Bitcoin Holds Above $84,000 Despite Tariff Jitters: Technicals Point to More Volatility

The world’s largest cryptocurrency, Bitcoin (BTC), is holding above the $84,000 mark despite recent turbulence triggered by President Donald Trump’s changing stance on Chinese tariffs. After experiencing a significant drop over the weekend, Bitcoin BTC/USD has stabilized, though market analysts anticipate potential volatility ahead due to geopolitical tensions continuing to impact investor sentiment.

Trump’s Mixed Signals on Tariffs Create Uncertainty

On Sunday, Bitcoin dropped over 2% and dropped to $83,502 during Asian trading hours as markets worked through contradicting signals from the Trump administration about trade policies with China.

President Trump confirmed via Truth Social that although original reports implying some electronics—including smartphones, semiconductors, and laptops—might be excluded from additional tariffs, these items would still be subject to a 20% levy linked with national security and drug enforcement issues.

“NOBODY is getting ‘off the hook,’ for the unfair trade balances, and non-monetary tariff barriers, that other nations have used against us, especially not China, which, by far, treats us the worst!” Emphasizing in his writing that “there was no tariff ‘exception’ announced on Friday,” Trump said

Adding to the market uncertainty is the indication by Commerce Secretary Howard Lutnick that new sector-specific tariffs on electronics will be imposed within the next two months.

Institutional Interest Remains Strong Despite Market Fluctuations

Institutional interest in Bitcoin shows resiliency even with recent price falls. Although the overall value of these assets dropped by almost $5 billion to $50.3 billion owing to price swings in Bitcoin and Ethereum, BlackRock, the biggest asset manager in the world, said that its spot digital asset-focused funds received net inflows for a sixth consecutive quarter.

Under Michael Saylor’s direction, strategy has indicated plans to start buying Bitcoin once almost two-week pause ends. With their most recent purchase of 22,048 Bitcoin on March 31, the company’s total holdings came to 528,185 BTC, presently reflecting nearly $8.6 billion in unrealized gains—a 24% rise on their investment.

