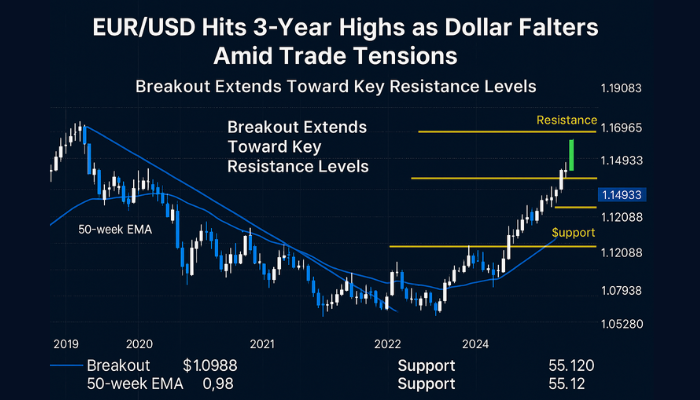

EUR/USD Hits 3-Year Highs as Dollar Falters Amid Trade Tensions

After months of consolidation, EUR/USD has finally broken above 1.14, its highest level in over three years.

The move comes as the dollar weakens and trade tensions flare up – China has just hiked tariffs on US goods from 84% to 125%. This retaliation in the trade war has spooked markets and has US recession fears growing.

Dovish Fed Bets Rise as Tariff Risks Intensify

Investors are now rethinking the Federal Reserve’s next move. As recession worries get louder, rate cut expectations have shifted closer, with some now looking at June instead of September as the earliest rate cut.

Meanwhile in Europe, sentiment is boosted by the EU’s decision to suspend retaliatory measures for 90 days – seen as a sign that trade tensions might ease slightly. Add to that relatively stable eurozone inflation and a more balanced ECB tone and the euro has room to run.

Breakout Heads Toward Key Resistance Levels

Technically, the pair has broken out of a long-term descending triangle, above 1.12088 and now testing 1.14933. Last week’s bullish weekly candle is a clear medium-term shift.

Technical Highlights:

Breakout Confirmed: The pair has broken above 1.12088 and is heading towards 1.14933.

EMA Confirmation: Price is above the 50-week EMA at 1.07197, bullish medium-term.

Next Resistance Targets:

1.14933 – current resistance

1.16965 – key supply zone

1.19083 – multi-year high

Support Levels to Watch:

1.12088 – former resistance turned support

1.07938 – previous range top

1.05280 – mid-2023 support zone

RSI Overbought But Momentum Strong

RSI is at 70.84, overbought. While this could mean a short-term pullback or consolidation, it doesn’t mean a reversal is imminent. Momentum is still with the bulls.

If we do get a dip, traders will be looking for entries near 1.12088 or 1.13 as long as price holds above that support.

What’s Next for EUR/USD?

Unless US data – PPI or Michigan Consumer Sentiment – beats expectations big time, the dollar will remain weak.

Commerzbank analysts think Trump’s aggressive trade agenda and the push to weaken the dollar will further reduce the dollar’s upside. With the Fed walking the tightrope between inflation and growth, the balance is in favor of a softer dollar outlook.

Weekly Outlook Summary:

Trend: Bullish breakout

Short-Term Target: 1.14933

Next Major Resistance: 1.16965

Key Support: 1.12088

Bias: Bullish above 1.12; looking for overbought correction

As long as EUR/USD is above 1.12, the technicals favor more upside. A clean break above 1.14933 could lead to a retest of 1.17, 1.19 if the dollar weakness continues.