyes Breakout; Market Cap Nears ZAR 20.45 Trillion

The JSE continued its upward trend on April 14, 2025 with the Top 40 Index closing at 79,312.3, up 0.11% for the day.

While the gain was small, it adds to the rebound that has followed the sell-off at the beginning of April.

The All Share Index is still below its recent highs but showing signs of improving sentiment. This week’s moves have been driven by improving risk appetite, a stronger rand and steady flows into domestic equities.

Total market capitalisation is approaching ZAR 20.45 trillion, making the JSE Africa’s biggest capital market.

Technical Picture: Top 40 Nears Key Resistance at 79,977

From a technical perspective the JSE Top 40 has bounced sharply from its recent low of 69,966. Now all eyes are on the major resistance at 79,977 which is a trendline and 50% Fibonacci retracement zone.

Support Levels:

78,072

78,496 (50-EMA)

Resistance Levels:

79,977 (trendline + horizontal resistance)

Next targets if breakout succeeds: 81,381 and 83,085

RSI: 59.41 – Momentum building, but still shy of overbought

A break above 79,977 could clear the way for a move above 81,000, while a rejection here could see a pullback to 76,500-78,000 in the short term.

Rand Strength Supports Stocks, But Politics Add Risk

The rand has been firmer, now at 19.2050 per USD, as global dollar demand has eased and US tariffs have paused. This is supporting local exporters and mining stocks.

But politics remains a risk. The ANC and DA are at loggerheads over fiscal policy and upcoming budget votes and this has raised questions about coalition stability. A breakdown in the partnership could see the ANC turn to more radical political allies – and that would be a worry for market confidence and capital outflows.

Top Movers – April 11 Recap

Biggest Gainers:

Grand Parade Investments (GPL): +12.00%

4Sight Holdings (4SI): +9.68%

African Rainbow Minerals (ARI): +9.15%

Sibanye Stillwater (SSW): +9.04%

Reunert Limited (RTN): +8.58%

Biggest Decliners:

Gemfields Group (GML): −22.67%

Acsion Limited (ACS): −14.04%

Quantum Foods Holdings (QFH): −10.32%

Bond Market

Yields on South Africa’s 2030 government bond rose 6.5 basis points to 9.305% as investors are cautious ahead of local political noise and global interest rate volatility.

Outlook: Watch the 79,977 Breakout Zone

The short term direction of the JSE will depend on whether the Top 40 can break above 79,977. If it does, the bulls could have room to run to 81,000-83,000. But if momentum stalls at resistance, we could see another phase of consolidation or downside testing.

In the bigger picture, investors should keep an eye on politics, the rand and global risk sentiment, all of which will determine the next leg of the market’s recovery.