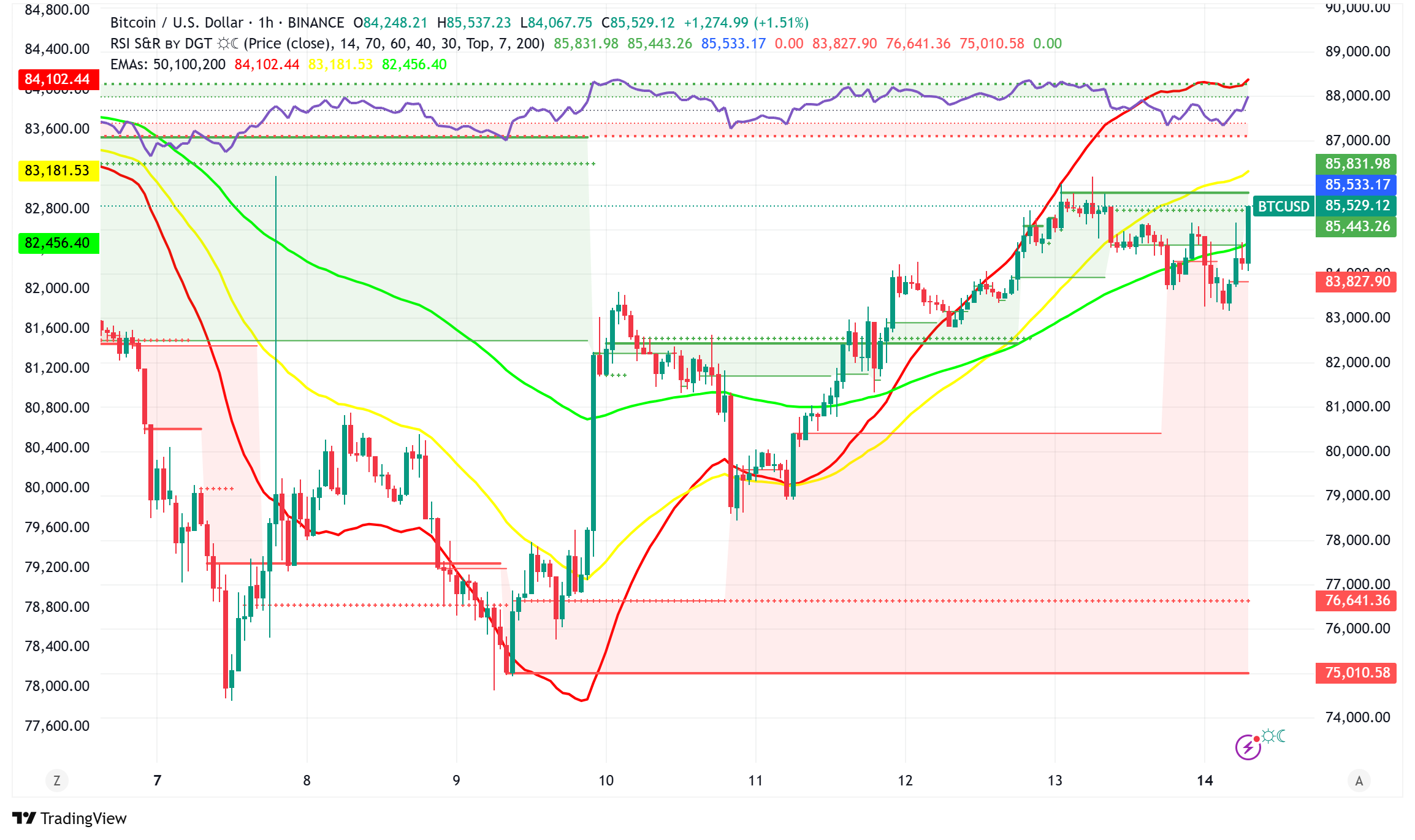

BTC/USD Technical Analysis: Bitcoin at Critical Junction

Technical analysts are actively monitoring key support levels close to $81,000, with a possible breakout below this level likely setting off liquidations across leveraged assets.

After rebounding from recent lows, Bitcoin has been trading within a defined range; on April 13, it momentarily touched $86,000—an eleven-day high. Still, the 200-day exponential moving average (EMA) around $85,000 presents major opposition to this rebound, which keeps bulls psychologically challenged.

Suggesting the prospect of more consolidation before a clear trend emerges, Trader Peter Brandt said the comeback from recent lows was “more corrective than it does impulsive”.

Analyst Rekt Capital has also noted a positive divergence on daily timeframes and a strong signal in Bitcoin’s relative strength index (RSI). Rekt Capital noted, pointing out that such trends have typically accompanied upward price reversals, “Bitcoin is developing yet another Higher Low on the RSI while forming Lower Lows on the price.”

Is Bitcoin a Good Store of Value?

The state of macroeconomics right now offers Bitcoin a chance to show its durability as a store of value. Although trade war worries caused major losses in traditional markets, Bitcoin’s 22% drop from its January record of $109,000 stands in good comparison to the larger altcoin market, which has dropped nearly 33% of its value since December 2024.

Blockstream CEO Adam Back said at Paris Blockchain Week 2025 that macroeconomic constraints from a protracted trade war will make Bitcoin more appealing as a store of value. His projection of inflation rising to 10–15% in the following decade presented difficult circumstances for conventional asset classes.

“There is a genuine prospect of Bitcoin competing with gold and then starting to take some of the gold use cases,” Back said.

The Federal Reserve’s approach to interest rates will probably have a major impact on Bitcoin’s performance in the next weeks as traders negotiate the uncertain economic terrain; market expectations for rate cuts now point toward June instead of May because of inflationary issues related with the new tariff policies.