Trading income Boosts JPMorgan Chase

JPMorgan Chase & Co. announced a 9% increase in first-quarter profit, primarily driven by higher trading revenue. Despite CEO Jamie Dimon expressing caution regarding the economy as US businesses evaluate the ramifications of President Donald Trump’s tariffs, shares of the largest US bank finished the last trading session of the week in New York on a positive note.

Jamie Dimon remarked, “Geopolitical and trade tensions have led clients to adopt a more cautious stance amid heightened market volatility.”

He noted, “The economy is experiencing significant turbulence, particularly in the geopolitical realm.”

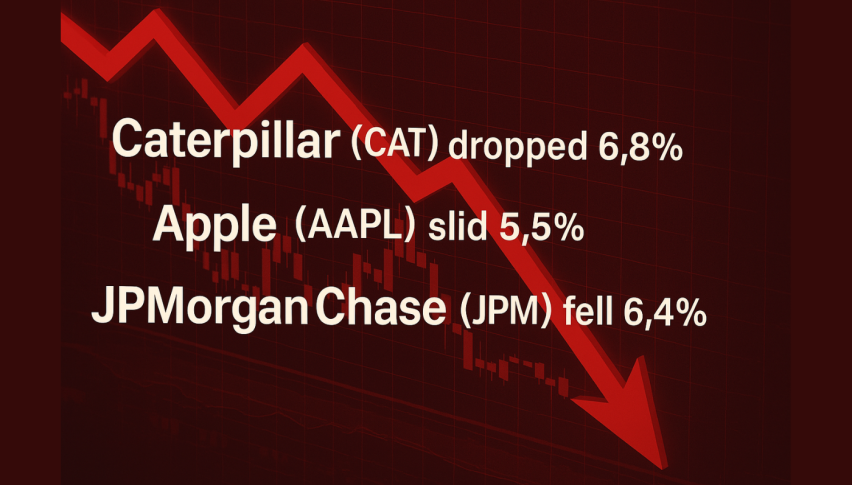

The industry has garnered special attention due to the turmoil that President Trump’s tariffs on major trading partners caused earlier in April. Meanwhile, American banking stocks have faced considerable pressure, as investors are concerned about a potential recession in the world’s largest economy.

JPMorgan reported $14.06 billion in profit, or $5.07 per share for the three months ending March 31.

Last year, the largest US bank recorded $134.4 billion in quarterly profits, equating to $4.44 per share. Trading revenue surged 21 percent, surpassing earlier expectations for a double-digit increase, while investment banking expenses rose 12 percent to $2.02 billion.

Trading revenue soared 48 percent to a record $3.08 billion, driven by early optimism regarding President Trump’s implementation of pro-growth policies, including tax reductions and deregulation. However, uncertainty surrounding Trump’s trade policy may undermine this momentum.