GBP/USD Surges Past 1.31 as Trade Tensions and Weak US Data Weigh on Dollar

GBP/USD hit 1.31 this week, a new multi-month high and extending its rally on the back of two big drivers:

US-China trade tensions and weak US data. As I write this, the pair is at 1.3146 – up over 2% on the week – and looking like it could go even higher in the coming weeks.

Trade War Heats Up, US Data Cools Off

Markets are on edge after China hit back at President Trump’s tariff hikes with a 125% tax on US goods, and global supply chains are under pressure again and inflation risks are rising.

Meanwhile the US economy is sending mixed signals. The University of Michigan Consumer Sentiment Index fell to 50.8 in April, its lowest in months, while inflation expectations rose – one year expectations jumped from 5% to 6.7% and five year expectations rose to 4.4%.

On inflation, the PPI came in softer than expected, down from 3.2% to 2.7% YoY, while core PPI was 3.3% – still elevated.

Fed’s Mixed Messages Add to Market Confusion

Fed officials aren’t helping. Minneapolis Fed President Neel Kashkari was optimistic, citing the latest CPI report. But others, like Boston Fed’s Susan Collins and St. Louis Fed’s Alberto Musalem were more cautious – warning of stubborn inflation and a slowing economy. This divergence is only adding to the uncertainty around the next rate move.

Markets are now pricing in a rate cut as early as June, but opinions are divided.

Pound Boosted by UK GDP Surprise and Bullish Breakout

On the other hand the UK delivered a nice surprise: February GDP grew 0.5% beating forecasts and giving the pound some extra wind in its sails. This stronger than expected print adds to the speculation that the Bank of England may not cut rates so soon if inflation cools in a stable way.

And the chart looks bullish.

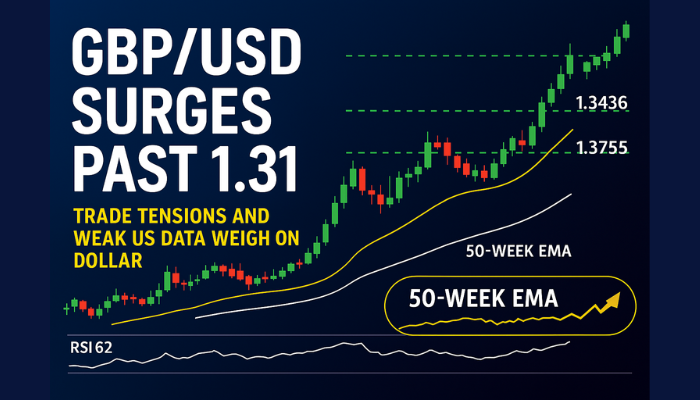

GBP/USD Weekly Technical Outlook: Bulls Eye 1.3436

GBP/USD has broken through the 1.3080 resistance level and now sits comfortably above the 50-week EMA (1.2727), suggesting that bulls are firmly in control.

Key resistance levels ahead:

1.3436 – descending trendline resistance

1.3755 – multi-year high

1.4207 – major long-term target

Key support levels:

1.3080 – immediate support

1.2717 – prior resistance turned support

1.2358 – critical swing low

The RSI is 62 – strong momentum but not overbought. As long as the pair is above 1.3080 the path is open to 1.3436 and beyond.

Key Takeaways:

GBP/USD jumps over 2% to hit 1.3146, its highest in months.

China imposes 125% tariffs on US goods; trade tensions deepen.

US PPI cools to 2.7%, but core inflation remains sticky.

Consumer confidence in the US drops to 50.8; inflation expectations rise.

UK GDP surprises with 0.5% growth, boosting sterling.

GBP/USD breakout above 1.3080 opens room for 1.3436 test.

Outlook:

With technical momentum on the pound’s side and dollar pressure building, GBP/USD will test 1.3436 soon. Unless the US surprises with inflation or retail data, the bulls are in charge.